As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Dallas Fed: Improved Conditions in 2021 Fourth-Quarter Ag Survey; Input Costs a Concern for 2022

Earlier this week, the Federal Reserve Bank of Dallas released its Agricultural Survey for the fourth quarter of 2021.

The Survey pointed out that, “Bankers responding to the fourth-quarter survey reported improved conditions across most regions of the Eleventh District. Survey respondents noted record yields and prices for corn and cotton crops.

The #corn price, at $5.27 per bushel, is up 25 cents from last month and $1.48 from November 2020.

— Farm Policy (@FarmPolicy) December 30, 2021

- Monthly Ag Prices, https://t.co/JSg58RboQk @usda_nass pic.twitter.com/3DgoUqjL8y

At 85.9 cents per pound, the price for upland #cotton is 1.5 cents higher than October and 22.5 cents higher than November 2020.

— Farm Policy (@FarmPolicy) December 30, 2021

- Monthly Ag Prices, https://t.co/JSg58RboQk @usda_nass pic.twitter.com/PQ9XiQHtvI

“However, they also noted extremely dry conditions and increased input costs as major concerns for 2022.

‘It looks like increases in the cost of goods and services related to producing crops in 2022 will greatly reduce net profits even with crop prices above normal,’ said one survey respondent.

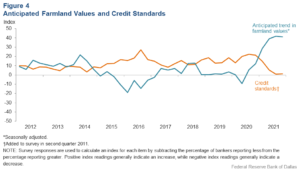

“Strong demand for agricultural real estate continues, with rural real estate prices increasing almost weekly in some regions.”

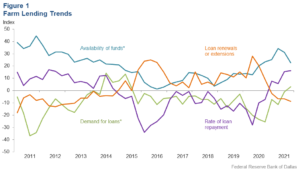

The Dallas Fed noted that, “Demand for agricultural loans increased for the first time since third quarter 2015 as the loan demand index improved to 3.1 from -1.0 in the previous quarter. Loan renewals or extensions fell for the fourth quarter in a row, while the rate of loan repayment continued to increase.”

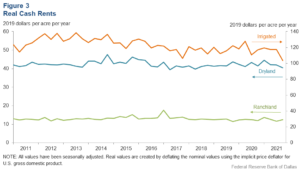

The Survey added that, “Irrigated, dryland and ranchland values rose this quarter.

“According to bankers who responded in both this quarter and fourth quarter 2020, irrigated cropland and ranchland values increased year over year in Texas and southern New Mexico.”

“The anticipated trend in farmland values index grew in the fourth quarter, suggesting respondents expect farmland values to continue increasing,” the Survey said.