A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

China: Focus on Domestic Production, as Soy, Pork Imports Fell in 2021; Corn Imports Hit Record- Meat Production Surges

Wall Street Journal writer Lingling Wei reported last week that, “Beijing is trying to fortify the Chinese economy against a prolonged period of tension with the U.S. and other countries, stockpiling some essentials and planning on more domestic production as it accelerates efforts to make China less dependent on the world.

“China’s economic agencies, including the top planning authority, the National Development and Reform Commission, and the ministry overseeing agriculture, recently have singled out ‘security’ as a priority for 2022, according to official releases. In particular, authorities are pledging to secure the supplies of everything from grains to energy and raw materials, as well as the processes involved in production and distribution of industrial parts and commodities.

“Having ramped up grain purchases in recent months, China has also detailed plans to set aside arable land to grow soybeans, a crop it had all but abandoned after its 2001 entry into the World Trade Organization.”

Nonetheless, the Journal article noted that, “Analysts like Ken Morrison are skeptical about the soybean plan. ‘Ramping up one crop production diminishes supply in another’ such as corn, said Mr. Morrison, a former commodities trader for Cargill Inc., the U.S. agricultural giant, who now writes a newsletter on the industry. ‘Arable land that’s fit for growing crops is not sitting idle.'”

Dow Jones writer Kirk Maltais reported last week that, “Soybean futures fell Friday, with the drop coming as Chinese officials indicated plans to set aside more acreage for growing their own soybeans–all this while Beijing still hasn’t met the targets for purchasing U.S. soybean exports set in 2020’s Phase One trade deal.”

Also last week, Reuters News reported that, “China said on Thursday that it hopes the United States can create conditions to expand trade cooperation, after Chinese purchases of U.S. goods in the past two years fell short of the targets in a Trump-era trade deal.”

The Reuters article noted that, “‘Since the agreement came into effect, China has worked hard to overcome multiple adverse factors caused by the impact of a pandemic, the global recession and supply chain disruptions, and pushed for the implementation of the deal from both sides,’ Commerce Ministry spokesperson Shu Jueting told an online news conference.”

The article added that, “The U.S. will continue to press China on the need for complete enforcement of the trade deal before discussing extensions, U.S. Agriculture Secretary Tom Vilsack said on Tuesday.”

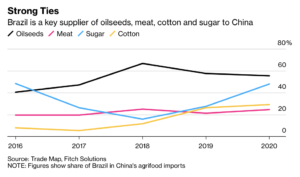

And on Monday, Bloomberg News writer Jasmine Ng reported that, “Relations between the U.S. and China are set to remain strained, which could prompt Beijing to continue diversifying its imports of agricultural goods and keep America’s share low, according to Fitch Solutions.

“China may continue to limit soybean and other agricultural purchases from the U.S. as geopolitical tensions persist, the research company said in a note. Brazil will be a winner, with its share in the Chinese market poised to stay elevated and could rise further for some commodities such as meat and cotton.”

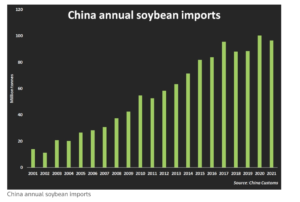

In a closer look at 2021 Chinese commodity purchases, Reuters writers Hallie Gu and Dominique Patton reported last week that, “China’s soybean imports in 2021 fell from the previous year, the first annual drop since 2018, customs data showed on Friday, depressed by weakening demand from its massive livestock sector.

“China, the world’s top buyer of soybeans, brought in 96.52 million tonnes of the oilseed in the 12 months of 2021, down 3.8% from 100.33 million tonnes in 2020, data from the General Administration of Customs showed, as falling hog margins and increased wheat feeding curbed demand.”

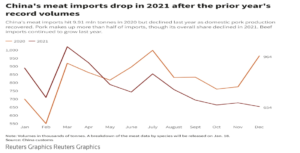

With respect to Chinese meat imports, Reuters writer Dominique Patton reported last week that, “China’s imports of meat fell 5.4% in 2021 from the year before, customs data showed on Friday, as a surge in domestic supply of pork cut demand for overseas supplies.

“More than half the meat imported by China is pork, the nation’s favourite protein, while about a quarter is beef.”

In more detailed reporting on the surge in China’s pork output, Dominique Patton reported in a separate Reuters article this week that, “China’s 2021 pork output jumped 29% from the previous year, official data showed on Monday, recouping most of the production lost during a devastating outbreak of African swine fever two years before.

“Annual output reached 52.96 million tonnes last year, just below the 53.4 million tonnes produced in 2017, the year before the hog disease began killing pigs across the world’s top pork producer. The disease had wiped out about half of breeding farms by 2019.”

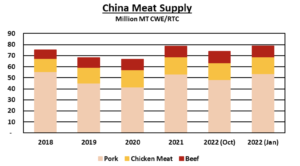

And looking ahead to this year, the USDA’s Foreign Agricultural Service indicated in its Livestock and Poultry: World Markets and Trade report last week that, “Total China meat supply in 2022 is expected at 79 million tons, revised up 7 percent from the prior forecast and again surpassing total meat supplies before the emergence of African swine fever (ASF). Driving the higher estimate is a large upward revision to pork production, which is now expected to grow for a second consecutive year.

“While hog prices are well below the record levels seen over the last few years, they have firmed since bottoming out in the fall. Smaller producers are likely to continue to struggle in the current price environment; however, large operations will look to cover the high fixed costs associated with rapid expansion and modernization as long they can cover their variable costs, at least in the short term. This, coupled with government support, is expected to accelerate trends towards continued consolidation, providing incentives for large operations to keep raising and marketing pigs – assuming the sector can effectively manage endemic ASF. Plentiful supplies of domestic pork will weigh on import demand, causing 2022 pork imports to be lowered 12 percent from the prior forecast. Although 5 percent lower year-over-year, 2022 imports remain elevated by historical standards. Overall, pork supplies are expected to reach 53.7 million tons in 2022 as higher production more than offsets weaker imports.”

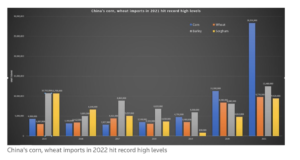

Lastly, Reuters News reported this week that, “China’s 2021 corn imports almost tripled in volume from the previous year, hitting a new record, customs data showed on Tuesday, as buyers turned to cheaper alternatives overseas amid soaring prices and a domestic supply crunch.

“China, the world’s top grains market, brought in 28.35 million tonnes of corn in all of 2021, up 152% from an annual record figure of 11.3 million in 2020, data from the General Administration of Customs showed.

“Imports of wheat in the first 12 months of the year also hit a record at 9.77 million tonnes, and were up 16.6% from 8.38 million in 2020, the data showed.”