The world's farmers face soaring fertilizer and fuel prices as the war in the Middle East escalates, leaving some scrambling for supplies as the spring planting season approaches and causing…

Amid Potential Russian Export Complications, Wheat Prices Climb- GM Corn an Alternative For Lost Ukrainian Exports

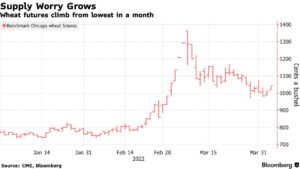

Bloomberg writers James Poole, Megan Durisin, and Kim Chipman reported earlier today that, “Wheat futures in Chicago extended their climb from the lowest close in a month on Friday on prospects for more sanctions on Russia in response to allegations of war crimes in Ukraine.”

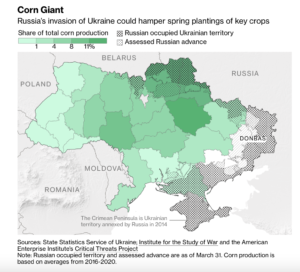

“More sanctions may impede Russian grain exports, while the war is likely to prevent planting on a large amount of land in the east of Ukraine. Shipments from Ukraine are at a virtual standstill, with its Black Sea ports closed,” today’s article said.

“Agricultural products haven’t been directly targeted by sanctions on Russia so far. The country is one of the world’s biggest wheat shippers and has still been exporting at a rapid clip,” the Bloomberg article said; adding that, “Wheat futures in Chicago jumped 3.1% to $10.42 a bushel on Tuesday, bringing the advance over two days to almost 6%. Prices slumped about 11% last week, posting the worst weekly performance since 2011.”

In related news regarding Russian exports, Reuters writer Jonathan Saul reported yesterday that, “London’s marine insurance market on Monday added all of Russia’s waters to its list of areas deemed high risk, an advisory showed, which is likely to raise the cost of shipping and adds to the logistical pressures on Moscow.”

Meanwhile, yesterday’s Crop Progress report from the USDA’s National Agricultural Statistics Service indicated that the U.S. winter wheat condition was rated 30% good-to-excellent, down from 53% last year.

Dow Jones writer Kirk Maltais reported yesterday that, “A largely dry forecast ahead for the next two weeks in winter wheat areas looks to provide support for higher wheat futures.”

In other developments, Bloomberg News reported yesterday that,

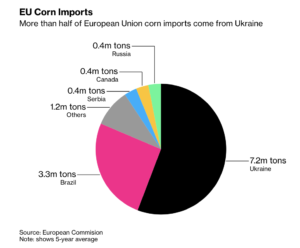

European farmers are set to buy more genetically modified animal feed from the U.S. and South America after Russia’s invasion cut off corn shipments from Ukraine.

“The war in Ukraine is already pushing companies to turn to alternatives to sunflower oil, and that shift in trade flows is also likely to include corn, which is mainly used as animal feed. Ukraine’s non-GM corn accounts for about half the European Union’s imports. However, 92% of U.S. corn is GM, according to the Center for Food Safety, with similar levels in Brazil.”

“The price of corn and other grains have surged in the wake of Russia’s invasion. Ukraine had exported about 6.6 million tons of corn to the EU by the end of March, compared with a five-year average of 7.2 million tons,” the Bloomberg article said.

Reuters writer Pavel Polityuk reported yesterday that, “Ukraine’s agriculture minister said on Monday he expects ‘quite a large harvest’ this year and hopes Ukraine will be able to export grain, but warned that continuation of the war would mean higher prices for all countries.

“The minister, Mykola Solskyi, said the situation was ‘difficult’ with fuel, which is needed for spring fields.”

Also yesterday, Bloomberg’s Megan Durisin, Pratik Parija, and Irina Anghel reported that, “Across Ukraine’s farm belt, silos are bursting with 15 million tons of corn from the autumn harvest, most of which should have been hitting world markets.”

“Before Russia’s attack, Ukraine’s corn would have made its way to Black Sea ports like Odesa and Mykolaiv by rail and loaded on to ships bound for Asia and Europe. But with the ports shuttered, small amounts of corn are creakily winding their way westward by rail through Romania and Poland before being shipped out. An added aggravation: wheels on the wagons have to be changed at the border because unlike European rails, Ukrainian train-cars run on wider, Soviet-era tracks.”

Deliveries from Ukraine and Russia, which account for about a quarter of the world’s grains trade, are becoming complicated, spurring food-security worries. Today's Big Take breaks down the impact o the war in Ukraine on the $120 billion global grain tradehttps://t.co/GICHrZBtvm pic.twitter.com/plqJdh1Fwa

— Bloomberg TV (@BloombergTV) April 5, 2022

The Bloomberg writers explained that, “Disruptions in the flows of grains and oilseeds — staples for billions of people and animals across the world — are sending prices soaring. Countries fearing potential food shortages are scrambling to find alternative suppliers and new trades are emerging.”

Yesterday’s article pointed out that, “India, which historically kept its huge wheat harvests at home — thanks to a government-set price — is jumping into the export market, hawking record amounts across Asia. Brazil’s exports of wheat in the first three months have far surpassed those in all of last year. U.S. corn cargoes are heading to Spain for the first time in about four years. And Egypt is considering swapping fertilizer for Romanian grain and holding wheat talks with Argentina.

“Even those efforts may not be good enough, said Dan Basse, president of AgResource, an agriculture markets research firm.

“‘We can move the deck-chairs around today,’ he said. But if the conflict stretches into the summer, when wheat exports from the Black Sea usually accelerate, ‘then you start running into problems. That’s when the world starts to see shortfalls,’ Basse said.”