The world's farmers face soaring fertilizer and fuel prices as the war in the Middle East escalates, leaving some scrambling for supplies as the spring planting season approaches and causing…

Russia Invasion: Likely “Biggest Grain Supply Shock in Living Memory,” Wheat Prices Continue to Surge

David L. Stern, Alex Horton, John Hudson and Kareem Fahim reported on the front page of today’s Washington Post that, “Russian forces laid siege to key urban areas across Ukraine on Wednesday, advancing on the strategic port city of Kherson and bombarding Kharkiv, the nation’s second-largest city, while facing fierce resistance and resupply challenges in other areas.”

Meanwhile, Bloomberg writer Elizabeth Elkin reported on Wednesday that,

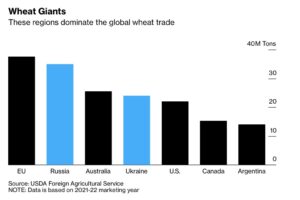

Russia’s invasion of Ukraine could devastate global grain markets so deeply that it’s likely to be the biggest supply shock in living memory.

“That’s according to Scott Irwin, an agricultural economist at the University of Illinois. Tens of millions of acres of grain production are at stake, he said Wednesday on Twitter.

5. I am convinced it is going to be the biggest supply shock to global grain markets in my lifetime. As just one data point. It has been reported that there are 600 million bushels of corn contracted for export that is currently trapped in Ukraine. And what about 2022 prod?

— Scott Irwin (@ScottIrwinUI) March 2, 2022

“‘I am convinced it is going to be the biggest supply shock to global grain markets in my lifetime,’ Irwin said.”

The Bloomberg article indicated that, “The world ‘desperately‘ needs farmers to plant more acres in 2022, he said, but ‘basically nothing can be done in the short-run except to run up the price of grain high enough to ration demand.'”

In his Twitter thread on Wednesday, Irwin stated: “So my simple proposal is to let every CRP [Conservation Reserve Program] acre be eligible for cropping for 2022 and only 2022. No interruption of payments or contracts. Just change the rules on an emergency basis so it can be cropped if a farmer wants to risk it this year.”

11. So my simple proposal is to let every CRP acre be eligible for cropping for 2022 and only 2022. No interruption of payments or contracts. Just change the rules on an emergency basis so it can be cropped if a farmer wants to risk it this year. pic.twitter.com/FinXX1fPmr

— Scott Irwin (@ScottIrwinUI) March 2, 2022

Similar themes have emerged from the European Union.

Reuters News reported on Wednesday that, “The European Union should let farmers cultivate fallow land and offer aid for rising fertiliser prices so the bloc can help replace millions of tonnes of Ukrainian wheat that may be lost due to war, French agricultural group InVivo said.”

The Reuters article stated that, “The ongoing conflict could have lasting effects on Ukraine’s grain supply, with some estimates suggesting the country’s wheat output could drop by at least half and leave the world market short of 20 million tonnes of wheat, InVivo Chief Executive Thierry Blandinieres told reporters on Wednesday.

“‘We’re asking for the production potential of the European Union to be unleashed,’ he said during a news conference at the Paris farm show.

A waiving of set-aside rules under the EU’s Common Agricultural Policy could increase its cultivated area by 10-15% next season, he said.

Bloomberg writer James Poole reported on Wednesday that, “Wheat prices extended their meteoric rally, soaring past $11 a bushel to the highest level in 14 years, as Russia’s invasion of Ukraine brings shipments from one of the world’s biggest growing areas to a virtual standstill.”

Food inflation is now seen as a key catalyst for the Arab Spring protests -- UN's Food + Ag Price Measure is already higher than it was in Dec. 2010. "This is the kind of stuff that leads to food riots," Kona Haque at ED&F Man warns @daniburgz @bloombergtv pic.twitter.com/FZhsHEyGye

— Simone Foxman (@SimoneFoxman) March 3, 2022

Poole added that, “The shortages are likely to spill over to next season, or potentially even longer. Bumper harvests in North America and other parts of Europe will be critical this summer to curb more price increases. With flows from the Black Sea region snarled by the war, buyers are considering forward contracts for Australian grain as far out as the third quarter, said top shipper CBH Group.”

And Bloomberg writer Jen Skerritt reported on Wednesday that, “One of the world’s top wheat exporters won’t be able to fill supply shortfalls caused by Russia’s invasion of Ukraine after drought withered its own grain inventories.

“Dry conditions zapped as much as 40% of Western Canada’s grain output, and finding additional supplies to export would be a ‘struggle,’ said Phil Speiss, commodity futures broker for RBC Dominion Securities in Winnipeg, Manitoba. Stockpiles of wheat in Canada dwindled to 15.6 million tons at the end of December, down 38% from a year earlier, government data show.”