A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

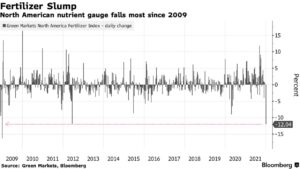

Fertilizer Price Index Falls, At Least for Now

Bloomberg writer Elizabeth Elkin reported on Friday that, “Soaring fertilizer prices that have helped drive up food inflation finally tumbled this week, but the reprieve may be short-lived.

The Green Markets North American Fertilizer Price Index fell 12% on Friday, the most since 2009.

“Prices for urea, a type of nitrogen fertilizer, swung wildly. They rose and fell by more than $100 per short ton every day this week as the market tried to assess prospects for spring demand and natural gas came off highs in Europe, said Alexis Maxwell, an analyst at Green Markets.”

The Bloomberg article added that, “This week’s drop isn’t a sign that high fertilizer prices will continue to ease, Maxwell said in an email.

“‘Major producers like the Middle East and Egypt are sold out of urea through February and much of Europe remains shut– so those looking for tons will have to search far afield,’ she said. ‘China, the best option for spare supply, remains out of the market on an export ban that runs until May.'”

Meanwhile, a separate Bloomberg article on Friday by Jen Skerritt and Elizabeth Elkin stated that, “These are boom times in the fertilizer market, with record prices amid strong demand. But the world’s largest producer is in disarray after losing two chief executive officers in less than a year, and investors are still waiting for an explanation for the latest departure.

The surprise exit this week of Nutrien Ltd. CEO Mayo Schmidt just eight months into the job has fueled concern about corporate governance at the Canadian company.

“Frequent leadership changes in a company can sometimes be a sign of instability or poor management,” the Bloomberg article said.