As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

USDA Lowers Wheat, Corn Export Estimates for Ukraine; Fertilizer, Food Security Worries Escalate

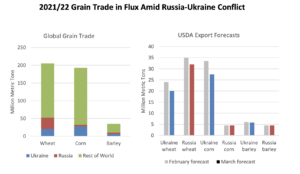

Bloomberg writer Megan Durisin reported yesterday that, “The U.S. Department of Agriculture lowered its estimate for Ukraine and wheat and corn exports due to the attack by Russia.

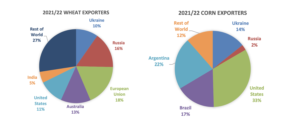

“The USDA in its monthly World Agriculture Supply and Demand Estimates report cut Ukraine wheat exports by 4 million tons to 20 million in 2021-2022. Other wheat exporters will only partly offset those losses. USDA raised its estimates for Australia and India, which are both seen at an all-time high. Despite the loss of some Ukraine and Russia supply the outlook for U.S. wheat sales was lowered.”

The Bloomberg article added that, “USDA slashed its outlook for Ukrainian corn sales by 6 million tons. Still, that’s less than half the amount the United Nations expected they still have left to ship. U.S. corn exports were raised by 1.9 million metric tons. This relects ‘expectations of sharply lower exports from Ukraine,’ according to the agency.

“Russian wheat sales are expected to be 3 million tons lower at 32 million. Vessel transportation is expected to be constrained by the conflict and the imposition of economic sanctions, the agency said.”

#Ukraine: Crop Calendar pic.twitter.com/65Fo0mQScn

— Farm Policy (@FarmPolicy) March 9, 2022

#Russia: Crop Calendar pic.twitter.com/JJSOhKwXY7

— Farm Policy (@FarmPolicy) March 9, 2022

Also yesterday, Dow Jones writer Kirk Maltais reported that, “Extensive drought in South America has further cut into this year’s crop-production forecasts, the U.S. Department of Agriculture said Wednesday.

“In its monthly world supply and demand report, the USDA said production of soybeans in Brazil is likely to be 127 million metric tons, while corn production is unchanged at 114 million tons. For soybeans, this month’s projection is a 7-million-ton drop, amid drought conditions that have stymied crop growth there. The soybean forecast fell short of the average estimate of analysts surveyed by The Wall Street Journal.

“Production in Argentina is also seen as falling, according to the USDA’s latest outlook, with corn production seen at 53 million tons while soybean production is projected at 43.5 million tons. These are both below last month’s forecast by the USDA, but the decrease is less than expected by analysts.”

Reuters writer Mark Weinraub reported that, “The domestic stockpile of soybeans will be smaller than previously thought as crop shortfalls in Brazil and Argentina boost export demand for U.S. supplies, the government said on Wednesday.”

And Reuters writer P.J. Huffstutter reported yesterday that, “Chicago wheat futures hit their daily trading limit on the downside for the second straight day on Wednesday, as the U.S. government cut domestic wheat exports and global markets continue to be roiled by supply disruptions stemming from Russia’s invasion of Ukraine.”

Huffstutter added that,

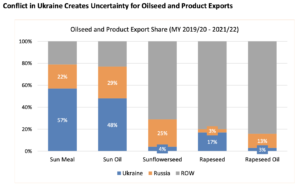

Meanwhile, a global food crisis continues to escalate, as merchants and importers are seeking alternatives to Ukrainian and Russian supplies, with European Union grain in particular demand.

“Argentina’s corn exporters have held talks over selling their crop to Spain, with expectations that the European country will ease import rules.”

With respect to the growing food crisis, Reuters writer Nigel Hunt reported yesterday that, “A global food crisis sparked by Russia’s invasion of Ukraine escalated on Wednesday as Indonesia tightened curbs on palm oil exports, adding to a growing list of key producing countries seeking to keep vital food supplies within their borders.”

“Malaysian palm oil futures rose to an all-time high following Indonesia’s announcement while soybean oil prices jumped to a 14-year peak,” the Reuters article said.

In developments highlighting fertilizer market variables, Bloomberg writers Stephen Treloar and Samuel Gebre reported yesterday that, “European fertilizer makers, including Yara International ASA and Borealis AG, are cutting output because of surging natural gas prices, adding to the growing risks for global food inflation.

“Russia’s invasion of Ukraine has roiled commodities markets and propelled natural gas — the feedstock of nitrogen fertilizers — to record levels. That’s forcing producers to curb ammonia output, pushing up farm input costs and adding to the risks of a worldwide food shock.”

Also yesterday, DTN writer Russ Quinn reported that, “After a week in which half of the average retail fertilizer prices were lower, prices for most fertilizers moved higher the first week of March 2022 compared to a month earlier, according to sellers surveyed by DTN.”

Quinn stated that, “DAP had an average price of $879 per ton, MAP $937/ton, potash $815/ton, 10-34-0 $837/ton, anhydrous $1,487/ton, UAN28 $603 (all-time high price) and UAN32 $703/ton (all-time high price).”