Newsweek's Jasmine Laws reported Tuesday that wholesale "egg prices in the U.S. have fallen to $3.45 per dozen, reaching their lowest level in nearly five months, following a period of…

Anhydrous Reaches an All-Time High, While Belarus Potash Restrictions “May Play Into Russia’s Hands”

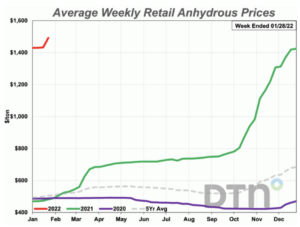

DTN writer Todd Neeley reported on Tuesday that, “Most retail fertilizer prices tracked by DTN continued to rise during the fourth week of January, while several of them continued to hit all-time highs.

“Seven of the eight major fertilizers were slightly higher, although none of them saw significant increases as determined by DTN to be 5% or more.

“Anhydrous led all fertilizers with a 4% spike, reaching at an all-time high $1,492 per ton, a jump from $1,433 the prior week. UAN28 saw a 3% jump to an all-time-high price of $601/ton, shattering the previous high of $585/ton. UAN32 continued its record pace this week, coming in at $699/ton, an increase of about 2% and also an all-time high.”

Neeley pointed out that, “After hitting the $800/ton level for the first since March 2012 last week, 10-34-0 increased by about 2% to $817/ton.

“DAP had an average price of $877 per ton, MAP $936/ton and potash increased slightly to $814/ton.

“Urea was the only fertilizer price to fall, by about 1% to $910/ton.”

#Fertilizer: The index for December, at 105.0, is up 8.4 percent from November and 62 percent from December a year ago.

— Farm Policy (@FarmPolicy) January 31, 2022

Since November, prices are higher for #nitrogen, mixed fertilizer, and #potash & phosphate, https://t.co/KVYGAsLPmb @usda_nass pic.twitter.com/Ta9dnCh2Ug

Meanwhile, Andrew Higgins reported in Monday’s New York Times that, “For nearly two decades, long freight trains laden with reddish-brown grit have rumbled into Lithuania’s main port on the Baltic Sea, providing an economic lifeline for Aleksandr G. Lukashenko, the autocratic president of neighboring Belarus.

“That lifeline is to be cut on Feb. 1 after a decision by the Lithuanian government to halt the wagons carrying Mr. Lukashenko’s biggest source of cash: potash fertilizer for export to Europe and beyond through the port of Klaipeda.

Mr. Lukashenko’s opponents applaud the move, but others worry about an unintended consequence: It benefits Russia, which is expected to take over the transport of Belarusian potash and could gain a stranglehold over a substantial portion of the world’s supply of the obscure but indispensable commodity.

The Times article pointed out that, “Potash, which Russia also produces, might not look like much, but, prized as a crop nutrient vital for global food security, it has more than doubled in price over the past year, generating billions of dollars in extra income for Mr. Lukashenko and other producers. The closing of what had been Belarus’s only export route for the commodity through the Baltics will drive prices even higher.”

Monday’s article explained that, “But the American-led drive to bankrupt Mr. Lukashenko has stirred alarm about the resulting windfall for Russia. Canada, the world’s biggest potash producer, will also gain from an expected surge in prices, but Russian gains go far beyond just price.

“‘Russia is applauding,’ Algis Latakas, the director of Klaipeda port, said in an interview. Belaruskali, he said, will most likely simply switch to using Russian trains and transport the commodity to Ust-Luga, a Russian port near St. Petersburg whose development has long been a pet project of President Vladimir V. Putin’s.

“Mr. Latakas said he understood his government’s desire to ‘fight nondemocratic forces’ but cautioned that the end result in this instance could well be that ‘Russia gets a big economic advantage’ and the ‘power to control food prices.'”