As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

USDA Agricultural Projections to 2031- Focus on Corn, Soybeans

On Wednesday, the U.S. Department of Agriculture released its 10-year projections for the food and agricultural sector.

In part, the baseline update explained that, “The Agriculture Improvement Act of 2018 is assumed to remain in effect through the projection period. The projections are one representative scenario for the agricultural sector and reflect a composite of model results and judgment-based analyses. The projections in this report were prepared using data through the October 2021 World Agricultural Supply and Demand Estimates (WASDE) report, except where noted otherwise. Macroeconomic assumptions were concluded in August 2021.”

Corn

The report stated that, “The baseline projects U.S. corn production to grow over the next decade as yield gains offset a gradual decline in acreage. Planted area is projected to steadily decline after 2021/22’s strong response to increased global demand and tight supplies.”

“Through the baseline period, supply grows at a faster rate than use, resulting in a steadily increasing stocks-to-use ratio,” the report said.

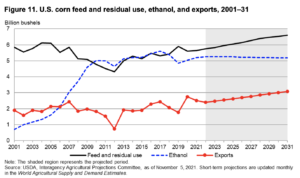

With respect to ethanol, the report noted that, “Corn used for ethanol production declines slightly over the projection period, from 5.250 billion bushels to 5.175 billion by 2031/32. Expected declines in motor gasoline consumption constrains ethanol demand.”

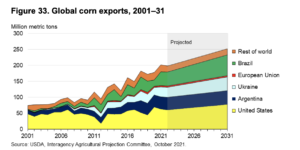

While addressing long-term corn exports, USDA explained that, “U.S. exports are projected to reach 3.150 billion bushels by 2031/32, compared with the record-setting 2020/21 total of 2.753 billion.”

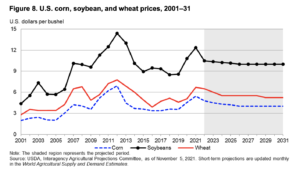

“Nominal corn prices are projected to fall from $4.80 per bushel in 2022/23 to $4.00 by 2026/27, and then remain stable at that level through 2031/32,” the report said.

Soybeans

Wednesday’s report noted that, “U.S. soybean plantings rebounded sharply in 2021/22 from the prior two years, with the area projected to remain elevated over the course of the decade. Plantings remain near 88 million acres, supported by high prices and net returns relative to much of the last 5-7 years.”

The update pointed out that, “Soybean oil use for production of biofuels increases from 8.8 billion pounds in 2020/21 to 15 billion pounds by the end of the projection period. Current policy is assumed, which is largely driven by soybean-oil based renewable diesel for the California market and substitution of renewable diesel for Fatty Acid Methyl Ester in all markets.”

“Nominal soybean prices are projected to start at $10.50 per bushel in 2022/23, declining significantly from 2021/22 and continuing to fall through 2026/27 before flattening at $10.00 the remainder of the projection,” the report said.

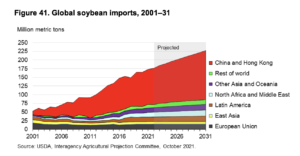

In more detailed demand analysis, the baseline report added that, “Chinese demand will drive continued growth in soybean trade during the next 10 years, as world soybean imports climb 51.1 million tons (29 percent) to 227.5 million tons.”

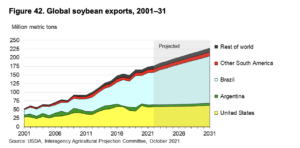

Turning to world soybean exports, USDA stated that, “The three leading soybean exporters—the United States, Brazil, and Argentina—are projected to account for 90 percent of world soybean trade by 2031/32.”

The baseline report also noted that, “The U.S. share of global soybean exports is about 33 percent in 2022/23 and is projected to decrease to 27.2 percent by 2031/32. U.S. soybean exports are projected to increase from 58.2 million tons in 2022/23 to 61.9 million tons by 2031/32.”