A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Fertilizer Price Records Continue, as White House Economist Sees Increased Planting in U.S.

Bloomberg writer Elizabeth Elkin reported yesterday that, “Fertilizer prices continue to spike to records as Russia’s invasion of Ukraine puts a massive portion of the world’s fertilizer supply at risk, adding to concerns over soaring global food inflation.

“A gauge of prices for the nitrogen fertilizer ammonia in Tampa surged 43% to $1,625 per metric ton Friday, a record for the 29-year-old index. Production outages and tight global supply are driving the jump, according to a note from Bloomberg Intelligence.”

“Rising costs for farm inputs like fertilizer could further send the price of food skyrocketing,” the Bloomberg article said.

Also yesterday, Bloomberg writer Volodymyr Verbyany reported that, “Ukraine may ease wheat-export curbs as soon as next month, once it is confident that spring sowing is progressing enough despite Russia’s invasion, though export capacity remains strained with some seaports effectively closed by fighting, an official who oversees the country’s trade said.”

Verbyany added that, “The eastern European nation is struggling to conduct its spring planting campaign in conditions that it hasn’t faced since the Second World War, with farmers having to work in fields under constant risk of shelling and fighting. The Agriculture Ministry estimates sowing areas may shrink by 30% to 50% from last year.”

Meanwhile, Bloomberg’s James Poole reported today that, “Wheat prices held their biggest daily drop in more than a week as India, the second-largest grower, looks set to export a record amount of the grain in the coming year to help fill the gap left by choked Black Sea supply.

“Another bearish sign was a significant improvement in the condition of Kansas winter wheat, which will be harvested in future months. Countering the mood to some extent was that Australia has ‘pretty well’ sold out of wheat in the first half of this year, and most of the available capacity is now in the second half.”

With respect to U.S. grain exports, Dow Jones writer Kirk Maltais reported yesterday that, “Export inspections for U.S. corn, soybeans and wheat all rose in the past week, with China being a leading destination for grains.”

“This week’s export inspection figures come amid a focus among traders on nations replacing their exports that were coming from the Black Sea with other alternatives, with U.S. grains expected to be a highly sought choice,” the Dow Jones article said.

In other grain trade news, Reuters writer Julie Ingwersen reported yesterday that, “The following are selected highlights from a report issued by the U.S. Department of Agriculture’s (USDA) Foreign Agricultural Service (FAS) post in Cairo:

“Egypt is closely following the repercussions of the Russian-Ukrainian crisis. Certainly Egypt’s grains imports from both countries were affected. Accordingly, FAS Cairo forecasts Egypt’s wheat imports in MY 2022/23 (July–June) at 11 MMT (million metric tons), down by 8.3 percent from MY 2021/22 Post’s import estimate figure of 12 MMT. Importing and buying wheat from other markets remains a viable option for government and private purchases. Wheat production in MY 2022/23 is up by 8.9 percent from the previous marketing year.

Egypt has sufficient wheat stocks for its bread subsidy program until the end of calendar year 2022.

And Reuters writers Leigh Thomas, Aidan Lewis, Gus Trompiz and John Irish reported yesterday that, “France will ensure that Egypt gets the wheat it needs in the coming months as the war in Ukraine creates supply risks for grain importing countries, French Finance Minister Bruno Le Maire said on Monday.”

Wall Street Journal writer Yuka Hayashi reported yesterday that, “Egypt, the world’s largest importer of wheat, has already felt economic stress from the war. Last week, it sought financial support from the International Monetary Fund.”

Also yesterday, Reuters writer Moataz Mohamed reported that, “Bahrain’s wheat reserves are sufficient for about 4-1/2 months of consumption, local newspaper Al-ayam reported on Monday citing Marwan Tabbara, the chairman of Bahrain’s flour mill company.”

Meanwhile, Reuters writer Rajendra Jadhav reported today that, “India has contracted 45,000 tonnes of Russian sunflower oil at a record high price for shipments in April as edible oil prices in the local market surged after supplies from rival Ukraine stopped, five industry officials told Reuters.”

More broadly on the food oil market, Bloomberg writers Anuradha Raghu and Pratik Parija reported yesterday that, “Cooking oil shortages have been worsening since last year. In Malaysia—the world’s number two palm oil producer—output fell drastically due to a chronic labor shortage. Then drought decimated the canola crop in Canada and slashed the soybean harvests in Brazil and Argentina. Buyers were counting on filling in with sunflower oil from Ukraine and Russia, which together make up about 75% of the world’s exports. The invasion ended that possibility.

“The market reacted swiftly. Prices of the four major cooking oils—palm, soybean, rapeseed and sunflower—soared, and the rally is set to cascade down to shoppers in the form of higher costs for everything from candy to chocolate.”

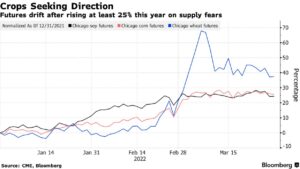

Considering U.S. crop planting prospects, Bloomberg writer Nancy Cook reported yesterday that, “U.S. farmers will respond to ‘price signals’ and increase their production to avert any domestic food shortage stemming from Russia’s invasion of Ukraine, the White House’s chief economist said Monday.

“‘We don’t expect a shortage here, because we are net exporters,’ Cecilia Rouse, the chair of President Joe Biden’s Council of Economic Advisers, told reporters at a briefing. ‘But we are acutely aware of the fact that there are regions in the world that depend heavily on exports of wheat in particular and other grains from Ukraine and Russia.’

“She predicted that American farmers would adjust and increase their planting to take advantage of higher prices.”