The world's farmers face soaring fertilizer and fuel prices as the war in the Middle East escalates, leaving some scrambling for supplies as the spring planting season approaches and causing…

Fertilizer and Commodity Trade Flows Continue to Adjust to Russian Invasion

Reuters writer Tom Polansek reported yesterday that, “CF Industries Holdings is increasing fertilizer shipments to both U.S. coasts from the world’s largest nitrogen complex in Louisiana to help offset a decline in exports from Russia after it invaded Ukraine, Chief Executive Tony Will said.”

The Reuters article explained that, “CF Industries has five U.S. nitrogen manufacturing complexes, along with plants in Canada and the United Kingdom. The company’s ability to increase production is limited because it tries to operate plants at their maximum rate all year, Will said.

“‘We’re moving as much product as we can right now with the assets that we have available,’ he said.”

With respect to fertilizer production, Reuters writer Anthony Boadle reported earlier this week that, “A Canadian-owned company has proposed doubling planned output of potash from a deposit in Brazil’s Amazon to reduce the agricultural powerhouse’s dependence on fertilizer imports disrupted by the Ukraine war.

“Brazil Potash Corp said on Tuesday that its executives met with Brazilian Agriculture Minister Tereza Cristina Dias in Ottawa and discussed increasing from 2.44 million tonnes to over 5 million tonnes per year the output from its Autazes project.”

Meanwhile, a news release on Wednesday from Nutrien stated that, “Nutrien Ltd. announced today that in response to the uncertainty of potash supply from Eastern Europe it plans to increase potash production capability to approximately 15 million tonnes in 2022, an increase of nearly one million tonnes compared to previous expectations. The majority of additional volume is expected to be produced in the second half of the year.”

In response to the global supply uncertainty caused by the conflict in #Ukraine, we will increase our #potash production capacity to 15 million tonnes in 2022. This is the most potash we have ever produced, an increase of nearly 20 per cent over the past two years. (1/5)

— Nutrien (@NutrienLTD) March 17, 2022

However, Reuters News reported yesterday that, “Canadian Pacific Railway will lock out its employees in 72 hours if there is no agreement with a union, the company said on Wednesday, a move that would potentially disrupt the movement of grain, potash and coal at a time of soaring commodity prices.”

BUT -- CP is the main carrier of Canadian potash, so if there's a prolonged lockout, followed by shipment backup that takes awhile to resolve -- getting potash to export customers could prove more tough than producing it

— Rod Nickel (@RodNickel_Rtrs) March 17, 2022

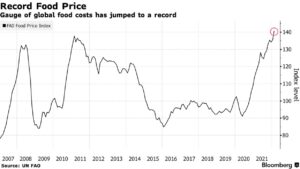

Also yesterday, Bloomberg’s Tatiana Freitas reported that, “The world’s agricultural superpowers are divided over whether Russian fertilizers should be sanctioned as surging prices threaten to further stoke food inflation.

Brazil, the top exporter of everything from soybeans to coffee and sugar and the biggest importer of fertilizers, argues for keeping crop nutrients sanction free in the name of food security. The U.S., on the other hand, leans toward upping the ante against Russia.

“‘Maybe sacrifices are necessary to address the unjustified war that Russia has chosen to start,’ U.S. Agriculture Secretary Tom Vilsack said during a virtual event organized by the United Nations’ Food and Agriculture Organization on Wednesday.”

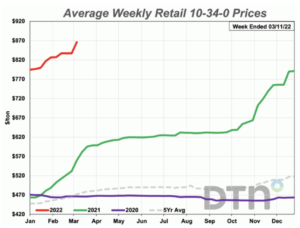

In a closer look at U.S. fertilizer prices, DTN writer Russ Quinn reported yesterday that, “Retail fertilizer prices tracked by DTN continued to be mostly higher the second week of March 2022.”

Quinn pointed out that, “Most fertilizers continue to be considerably higher in prices than one year earlier.

MAP is now 38% more expensive, 10-34-0 is 49% higher, DAP is 50% more expensive, urea is 87% higher, potash is 95% more expensive, UAN28 is 97% higher, UAN32 104% is more expensive and anhydrous is 139% higher compared to last year.

News articles this week also highlighted recent adjustments to commodity trade flows, and prices.

Reuters writer Naveen Thukral reported yesterday that, “A surge in wheat and corn prices is boosting demand for low-grade rice in animal rations across Asia, pushing up prices of the world’s most important staple at a time when global food inflation is already hovering near record highs.”

Also yesterday, Reuters writer Momen Saeed Atallah reported that, “Egypt’s cabinet on Wednesday agreed to add 65 Egyptian pounds ($4.15) per ardeb (150 kilograms) to its procurement price of local wheat as an incentive for farmers to sell more of the local crop to the government ahead of the harvest.”

A separate Reuters article from yesterday reported that, “Italy’s imports of some agricultural commodities from Ukraine are limited enough to be offset by a shift towards other markets after Moscow’s invasion of Ukraine caused shortfalls, agriculture minister said on Wednesday.”

With respect to France, Reuters News reported yesterday that, “French producers of livestock feed have asked the government to guarantee a certain volume of grain is available for their sector in the face of rising export demand linked to the war in Ukraine, the head of feed makers’ association SNIA said.”

Reuters writer Roberto Samora reported yesterday that, “Brazil, one of the world’s biggest wheat importers, could sharply reduce its dependence on foreign crops as record export demand provides farmers with the funds to expand their planting areas.”

Despite adjustments, shortages may ensue: Reuters writer David Lawder reported yesterday that, “The World Bank on Wednesday said a number of developing countries face near-term wheat supply shortages due to their high dependence on Ukrainian wheat exports that have been disrupted by Russia’s invasion.”

And Dow Jones writer Kirk Maltais reported yesterday that, “Wheat for May delivery fell 7.4% to $10.69 1/4 a bushel on the Chicago Board of Trade Wednesday, dropping by its extended limit of 85 cents per bushel as rainfall is expected to hit dry areas in the next week.”