Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

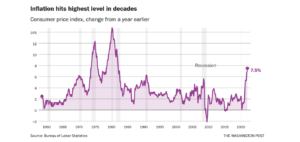

Food Prices Surge 7%, The Most Since 1981

Washington Post writers Andrew Van Dam andRachel Siegel reported on the front page of Friday’s paper that, “Prices continued their upward march in January, rising at an annual rate of 7.5 percent, the fastest pace in 40 years, as pandemic inflation continues to defy expectations, climbing faster and lasting longer than nearly anyone would have guessed.”

More narrowly with respect to food costs, Gwynn Guilford reported on the front page of Friday’s Wall Street Journal that,

Food prices surged 7%, the sharpest rise since 1981.

“Restaurant prices rose by the most since the early 1980s, pushed up by an 8% jump in fast-food prices from a year earlier. Grocery prices increased 7.4%, as meat and egg prices continued to climb at double-digit rates.”

CPI, #Food. pic.twitter.com/u8AVrdB9Br

— Farm Policy (@FarmPolicy) February 10, 2022

CPI, #Food at Home pic.twitter.com/RtWqeb2oSK

— Farm Policy (@FarmPolicy) February 10, 2022

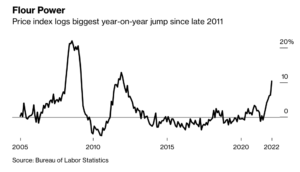

Bloomberg writer Allison Nicole Smith reported last week that, “If surging cocoa prices have you planning to gift cupcakes instead of chocolates this Valentine’s Day, you’re still out of luck: Even flour is getting too pricey thanks to red-hot inflation.

“The building block for most cookies, cakes, breads and pastries has spiked 10.3% in the past year, the biggest jump since 2011, U.S. government data released Thursday show. That’s among the highest inflation rates for any category of food outside of meat, eggs and oils.”

Inflation is at a 40-year high. Where are Americans seeing big price hikes?

— Heather Long (@byHeatherLong) February 10, 2022

Used cars 40.5% y/y

Gas 40%

Rental cars 29%

Utility gas 24%

Hotels 21%

Furniture 20%

Bacon 18%

Steak 17%

Peanut Butter 15.5%

Pork 14.5%

Fish 13%

Eggs 13%

New cars 12%

Electric 11%

Chicken 10%

Oranges 10%

Also last week, Bloomberg writer Leslie Patton reported that, “Chipotle Mexican Grill Inc. Chief Executive Officer Brian Niccol said he’s not seeing any signs that inflation is slowing down, specifically highlighting higher beef costs.”

Patton pointed out that, “Companies across industries are increasing prices amid higher manufacturing and shipping costs and a shortage of available labor. Meanwhile, global food prices jumped toward a record last month, pushed up by more expensive vegetable oils and dairy, according to the United Nations’ index of prices.”

And Wall Street Journal writer Patrick Thomas reported last week that, “Escalating meat prices haven’t slowed restaurant and retailer demand for meat, Tyson Foods Inc. executives said, as rising prices helped to more than double the company’s quarterly profit.

“Tyson, the biggest U.S. meat processor by sales, said that orders for beef, chicken and pork continue to outpace its ability to supply products, with its plants still short on workers. Raising wages and expanding benefits to recruit and retain staff is helping drive meat prices higher, Tyson said, along with transportation and other costs.

“Over the three months ended Jan. 1, Tyson said its average beef prices rose by nearly one-third compared with the same period a year earlier, while pork prices increased by 13% and chicken by about 20%.”

“Inflation throughout the supply chain is leading to higher prices for many products and services in a variety of industries, especially food,” the Journal article said.

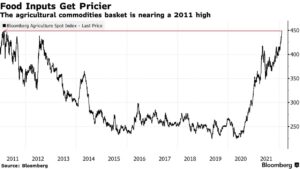

Meanwhile, Bloomberg writers Irina Anghel and Megan Durisin reported last week that, “From morning coffee to dinnertime roasts, prices for major food staples are on the rise.

“The Bloomberg Agriculture Spot Subindex, which tracks nine agricultural commodities, is nearing an all-time high. Prices across grains, oilseed and softs markets have rallied as supply shortfalls abound, a signal that food inflation already hitting consumers worldwide is unlikely to let up soon.”