A new 10% tariff on goods from around the world took effect Tuesday — with a list of exemptions including beef. Other exemptions affecting the food and agriculture industries include…

Russia-Ukraine Tensions Unnerving Grain Markets- Could “Spark Unrest Far From the Front Lines”

Wall Street Journal writer William Mauldin reported on the front page of Tuesday’s paper that, “A senior U.S. diplomat accused Russia of trying to destabilize Ukraine, and a Kremlin representative in turn criticized Washington for stoking fears and tensions as the two sides squared off in a fractious debate in the United Nations Security Council.

“Ambassadors from the U.S., Ukraine and member-nations of the North Atlantic Treaty Organization questioned Russia’s motivations, its troop buildup and what they described as its threat to Ukraine’s and Europe’s security, during Monday’s Security Council meeting.”

Mauldin explained that, “Beyond the U.N., a series of foreign leaders—including the prime ministers of the U.K., the Netherlands and Poland, and the president of Turkey—are scheduled to visit Ukraine this week to try to deter Russia from attacking and look for a diplomatic solution to the standoff.

“Other diplomatic initiatives inched forward. Russian President Vladimir Putin and French President Emmanuel Macron spoke for the second time in recent days on Monday, discussing the situation around Ukraine and Russia’s security concerns, according to the Kremlin.”

And on the front page of Tuesday’s Washington Post, Robyn Dixon, Karen DeYoung, Rachel Pannett and John Hudson reported that, “Russia and the United States clashed head to head at the United Nations on Monday over the situation in Ukraine, as each charged the other with lying about their intentions and promoting panic and hysteria to serve their own ends.”

“World leaders continued applying diplomatic pressure on Russia across several fronts in an effort to head off what they have said is an invasion that is possibly only days or weeks away,” the Post article said.

With respect to the ongoing tensions and agricultural markets, Will Horner and Kirk Maltais reported in Tuesday’s Wall Street Journal that, “The threat of war between Russia and Ukraine is rattling international grain markets, driving wheat prices higher on both sides of the Atlantic and leaving traders girding for more volatility ahead.

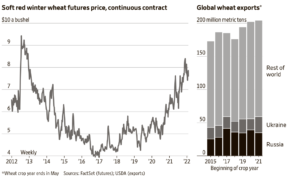

“The two nations combined account for 29% of global wheat exports, according to data from the U.S. Agriculture Department. The nearby Black Sea serves as a major conduit for international grain shipments and Ukraine is also among the top exporters of barley, corn and rapeseed.

“The mounting tensions and growing militarization along the Russia-Ukraine border have helped drive wheat futures traded in Chicago up over 7% over the past two weeks to nearly $8 a bushel Monday—which is just below a nearly decade high of $8.50 a bushel reached last year. Benchmark European wheat futures, which are traded in Paris, have gained almost 6% over the same period to €278, equivalent to $310, a metric ton and near last year’s highs.

Some analysts worry a deep Russian push into Ukraine and Western sanctions that curtail Russian exports would be a worst-case scenario and could deprive global markets of the lion’s share of both nations’ wheat supplies.

The Journal article added that, “Even a limited conflict that doesn’t stray far from the Ukrainian-Russian border and only causes minor damage to Ukraine’s agricultural infrastructure could drive prices up between 10% and 20%, said Andrey Sizov, managing director of SovEcon, a Russian research firm focused on Black Sea grains markets.”

Meanwhile, Washington Post columnist Anthony Faiola indicated last week that, “But in a worst-case scenario, the cost of a major Russian invasion of Ukraine — one of the world’s largest grain exporters — could ripple across the globe, driving up already surging food prices and increasing the risk of social unrest well beyond Eastern Europe.”

Faiola stated that, “Over the past 20 years, bountiful Ukrainian harvests boosted the country’s role as a global breadbasket. Some of its biggest clients are economically battered, war-torn or otherwise fragile states in the Middle East and Africa, including Yemen, Lebanon and Libya, where grain shortages or cost surges could not only deepen misery but churn up unpredictable social consequences.”

The Post column also noted that, “In 2020, Ukraine exported more than 8 million tons of corn to China, accounting for just over a quarter of Ukraine’s total corn exports that year, according to the United States Department of Agriculture. Given the agricultural cycle, a significant chunk of Ukraine’s seasonal corn exports — much of it purchased by China — has already shipped.

“But Peter Meyer, head of grains analysis at S&P Global Platts, told me [Faiola] there’s word on the street that the Chinese have been quietly shopping around for U.S. corn in the event the Ukrainians can’t make good on deliveries later this year.”