As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

U.S. Soy Exports to China Face Headwinds

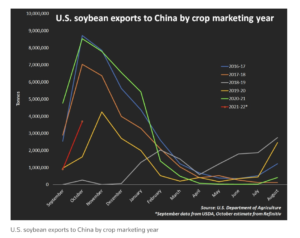

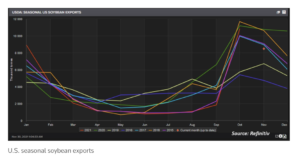

Reuters writers Hallie Gu and Karl Plume reported this week that, “China’s soybean imports from the United States in 2021/22 are expected to fall sharply from last season after loading delays following Hurricane Ida.

“An early 2022 Brazil soy crop also shortened the U.S. export window to China, the world’s top soybean buyer.

China’s total imports of U.S. soybeans for the marketing year that started on Sept. 1 may drop by at least 20% to less than 30 million tonnes, according to analysts and top importers.

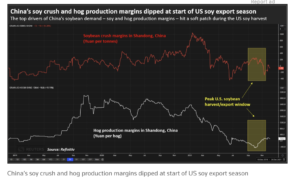

The Reuters article noted that, “Further, the main drivers of China’s soy demand – crushing and hog production margins – hit a soft patch right during the peak U.S. harvest window, blunting China’s appetite for U.S. supplies.

“U.S. loadings picked up sharply in October to over 10 million tonnes, according to Refinitiv data, but now face the prospect of an earlier-than-usual start to the 2022 export season out of Brazil, the world largest soy producer.”

The Reuters article added that, “Chinese soybean importers have nearly completed December purchases, and are now filling January and February needs just as the Brazilian export season ramps up, according to a U.S. exporter.”

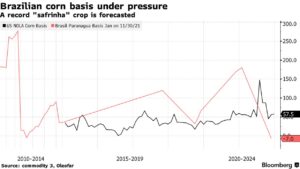

And with respect to soybean supply prospects in Brazil, Bloomberg writers Tarso Veloso Ribeiro and Michael Hirtzer reported last week that, “There are fresh signs the world’s largest ever soybean crop is getting even bigger, driving down global prices.

“Brazil has seen nearly ideal weather for growing the oilseed, with abundant rains during planting season followed by plenty of sunshine in key regions like Mato Grosso. As the harvest approaches, local prices are sliding, pointing to expectations of a bumper haul. Private consulting companies are now raising the country’s output to 145 million metric tons, a world record.

“The gigantic harvest could help to alleviate some of the inflation that has global food prices at the highest in years. Brazilian corn, known as safrinha, is also benefiting from the favorable weather, and output is expected to reach all-time highs.”

This week, Reuters News reported that, “The planting of Brazil’s 2021/22 soybean crop reached 94% of the estimated area as of Thursday and is progressing well in most of the country, although a recent lack of rains has put farmers in some Southern states on alert, agribusiness consultancy AgRural said on Monday.

“According to AgRural, national planting was up 4 percentage points from the previous week and remains ahead of the 90% that was planted at the same point in 2020/21.

“Fieldwork in southern states such as Rio Grande do Sul and Santa Catarina, however, is being affected by drought, it said, adding that Mato Grosso do Sul and Sao Paulo face the risk of potential losses due to the drier weather.”

The Reuters article added that, “‘On the other hand, the crop is progressing really well in the rest of the country. Harvest is expected to begin around Christmas in some Mato Grosso areas,’ said AgRural, which currently sees Brazil’s 2021/22 soybean crop reaching 144.3 million tonnes.”

Also this week, in separate news related to corn production, Reuters News reported that, “China’s corn output rose 4.6% in 2021 from the previous year to stand at 272.6 million tonnes, the statistics bureau said on Monday.”