A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

High Fertilizer Prices Impacting Developing Countries and Europe- Food Price Repercussions a Concern

Wall Street Journal writer Jon Emont reported last week that, “From South America’s avocado, corn and coffee farms to Southeast Asia’s plantations of coconuts and oil palms, high fertilizer prices are weighing on farmers across the developing world, making it much costlier to cultivate and forcing many to cut back on production.

“That means grocery bills could go up even more in 2022, following a year in which global food prices rose to decade highs. An uptick would exacerbate hunger—already acute in some parts of the world because of pandemic-linked job losses—and thwart efforts by politicians and central bankers to subdue inflation.

“‘Farms are failing and many people are not growing,’ said 61-year-old Rodrigo Fierro, who produces avocados, tangerines and oranges on his 10-acre farm in central Colombia. He has seen fertilizer prices double in recent months, he said.”

The Journal article noted that, “Farmers in the U.S. are also feeling the pinch, with some shifting their planting plans. But the impact is expected to be worse in developing countries where smallholders have limited access to bank loans and can’t pay up front for expensive fertilizer.

Fertilizer demand in sub-Saharan Africa could fall 30% in 2022, according to the International Fertilizer Development Center, a global nonprofit organization. That would translate to 30 million metric tons less food produced, which the center says is equivalent to the food needs of 100 million people.

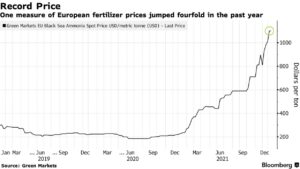

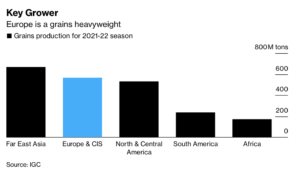

Also last week, Bloomberg writers Yuliya Fedorinova, Megan Durisin, and Veronika Gulyas reported that, “As Europe’s farmers prepare to spread fertilizers on fields after winter, sky-high nutrient prices are leaving them little choice but to use less and try to pass on the cost down the food chain.

“For growers of staples like corn and wheat, it’s the first time they’ve really been exposed to a fertilizer crisis fueled by an energy crunch, export curbs and trade sanctions. It now costs much more to buy chemicals needed for winter crops coming out of dormancy, and the extra expense could prompt smaller spring plantings that make up roughly a third of European grain.”

The Bloomberg writers explained that, “Europe has been hardest hit by fertilizer-plant cutbacks on soaring costs of natural gas used to run them — and nutrient prices there remain at a record even as the pressure eased in North America. Europe could face a deficit of about 9% of its annual nitrogen-fertilizer needs in the first half, VTB Capital estimates. Food may get even pricier if harvests suffer or crop prices rise.”