As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Kansas City Fed: Smaller Loans Limit Ag Lending, as Ag Economy Remained Strong in 2021

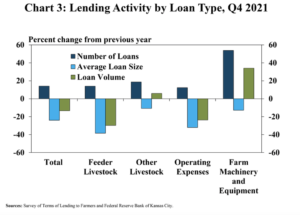

In an update last week from the Federal Reserve Bank of Kansas City, “Smaller Loans Limit Agricultural Lending,” Nathan Kauffman and Ty Kreitman stated that, “Smaller sized loans limited agricultural lending activity at the end of 2021. According to the Survey of Terms of Lending to Farmers, non-real estate agricultural loans at commercial banks decreased by 13% in the fourth quarter and the yearly average was the lowest since 2012.

“The decline was driven by a sharp drop in operating loans and lending at banks with the largest farm loan portfolios. Despite an increase in the number of all types of loans, the average size of all non-real estate and operating loans was more than 20% and 30% less than a year ago, respectively. Loan sizes decreased considerably at lenders of all sizes, but the number of loans increased notably at small and mid-sized lenders and decreased at banks with large agricultural portfolios.”

Last week’s update added that,

Broadly, conditions in the agricultural economy remained strong through 2021 and continued to support farm finances.

“Despite intensifying concerns about rising input costs impacting producer returns in the coming year, commodity prices remained elevated and supported profit opportunities through the end of the year. Higher costs are likely to put upward pressure on demand for credit, but strong farm income and working capital could also supplement financing for some borrowers.”

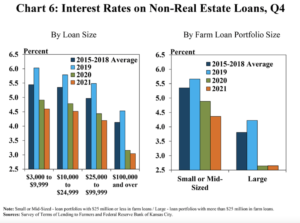

Kauffman and Kreitman also pointed out that, “The average interest rate charged on non-real estate loans also declined further, and remained lowest for the largest loans and at the largest agricultural banks. The average rate on loans greater than $100,000 remained about 140 basis points lower than rates on smaller loans and has declined slightly more from the same time in 2019.

“Similarly, the average rate at the largest farm banks remained lower than other lenders and has also declined slightly more from the same time in 2019.”