A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

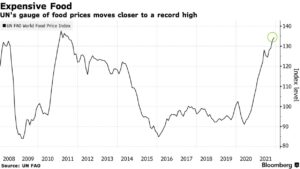

Global Food Prices Approach Record High

Bloomberg writer Grace Gitau reported last week that, “Food prices climbed closer to a record high, giving consumers and governments around the world an even bigger inflation headache.

“A United Nations gauge of global food prices rose 1.2% last month, threatening to make it more expensive for households to put a meal on the table. It’s more evidence of inflation soaring in the world’s largest economies and may make it even harder for the poorest nations to import food, worsening a hunger crisis.

“Prices have jumped for multiple reasons: bad weather hurt harvests, higher shipping rates, worker shortages and an energy crunch hit supply chains, and fertilizer costs have surged too. While it typically takes a while for commodity costs to trickle down to supermarkets, the rally is evoking memories of spikes in 2008 and 2011 that contributed to global food crises.”

And Dow Jones writer Will Horner reported last week that,

Global food prices rose for a fourth consecutive month in November, reaching their highest level since June 2011, the United Nations’ Food and Agriculture Organization said Thursday.

“The FAO’s Cereal Price Index, one of five subindexes that go into the broader gauge, rose 3.1%. Cereal prices increased largely as a result of rising wheat prices, the product of strong demand and supply issues, such as heavy rains in Australia that threaten to harm the quality of the nation’s crops.”

Meanwhile, Bloomberg writers Aine Quinn and Archie Hunter reported last week that, “Food prices are likely to stay near record highs next year due to consumers stocking up, high energy and shipping prices, adverse weather and a strong dollar, according to Rabobank.

“‘Inflation in this space is almost certainly not just ‘temporary’,’ analysts led by Carlos Mera wrote in a report. Next year ‘will likely bring fewer Covid-related disruptions, but when it comes to agricultural commodity prices, any sense of normalcy looks unlikely.'”