The world's farmers face soaring fertilizer and fuel prices as the war in the Middle East escalates, leaving some scrambling for supplies as the spring planting season approaches and causing…

Ukraine, Russia Tensions- A Growing Focus of Ag Markets

Robyn Dixon, David L. Stern, Isabelle Khurshudyan, John Hudson and Rachel Pannett reported on the front page of Wednesday’s Washington Post that, “President Biden and Russian President Vladimir Putin traded provocations Tuesday, with the Kremlin broadcasting a new round of military exercises within striking distance of Ukraine and Washington rushing a fresh shipment of weapons to Kyiv while suggesting thousands of U.S. troops could be deployed soon to shore up allies’ defenses in Eastern Europe.

“Officials on both sides accused the other of bringing Europe closer to a full-blown war — an outcome Biden said would have ‘enormous consequences worldwide.'”

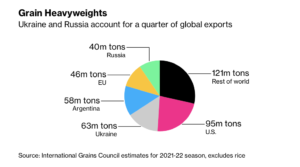

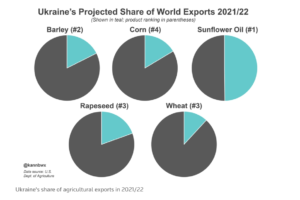

On Tuesday, Bloomberg’s Megan Durisin reported that, “Ukraine’s role as a major supplier of staple crops — from wheat to corn and sunflower oil — means that simmering tensions are a growing focus in agricultural markets, driving prices higher and adding more pressure on global food inflation.

“To be clear, cargoes are still flowing freely and there’s no indication of any disruptions. And while the U.S. has put thousands of troops on heightened alert for deployment to Eastern Europe, Russia has denied it intends to invade and Ukraine’s defense minister said an open invasion isn’t expected.

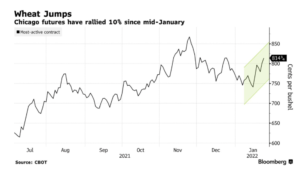

Yet crop traders are antsy, and wheat futures in Chicago and Paris have jumped about 10% since mid-January, while corn is near the highest since June.

“Markets may be remembering what happened in 2014 when Russia annexed Crimea, when wheat prices jumped even though shipments weren’t substantially affected, said Peter Collier, senior market adviser at U.K.-based CRM AgriCommodities.”

Dow Jones writer Kirk Maltais reported on Tuesday that, “Wheat futures on the CBOT continued to climb after the Pentagon said it had ordered up to 8,500 U.S. troops on standby for deployment to Eastern Europe.”

And Reuters columinst Karen Braun pointed out on Wednesday that, “Ukraine has significantly climbed the ranks in grain exports over the last decade, this year aiming for No. 3 in wheat and No. 4 in corn, though the latest conflict with Russia has instilled fear in markets over whether Ukraine’s export efforts can succeed.

“The timing of this potential export disruption is poor since the world is still trying to recover from last season’s historic supply tightness and multiyear-high prices across all grains and oilseeds.”

Braun explained that, “The country’s wheat shipments usually peak in August or September, but more than half of Ukraine’s expected corn volume must be shipped in the next five months.

“Much of that corn is destined for China, as Ukraine was its top supplier before the United States took over last year. It is unknown whether China is confident in fulfillment, but there have not been significant Chinese purchases of U.S. corn since May, signaling it is not yet seeking alternatives.”

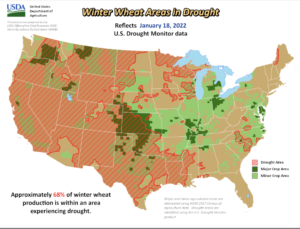

Meanwhile, Bloomberg writer Kim Chipman reported earlier this week that, “Declining conditions for growing U.S. crops is also pushing up wheat futures.”

.@usda_oce Wx: On January 23, more than one-quarter of the winter #wheat was rated in very poor to poor condition in #Kansas (31%), #Colorado (40%), #Oklahoma (43%), #Montana (65%), and #Texas (71%).

— Farm Policy (@FarmPolicy) January 26, 2022

“The U.S. Department of Agriculture on Monday reported lower winter wheat crop conditions in key growing states such as Kansas compared with a few weeks ago,” the Bloomberg article said.

More broadly regarding the wheat market, Reuters writers Hallie Gu and Gavin Maguire reported this week that, “China’s use of wheat in animal rations in 2021/22 is expected to be less than half of the amount of last season, analysts and traders said, as elevated prices cut demand.

“The volume of wheat used in feed could fall to between 10 and 24 million tonnes in the season that began in June, down from more than 40 million tonnes the previous year if current price trends persist, five traders and analysts estimated.”