A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Russia Invades Ukraine: Supply Disruption Concerns Fuel Wheat, Fertilizer Prices

Michael Birnbaum, Mary Ilyushina, Paul Sonne and Isabelle Khurshudyan reported on the front page of Thursday’s Washington Post that, “Russia on Thursday launched an attack on cities and military installations across Ukraine, forcing thousands of civilians to flee, as Ukraine’s president called for his nation to fight in the streets and NATO leaders said Europe’s security had been fundamentally altered.”

Also Thursday, Financial Times writers Emiko Terazono, Judith Evans and Hudson Lockett reported that, “Global food prices are set to soar still further after Russia’s attack on Ukraine threatened supply chains, pushing up commodities markets that had already hit multiyear highs.

“Russia and Ukraine together account for a third of the world’s wheat exports, a fifth of its corn trade and almost 80 per cent of sunflower oil production, according to the US Department of Agriculture.

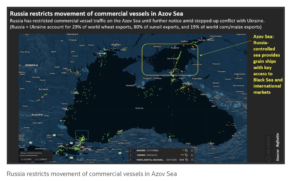

The attack has led to a ban on all commercial vessels in the inland sea of Azov — which connects to the Black Sea — and the closure of Ukrainian ports. Some 90 per cent of Ukrainian grain exports are transported by sea and the disruption is expected to wreak havoc on food supply flows, said analysts.

The FT writers explained that, “Wheat prices have risen by more than a fifth since the start of the year to near 10-year highs, while corn prices have risen 15 per cent.

“The disruption to supplies and the scramble to find alternative sources of grain will hit supply chains already struggling with high demand and rising prices because of poor harvests in key exporting countries such as Canada.”

“For China, about a third of its corn imports come from Ukraine and are used to feed the world’s largest hog herd,” the FT article said.

Reuters writers Polina Devitt, Gleb Stolyarov and Natalia Zinets reported on Thursday that, “Ukraine’s military has suspended commercial shipping at its ports after Russian forces invaded the country, an adviser to the Ukrainian president’s chief of staff said, stoking fear of supply disruption from leading grain and oilseeds exporters.

“Russia earlier ordered the Azov Sea closed to the movement of commercial vessels until further notice, but kept Russian ports in the Black Sea open for navigation, its officials and five grain industry sources said on Thursday.”

Bloomberg writers Thomas Biesheuvel, Isis Almeida, and Salma El Wardany reported on Thursday that, “Commodity exports from Ukraine, one of the world’s most important grain suppliers, were thrown into chaos after Russia’s invasion forced ports and railways to start closing.

“Traders could no longer book vessels to move goods in and out of the nation’s ports, people familiar with the matter said. However, some vessels already at ports were still being loaded to completion as of Thursday evening local time, and expected to depart, one person said. One of the biggest rail users said the government had suspended operations.”

Meanwhile, regarding potential sanctions placed on Russia, New York Times writer Ana Swanson reported on Thursday that, “It remains to be seen whether other countries will issue limits on agricultural trade. But White House officials have said their efforts aim to penalize Russian leaders, the military and industrial production, rather than the Russian populace. They have been preparing a further package of sanctions and export controls that would cut off Russian access to advanced technology, like semiconductors and aircraft parts.”

The Times article stated that, “Analysts at Rabobank said in a note last Friday that two-thirds of Russian wheat and barley for the season had already been exported, but that if sanctions ended up removing the remainder of the crop from foreign markets that could drive global prices up by nearly a third.

“The effects on global grain prices will partly hinge on what China decides to do, the analysts said. China imports massive amounts of corn, barley and sorghum for animal feed from world markets. It could choose to buy those commodities, as well as wheat, from Russia instead of other countries. In such a situation, the impact of sanctions on global grain markets would be relatively small, they said.”

With respect to fertilizer prices, Rhiannon Branch reported on Thursday at Brownfield that, “The global fertilizer market is reacting to Russia’s invasion of Ukraine in a big way.

“‘It has been intense.’

“Josh Linville, Director of Fertilizer for StoneX tells Brownfield Russia is a major exporter of nitrogen, potassium, and phosphorus fertilizers and because of that, ‘Out of the chutes we have seen global urea prices up over $200 a ton overnight. NOLA US prices are up $150-$200 per ton. The price of urea has jumped 32%-33% in less than 12 hours.’

“He says global supply and demand has not changed as a result of the attack yet, so right now the market is operating on fear.”

And Bloomberg’s Mike Dorning reported on Thursday that, “U.S. Agriculture Secretary Tom Vilsack warned fertilizer companies and other farm suppliers against taking ‘unfair advantage’ of the Ukraine conflict and said his department would be watching for unjustified price increases.”