President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

Wheat and Ethanol Prices Climb

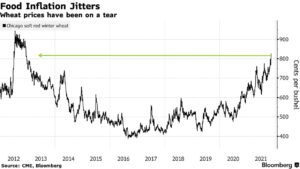

Wheat

In its November Wheat Outlook report on Friday, the USDA’s Economic Research Service (ERS) indicated that, “The 2021/22 Season-Average Farm Price (SAFP) is raised 20 cents per bushel to $6.90 based on the continued strong farmgate prices as reported in the October 29 National Agricultural Statistics Service (NASS) Agricultural Prices report as well as rising futures and cash prices.

“The September 2021 all- wheat farmgate price was estimated at $7.55, which is up from $7.13 in August 2021 and 63 percent above the $4.73 in September 2020. Through the last month, futures prices have surged higher, reaching contract highs on November 1 before trending down this week. Most notably, the Minneapolis spring wheat contract gained 16 percent from October 1 and reached $10.75 per bushel, the highest since July 2008.

This futures rally contributes to the expectation that the farmgate wheat price in the coming months will continue to remain robust.

Also last week, Bloomberg writers Kim Chipman and Megan Durisin reported that, “Benchmark wheat in Chicago is trading at its highest level since 2012 amid worsening inflation and fear of global grain shortages.

“Futures tied to hard red winter wheat also rose, reaching the priciest level in seven years. Tight supply of higher protein spring wheat is boosting demand for the winter grains to use as a substitute in some baked goods.

“Global wheat supplies have been stretched after bad weather struck harvests across major producers and a record trade pace shrinks reserves. Adding to those jitters is concern that shipments from Russia could be limited if the country revises the formula behind its floating grain-export tax.”

Global wheat stocks are their tightest since 2015. What’s driving the squeeze? Presented by @CMEGroup pic.twitter.com/GovghG35hY

— Bloomberg Quicktake (@Quicktake) November 12, 2021

And Reuters writers Gus Trompiz and Giancarlo Navach reported last week that, “Italian pasta makers are fearful of a substantial supply squeeze in the coming months after this summer’s durum wheat price shock, as the market runs out of ways to offset a dire harvest in top exporter Canada.

“Extreme heat and drought this year in the North American country, which usually accounts for about two-thirds of global durum trade, are expected to cut output there by about 3 million tonnes to nearly 50% below 2020 levels.

“That has sent durum quotations to 13-year highs, stoking concerns about food inflation at a time when many economies are struggling to recover from COVID-19.”

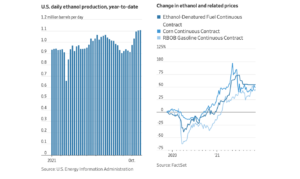

Ethanol

Wall Street Journal writer Kirk Maltais reported in Thursday’s paper that, “Demand for fuel as drivers return to the road is pushing ethanol prices close to an all-time high.

“Prices for ethanol, the corn-based fuel that is a common additive to gasoline, have risen about 50% year to date, with the near-term contract trading at about $2.20 a gallon on the Chicago Board of Trade. The price pushed through $2 a gallon earlier this year, the first time since 2014 it has done so. August traffic on the streets was up 8% from last year, according to the U.S. Federal Highway Administration.

“Gasoline prices are the highest they have been in seven years, hitting an average of $3.41 a gallon as of Nov. 8, according to data from the U.S. Energy Information Administration. The $1.31 increase from a year earlier has boosted profits for ethanol producers.”

Estimated Daily #Ethanol Plant Margins

— Farm Policy (@FarmPolicy) November 11, 2021

-- November #Corn & #Soybean Outlook Update https://t.co/kqpJEh8eUZ @PUCommercialAg pic.twitter.com/4OtlxznVwN

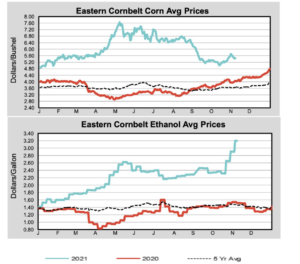

The Journal article explained that, “In the short term, corn prices are moving higher—with ethanol refineries hungry to consume what farmers harvest. Spot prices, the amount paid by those buying corn from farmers, are up in many Midwest locations and are at a premium to futures prices, according to data from StoneX Group.

“‘I think ethanol producers realize that the demand right now for the product is very strong,’ said Phil Flynn, a senior analyst at Price Futures Group. ‘They’re willing to pay up a little bit to secure corn.'”