President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

“Limitations” on How Fast U.S. Farmers Can Respond to High Commodity Prices, as “Global Oilseed Prices Soar”

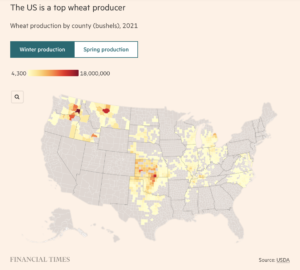

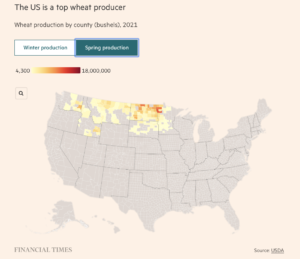

Financial Times writer Steff Chávez reported yesterday that, “The war in Ukraine is altering Shay Richter’s plans for his Montana family farm. As wheat exports dwindle from the Black Sea region, driving prices to record highs, Richter intends to plant more of the grain and fewer chickpeas, lentils and peas this spring.”

“But hopes that the US agricultural export powerhouse will stop an emerging crisis in world wheat markets are likely to be misplaced, experts said. Most of this year’s American wheat crop is already planted, while soaring costs for fuel and fertiliser are blunting the economic incentives offered by Chicago wheat prices that this month reached $13.40 a bushel, an all-time high,” the FT article said.

Chávez explained that, “But any response from the US this time will take time. After a poor harvest last year, domestic wheat stocks are at their lowest level in 14 years, according to the US Department of Agriculture. Farmers have already seeded 34.4mn acres with winter wheat, which accounts for the majority of US production, and there is a worsening drought in important winter wheat states such as Kansas.”

‘There’s just limitations on how much farmers can respond [to high prices] here in North America,’ said Scott Irwin, an agricultural economist at the University of Illinois.

The FT article also noted that, “For US farmers with crops left over to sell from last year, wild price moves have made marketing more challenging. Grain merchants operating country silos have in some cases ‘just pulled cash bids’ because ‘they can’t function in an environment where [prices] are changing that quickly,’ said Joseph Glauber, a senior research fellow at IFPRI and former chief economist at the US Department of Agriculture.”

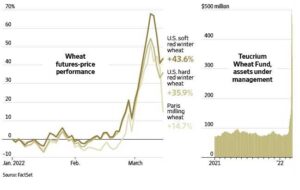

Meanwhile, Ryan Dezember reported in today’s Wall Street Journal that, “Russia’s invasion of Ukraine threatens a big portion of the world’s wheat supply and has sent prices on a dizzying ride to new highs as well as the sharpest weekly drop in years.”

“Still, the benchmark U.S. price, at $11.07 a bushel, is 72% higher than a year earlier and analysts expect the war will keep wheat high,” the Journal article said.

Dezember pointed out that, “While American consumers can expect more sticker shock at the grocery store, the loss of Black Sea exports risks leaving some countries that rely on imports unable to meet their grain needs, analysts and traders say.”

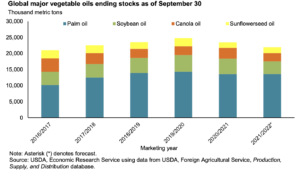

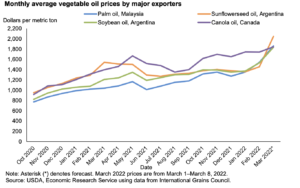

In its March Oil Crops Outlook report last week, the USDA’s Economic Research Service (ERS) stated that, “In 2021/22, global stocks of the four major vegetable oils (palm, soybean, canola, and sunflowerseed) are expected to decline to the lowest level of 21.94 million metric tons since 2016/17 as global oilseed crush has been reduced by 7 million metric tons.

“These tight vegetable oil stocks are the result of disappointing oilseed crops production between 2019 and 2021 in Canada, Europe, Russia, and Ukraine. Poor crops in South America have further extended run-ups in global vegetable oil prices. Volatility in vegetable oil prices has been expounded by the war in the Black Sea.”

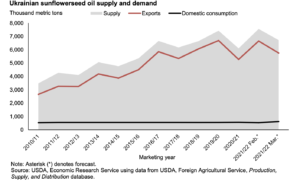

ERS added that, “Ukraine and Russia are the leading global producers of sunflowerseed with an estimated production of 17.5 and 15.6 million metric tons in 2021/22, respectively. Both countries crush a significant volume of sunflowerseed and—combined—produce nearly 60 percent of global sunflowerseed oil.”

The Outlook noted that, “Considering reductions in sunflowerseed oil production along with the closure of major ports, the 2021/22 Ukrainian sunflowerseed oil export forecast is lowered by 900,000 metric tons to 5.75 million metric tons.”