A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Edible Oil Prices Volatile; as Fertilizer Prices Fall Slightly

Reuters writers Naveen Thukral and Mei Mei Chu reported today that, “Global vegetable oil prices climbed on Monday to trade near multi-year highs, as Indonesia’s decision to ban palm oil exports heightened concerns about global food supplies.

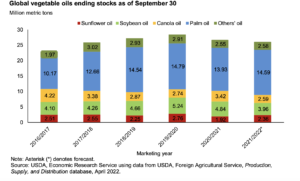

“Importers have been left with no option but to pay top dollar for edible oils with inventories of alternatives already running low due to adverse weather and Russia’s invasion of Ukraine.

“Prices of palm oil, the most widely used vegetable oil, climbed more than 6% on the Bursa Malaysia Derivatives Exchange, inching closer to an all-time high reached in March, while Chicago soyoil futures hovered near their highest since 2008.”

The Reuters article noted that, “In China, Dalian palm oil futures rose 3%, while soyoil added 1.5%.

‘The destination markets like India, China, Europe and others are bound to be hit by this new policy,’ said Anilkumar Bagani, research head of Mumbai-based vegetable oils broker Sunvin Group.

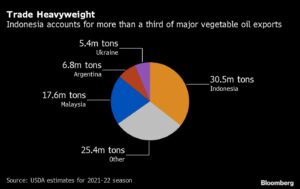

However, Bloomberg writers Anuradha Raghu and Eko Listiyorini reported today that, “Palm oil slumped on prospects that top producer Indonesia’s surprise ban of cooking oil exports will not be strict as feared.

“Indonesia will only halt exports of bulk and packaged RBD palm olein, a higher value product that has been processed. Exports of crude palm oil and RBD palm oil will still be allowed, according to people familiar with the matter. RBD olein accounts for 30% to 40% of Indonesia’s total palm oil exports.

“Benchmark futures initially rallied after Indonesia said Friday that a shipment halt on all cooking oil will start from April 28 and last until the government deems a domestic shortage resolved. The announcement came as a shock to the market as a complete ban would worsen global food inflation and aggravate volatility in crop markets still reeling from the war.”

The Bloomberg article noted that, “Palm oil for July delivery tumbled as much as 4.1% to 6,097 ringgit ($1,399) a ton in Kuala Lumpur after jumping 7% in early trade.”

Meanwhile, Reuters writer Mei Mei Chu reported today that, “Countries should pause or slow down the use of edible oil as biofuel to ensure adequate supply for use in food, a state-backed Malaysian palm oil group said on Monday, warning of a supply ‘crisis’ following an Indonesian ban on palm oil exports.”

The Reuters article explained that, “Palm oil, the most widely used edible oil, is also used as a biodiesel feedstock.

“Indonesia and Malaysia have made it mandatory for a certain amount of palm oil to be used for biofuel, and just last month said they remain committed to those mandates despite higher palm prices.”

And yesterday, Reuters writer Bernadette Christina reported that, “Indonesia’s Oil Palm Farmers Union said on Sunday it supported the government’s ban on palm oil exports, calling it a temporary measure that was needed to ensure supply and affordability of cooking oil in the domestic market.”

“Retail cooking oil prices in Indonesia have risen more than 40%. Previous efforts to tame prices, including subsidies and an export restriction between late January and the middle of March, have not only failed to bring down prices, but also exacerbated the rise in global prices,” the Reuters article said.

In other developments regarding food prices, policy and trade, Mary Anastasia O’Grady noted in an opinion column in today’s Wall Street Journal that, “The recent change in relative prices for wheat and other agricultural products ought to be a blessing for Argentina. In a free market, higher prices would act as a motivating factor to grow, sell and export more. As the value of harvests, measured in hard currency, went up, the nation would also become richer because dollar inflows would strengthen its buying power. To put it another way, the improvement in terms of trade would boost GDP.

“Yet rather than ride the wave of rising commodity prices with policies that encourage production and export, the government is trying to lower local prices by forcing producers to sell inside the country. The policy mix for this strategy is high export taxes and export quotas that limit the amount that can be shipped abroad. Both depress exports and make it better not to plant at all or to hold excess inventories in silos.

“In March the government announced that it will try to ‘decouple prices to protect the domestic market in a global context of war and sustained high wheat prices’ by subsidizing 800,000 metric tons of wheat to domestic millers. It may succeed, in the short run, in making bread and pasta cheaper for the public. But it’s an expensive ‘fix’ and gives consumers less incentive to find substitutes for wheat, which is one way to bring down high prices.”

O’Grady added that, “These policies harm the Argentine people and hurt the world’s poor because they diminish global food supplies.”

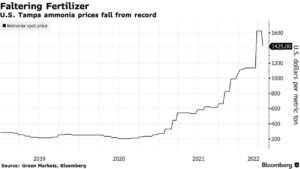

In other news, Bloomberg writer Elizabeth Elkin reported on Friday that, “Prices for a widely used nitrogen fertilizer fell the most in three years in a break in what has been a scorching rally.

“A gauge of prices for the nitrogen fertilizer ammonia in Tampa fell more than 12% Friday, the most since 2019, as high prices have slowed industrial demand with buyers in Southeast Asia pulling back on contracted volumes, said Alexis Maxwell, an analyst at Bloomberg’s Green Markets. In addition, some halted ammonia production in Europe has restarted, which could ease some market tightness.”

The Bloomberg article stated that, “While the rally ‘appears to be taking a breather’ in the second quarter as fertilizer demand shifts from the Northern Hemisphere to the Southern Hemisphere, ‘we expect that continued volatility in European natural gas prices will support relatively high nitrogen pricing through the end of the year,’ Maxwell added.”