A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

The 2022 Outlook for U.S. Agriculture From USDA’s Chief Economist

Speaking on Thursday at USDA’s virtual Agricultural Outlook Forum, USDA Chief Economist Seth Meyer provided a broad outlook for U.S. agriculture. Today’s update provides an overview of key aspects of Dr. Meyer’s presentation.

In his speech Thursday (transcript / slides), Dr. Meyer noted that, “Fiscal Year (FY) 2021 ended with record exports ($172.2B) based on very strong commodity prices and record exports supported by the U.S.-China Phase One Agreement. FY2022 is looking to also be a record year. This strength is reflected in USDA’s revised forecast for U.S. agricultural trade in FY 2022, which was released today with exports now forecast at a record $183.5 billion, or an increase of over $11.3 billion from FY 2021.” [Note: U.S. agricultural exports also set a record for calendar year 2021].

However, Dr. Meyer cautioned that, “There are other global uncertainties that could affect the U.S. agricultural trade forecast in 2022. For example, Russia’s invasion of Ukraine could have global economic and trade implications. Together the two countries account for almost a quarter of global grain exports. Although we may expect global and regional grain markets to reorient to alternative suppliers and markets which may limit direct effects on U.S. agricultural exports, short-term broader macro effects would reverberate through the global economy depending on the severity and duration of the conflict. Additionally, interlinkages through fertilizer and energy markets could have knock-on effects for agricultural producers across the world.”

“The U.S.-China trade relationship will also be a focus, given the importance of this market for U.S. agriculture,” Dr. Meyer added.

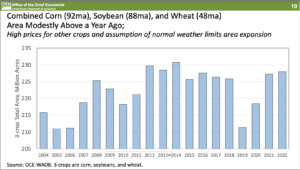

Turning to acreage prospects, Dr. Meyer explained that, “Combined corn and soybean area is forecast at 180.0 million acres, below the historical high of 180.6 million planted in 2021.

“Corn area for 2022 is expected to decline 1.4 million acres to 92.0 million, driven by more attractive relative prices for other crops and high input costs.

#Corn Market Outlook.

— Farm Policy (@FarmPolicy) February 26, 2022

- Michael McConnell, Agricultural Economist, Economic Research Service, USDA, Washington, D.C., #AgOutlook. pic.twitter.com/dLQfqfrbLz

“Soybean area is up 0.8 million acres to 88.0 million with very favorable forward pricing opportunities for producers given the drought in South America and continued strong U.S. crush demand.

#Soybean Market Outlook.

— Farm Policy (@FarmPolicy) February 26, 2022

- Michael McConnell, Agricultural Economist, Economic Research Service, USDA, Washington, D.C., #AgOutlook. pic.twitter.com/0FHhtYAc8a

“Wheat area is above a year ago with increases for both winter and spring wheat and at 48.0 million acres would be the highest since 2016.”

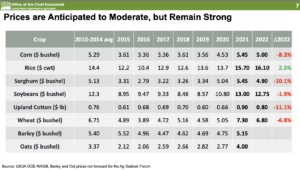

And with respect to prices, Dr. Meyer noted that, “Corn, soybean, and wheat prices received by producers in 2022 are expected to decline relative to the prior year, but nevertheless remain high relative to recent history.”

In remarks on farm income, Dr. Meyer pointed out that, “A strong agricultural economy continues to support farm cash receipts into 2022. Commodity prices continue to be high compared to the first half of 2020, when agriculture faced sharp adjustments to the COVID-19 pandemic. Commodity prices started adjusting upwards in the second half of 2020 and have generally remained high into 2022.

“However, supply disruptions and strong global demand, contributing to price inflation, have placed upward pressure on production expenses and these have eaten into net farm income in 2021, as are expected decreases in direct government payments compared to 2021.”