Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Wheat Soars to 14-Year High; Surge to $14 Possible, Citigroup Says

David L. Stern, Alex Horton, Loveday Morris and Cate Cadell reported on the front page of today’s Washington Post that, “Russia has sent nearly all its assembled combat power into Ukraine and on Thursday unleashed some of the most intense fighting since the invasion began, with local officials pleading for help as ground troops seized or encircled strategically important southern cities.”

On Thursday, Financial Times writers Neil Hume, Tom Wilson and Emiko Terazono reported that, “With exports from Ukraine and Russia at a virtual halt, wheat soared, with Chicago futures at the highest levels since 2008, when a rise in grain prices triggered protests and riots in Africa, Asia and Latin America.

“Wheat prices have risen 60 per cent since the start of February. Russia and Ukraine account for just under 30 per cent of global wheat exports, sending the grain to countries in the Middle East, north Africa and Asia.”

Bloomberg’s James Poole reported today that, “[Wheat] prices are heading for a record weekly gain of about 40%, spiking since Russia invaded Ukraine and the U.S. and Europe imposed sweeping sanctions on Russia. The war has closed major ports in Ukraine, and severed logistics and transport links. The fighting also threatens planting of crops in coming months. Trade with Russia has mostly dried up as buyers find it hard to navigate the complexity of sanctions and balk at soaring insurance and freight costs.”

“In the meantime, China, the world’s biggest importer of corn and soybeans and one of the top buyers of wheat, is moving to secure essential supplies in global markets, helping push prices even higher.”

Chinese buyers recently booked about 20 cargoes of American soybeans and about 10 shipments of corn, according to traders who asked not to be identified as they aren’t authorized to speak publicly. The move is another example of the country’s focus on securing supplies at a time of rising prices. Corn futures are up 17% this week, and heading for the biggest weekly gain since 2008.

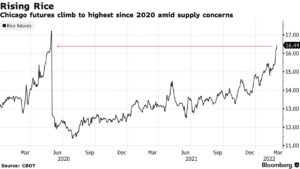

Poole also pointed out that, “Wheat futures jumped by the exchange limit in Chicago on Friday, rising 6.6% to $12.09 a bushel…[and]…Citigroup Inc. said prices could surge as high as $14 or $14.50 in an ‘extreme bull’ scenario if Black Sea exports remain locked out. Even rice has been swept up in the turmoil, with Chicago futures near the highest since May 2020.”

Also this week, William Watts reported at MarketWatch that, “Wheat futures have surged by nearly a third over the past four days, on track for the biggest weekly rise since at least 1959 as Russia’s invasion of Ukraine crimps exports of the crucial food grain and stokes global inflation fears.”

“‘I am convinced it is going to be the biggest supply shock to global grain markets in my lifetime,’ tweeted Scott Irwin, agricultural economist at the University of Illinois, on Wednesday.”

And Reuters writer Naveen Thukral reported today that, “The Chicago Board of Trade’s (CBOT) most-active wheat contract has climbed 40% this week, the biggest weekly gain on record, while corn is up 16% and soybeans have added 5%.”

An Associated Press article yesterday by Damian J. Troise, reminded readers of Russia’s importance to global fertilizer markets: “Russia, while a key player in the energy industry, also plays a key role in the global agricultural market with ingredients for fertilizer. It is facing increasingly restrictive sanctions and penalties as the war persists and that could stymie the flow of those ingredients, such as potash, or Russia could respond by cutting off supplies.”

Meanwhile, Reuters writers Gus Trompiz and Nigel Hunt reported on Thursday that,

The threat to wheat supplies from Russia’s invasion of Ukraine has been exacerbated by a shift in global stocks away from major exporters such as the United States and European Union, undermining their effectiveness as a cushion in times of crisis.

Trompiz and Hunt explained that, “Stocks in major wheat exporters – the European Union, Russia, the United States, Canada, Ukraine, Argentina, Australia and Kazakhstan – are set to fall to a nine-year low of 57 million tonnes by the end of the 2021/22 season, International Grains Council (IGC) data shows.

“They now account for just one-fifth of global inventories and, with world consumption expected to total 781 million tonnes, that would feed the world for just 27 days.”

“Some exporters like the EU and United States have seen wheat reserves ebb in recent decades due to subsidy reforms or a shift towards other crops like corn and soybeans,” the Reuters article said.

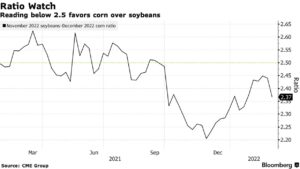

With respect to acreage prospects this spring, Bloomberg’s Kim Chipman reported yesterday that, “American farmers are set to plant more corn than last year, thanks in part to price increases caused by Russia’s attack on Ukraine, according to analytics firm Gro Intelligence.

“Corn acres will rise to 95 million, up from 93.4 million last year and soybeans will decline, according to the group’s AI-driven modeling. The figures come ahead of the U.S. Department of Agriculture planting estimates, which are due in a report at the end of this month.”

Recall that USDA’s Chief Economist, Seth Meyer, indicated late last month that, “Corn area for 2022 is expected to decline 1.4 million acres to 92.0 million, driven by more attractive relative prices for other crops and high input costs…[and]…soybean area is up 0.8 million acres to 88.0 million with very favorable forward pricing opportunities for producers given the drought in South America and continued strong U.S. crush demand.”