Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Wheat Falls as Russia-Ukraine Hold Talks, While War Reshuffles Trade and Budget Priorities

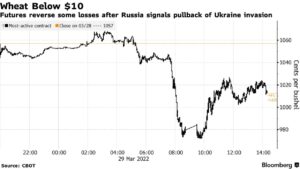

Bloomberg writers Megan Durisin and Allison Nicole Smith reported yesterday that, “Benchmark wheat and corn futures tumbled by the maximum allowed in Chicago trading as Russia signaled it may ease its attack in some parts of Ukraine, one of the world’s key sources of grain.”

Durisin and Smith explained that, “Russia said it would cut back military activity near the cities of Kyiv and Chernihiv. A pullback on Russia’s month-old invasion could ease some of the disruptions to global grain markets wrought by the war.

“Wheat futures sank as much as 8% to $9.72 a bushel, dipping below the $10 mark for the first time since the beginning of the month. Later, wheat erased some of those losses, closing the trading session at $10.1425 a bushel. Corn extended its decline, falling as much as 4.7% to $7.1350 a bushel, a four-week low, before settling at $7.2625, and Minneapolis wheat also dropped by the maximum allowed earlier in the trading session.”

Dow Jones writer Kirk Maltais reported yesterday that, “CBOT wheat futures remained lower, shedding risk premium as face-to-face talks to end the Russia-Ukraine conflict moved forward in Istanbul.”

Meanwhile, Reuters writer Michelle Nichols reported yesterday that, “The U.N. food chief warned on Tuesday that the war in Ukraine was threatening to devastate the World Food Programme’s efforts to feed some 125 million people globally because Ukraine had gone ‘from the breadbasket of the world to breadlines.’

‘It’s not just decimating dynamically Ukraine and the region, but it will have global context impact beyond anything we’ve seen since World War Two,’ WFP Executive Director David Beasley told the 15-member United Nations Security Council.

“Beasley said 50% of the grain bought by the WFP, the food-assistance branch of the United Nations, comes from Ukraine, ‘so you can only assume the devastation that this is going to have on our operations alone.'”

The Reuters article noted that, “Beasley added that the crisis was compounded by a lack of fertilizer products coming from Belarus and Russia.

“‘If you don’t put fertilizer on the crops, your yield will be at least 50% diminished. So we’re looking at what could be a catastrophe on top of a catastrophe in the months ahead,’ he told the council.”

Also yesterday, Reuters writer Mayank Bhardwaj reported that, “A delegation from Egypt will visit India in the first week of April to facilitate wheat imports as part of efforts to secure supplies and tide over shortages at one of the world’s biggest importers of the staple, Indian government sources said.

“Egypt, often the world’s biggest wheat importer, is reeling from a surge in bread and flour prices after Russia’s invasion of Ukraine closed off access to lower-priced Black Sea wheat.

“India, the world’s second biggest wheat producer, has emerged as a leading supplier of the grain to a host of countries that are struggling with cargo disruptions and sky-high grain prices in the wake of the crisis in the Black Sea region.”

And Reuters writer Tarek Amara reported yesterday that, “The European Union will allocate 200 million euros ($220 million) to Maghreb countries to help counter grain shortages resulting from the crisis in Ukraine, the European Commissioner for Enlargement Olivier Varhelyi said on Tuesday.

“Morocco, Algeria and Tunisia are significant importers of wheat from Russia and Ukraine and the invasion has caused sharp rises in grain prices.”

In other market developments stemming from Russia’s invasion of Ukraine, Wall Street Journal writers Jacquie McNish and Vipal Monga reported in today’s paper that, “Two weeks after Russia invaded Ukraine, Brazil’s agriculture minister was on a plane to Canada to head off a potential crop crisis.

“Brazil, one of the world’s largest agricultural producers, mostly fertilizes its crops with potash shipped from Russia and Belarus. When the two countries effectively halted potash exports during the Ukraine conflict, Brazil approached resource-rich Canada for backup.

“Tereza Cristina, Brazil’s minister of agriculture, said in a public statement she had secured an undisclosed increase in exports of potash from Canadian producers after meetings with government officials and industry executives. Before the Ukraine conflict, Brazil imported about 36% of its potash from Canada, compared with close to half imported from Russia and Belarus.”

The Journal writers pointed out that, “The growing interest in Canadian potash and other commodities is a reflection of how the conflict in Ukraine is shaking up and realigning global trade flows. Buyers seeking replacements for commodities that are restricted in Russia are also looking to Brazil for oil, to South Africa for platinum and Argentina for wheat.”

The Journal article noted that, “U.S. President Biden warned last week that global food shortages ‘will be real,’ and the issue came up as a source of concern at meetings with leaders of the Group of Seven leading nations.

“He said the U.S. and Canada would increase and more rapidly export the food resources.”

McNish and Monga added that, “Argentina, too, has seen a surge in interest. Gustavo Idígoras, head of a group that represents the country’s biggest grain processors and exporters, says he has received emails from French and Italian supermarkets seeking sunflower oil, as well as Egyptian and Lebanese government officials wanting long-term wheat and corn contracts. Indian clients are hoping Argentina can cover a gap in soy and sunflower oil that they used to buy from Ukraine, Mr. Idígoras said.”

And, Patricia Cohen, writing in today’s New York Times, reported that, “A wartime mind-set has also spread to sectors aside from defense. With prices soaring for oil, animal feed and fertilizer, Ireland introduced a ‘wartime tillage’ program last week to amp up grain production, and created a National Fodder and Food Security Committee to manage threats to the food supply.

“Farmers will be paid up to €400 for every additional 100-acre block that is planted with a cereal crop like barley, oats or wheat. Planting additional protein crops like peas and beans will earn a €300 subsidy.

“‘The illegal invasion in Ukraine has put our supply chains under enormous pressure,’ Charlie McConalogue, the agriculture minister, said in announcing the $13.2 million package. Russia is the world’s largest supplier of wheat and with Ukraine accounts for nearly a quarter of total global exports.”

Cohen pointed out that, “Spain has been running down its supplies of corn, sunflower oil and some other produce that also come from Russia and Ukraine. ‘We’ve got stock available, but we need to make purchases in third countries,’ Luis Planas, the agriculture minister, told a parliamentary committee.

“Mr. Planas has asked the European Commission to ease some rules on Latin American farm imports, like genetically modified corn for animal feed from Argentina, to offset the lack of supply.”