A new 10% tariff on goods from around the world took effect Tuesday — with a list of exemptions including beef. Other exemptions affecting the food and agriculture industries include…

Wheat: “Crazed Cash Market,” Many Grain Elevators Stop Issuing Bids as Futures and Cash Prices Diverge

Financial Times writer Guy Chazan reported today that, “Russia called a temporary halt to its bombardment of the Ukrainian port of Mariupol on Saturday, enabling thousands of civilians to take advantage of the brief break in fighting to flee the besieged city.”

On Friday, DTN writer Katie Micik Dehlinger reported that, “The May Chicago wheat futures contract closed 41% higher than last week at $12.09, a record-breaking weekly gain that reflects global fears about wheat supplies and exports amid Ukraine and Russia’s war.

“The May Kansas City hard red winter wheat contract finished the week 36% higher than last Friday, closing at $12.14 1/2.”

Dehlinger explained that,

The impact rippled across the Plains this week as many grain elevators stopped issuing bids or accepting offers from farmers to sell wheat.

“‘Prices are getting so high they just aren’t serving the physical markets,’ DTN Lead Analyst Todd Hultman said. Until there’s some resolution to or at least a better understanding of the situation in Ukraine, there’s little that could change the market’s direction. ‘Fear has gripped the market in a big way.'”

Also on Friday, Bloomberg writers Kim Chipman and Michael Hirtzer reported that, “Wheat prices are diverging in some local markets, with the differential between cash prices and benchmark futures on the Chicago exchange plummeting as wheat buyers balk at the highest prices since 2008. That’s potentially sidelining farmers who are already contending with the worst farm cost inflation in years.

“‘This crazed cash market scenario we are seeing because of the war is hurting farmers’ ability right now to market their old and even new crop wheat,’ said Mary Kennedy, an analyst at agriculture publisher DTN Progressive Farmer. Some growers say their bids have been pulled from grain elevators, she said.”

The Bloomberg article added that, “‘Wheat futures are in ludicrous mode, there is no other way to say it,’ said Matt Campbell, a risk management consultant at StoneX. ‘Futures and cash are diverging sharply. This is a very scary marketplace right now.'”

Beyond domestic market function concerns, Emiko Terazono and Michael Pooler reported on Friday at The Financial Times Online that, “The big price increases were already curtailing the ability of grain-importing countries to purchase wheat. Turkey, a leading buyer of Russian wheat, was forced to reduce its volumes for an international tender from its original targets.

“Demand was also shifting to alternative grains, said Commerzbank, leading to a significant rise in corn over the past few days. Corn traded in Chicago has risen almost 10 per cent since the Russian invasion.”

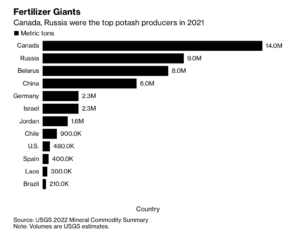

Turning to evolving variables in the global fertilizer market, Terazono and Pooler noted that, “In addition to grain prices, farmers around the world are likely to feel the impact of rising costs as Russia and Belarus are the leading fertiliser producers. The Russian Industry and Trade Ministry recommended that fertiliser producers temporarily halt exports, according to Interfax.”

Bloomberg’s Elizabeth Elkin reported on Friday that, “Russia’s efforts to halt fertilizer exports by domestic producers threatens to shock the global market and push prices of crop nutrients to new records, exacerbating food inflation around the world.”

In related news, Bloomberg writers Mariana Durao and Tatiana Freitas reported on Friday that, “The ripples of Russia’s invasion of Ukraine may reach all the way to Amazonian rainforests as Brazil sees disruptions to global fertilizer supplies as another reason to produce more of its own.”

Recent business news articles have also highlighted other market forces that are impacting components of global crop supply.

On Friday, Bloomberg writers Megan Durisin, Irina Anghel, and Volodymyr Verbyany reported that, “As Ukraine’s vast farmlands get caught up in war, there’s a real risk that the top sunflower grower will struggle to plant seeds this year and that harvests of other crops already sown will suffer.”

“The historic surge in wheat prices is expected to spur Canadian farmers to sow more acres,” Bloomberg’s Jen Skerritt reported on Friday.

And Reuters writers Hallie Gu and Shivani Singh reported today that, “The condition of China’s winter wheat crop could be the ‘worst in history,’ the agriculture minister said on Saturday, raising concerns about grain supplies in the world’s biggest wheat consumer.”