Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Egypt Wheat Supplies in Focus, While USDA Reports Highlight U.S. Wheat Exports, South American Production

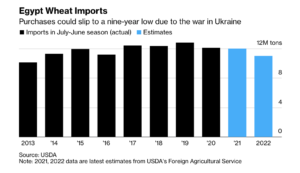

Egypt, Lebanon Wheat Supply Issues

Bloomberg writers Megan Durisin, Abdel Latif Wahba, and Salma El Wardany reported yesterday that, “Egypt, the world’s biggest wheat buyer, is accelerating efforts to ensure the supplies needed to feed its citizens as the war in Ukraine upends the global grains trade.

“The Egyptian government buys wheat in regular international tenders, which have for years been dominated by low-cost supplies from Russia and Ukraine. The country abandoned two tenders immediately after the invasion, leaving wheat stockpiles increasingly tight — they recently stood at just two and a half months worth. The local harvest will soon help replenish supplies, but Egypt needs to make sure it’s building reserves for the coming year.”

The Bloomberg article noted that, “The state buyer has now scheduled a new tender for Wednesday, a month sooner than the supply minister had indicated it would return to the market. The government is drawing up plans to allow buying wheat outside of the tender system to bolster purchases, Bloomberg reported earlier. And the country is actively pursuing new sources — a delegation from Egypt visited India this week to discuss the potential for wheat supplies, according to a person familiar with the matter.”

And Reuters writer Sarah El Safty reported yesterday that, “Egypt’s Supply Ministry has confirmed that it is considering this month adding wheat from India to 16 other national import origins accepted by its state grains buyer, as it seeks to shore up purchases disrupted by Russia’s invasion of Ukraine.”

Meanwhile, Reuters writer Julie Ingwersen highlighted a report issued yesterday by the U.S. Department of Agriculture’s Foreign Agricultural Service (FAS), which noted that, “India is heading for a record wheat harvest this marketing year (MY) thanks to highly favorable weather conditions in the major wheat growing areas. FAS New Delhi (Post) forecasts MY 2022/2023 (April-March) wheat production at a record 110 million metric tons (MMT) from 30.9 million hectares, and up from last year’s record 109.6 MMT from 31.1 million hectares. With the Russo-Ukrainian war disrupting supply from the Black Sea, Indian wheat is primed for record exports.”

Also yesterday, Reuters writers Laila Bassam, Aziz Taher and Maya Gebeily reported that, “Lebanon’s government has agreed to disburse $15 million to temporarily resolve growing bread shortages in the country, Economy Minister Amin Salam told Reuters, while saying that the funds would only last a few weeks.”

In related news, Reuters writer Francesco Guarascio reported yesterday that, “The EU aims to address rising wheat and fertilizer prices and expected shortages in the Balkans, North Africa and the Middle East with ‘food diplomacy‘ to counter Russia’s narrative on the impact of its Ukraine invasion, EU diplomats and officials say.”

“EU neighbours, particularly Egypt and Lebanon, are highly dependent on wheat and fertilizers from Ukraine and Russia,” the Reuters article said.

U.S. Wheat Exports

In its monthly Wheat Outlook report yesterday, the USDA’s Economic Research (ERS) stated that, “U.S. all-wheat exports in 2021/22 (June-May marketing year) are projected at 785 million bushels, the smallest since 2015/16 and the second lowest in 50 years.

The U.S. wheat exports forecast is lowered 15 million bushels to 785 million as the U.S. remains uncompetitive to most markets. Exports would be the lowest since 2015/16 and the second lowest in 50 years. #WASDE #OATT pic.twitter.com/UBpNZdxu4L

— USDA Office of the Chief Economist (@usda_oce) April 8, 2022

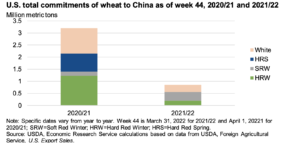

“A variety of supply and demand factors led U.S. exports to this low-tide moment. Tight U.S. supplies, combined with bumper crops in some competitor countries, resulted in U.S. wheat being priced high on a freight-on-board (FOB) basis. Further, international ocean freight rates trended higher due to outsized grain import demand from China and delayed vessel loading times following the Coronavirus (COVID-19) pandemic. Together, higher FOB prices and freight rates led to higher landed prices for wheat from the United States compared to cheaper alternatives from other competitors (table below).

“Additionally, competitors like Australia and Argentina are geographically closer than the United States to key import markets, exacerbating already-high ocean freight differentials.”

ERS also pointed out that, “High freight rates in some cases exacerbate these competitiveness issues with the United States losing some key markets to competitors that are better positioned to fill demand, specifically Australia and Argentina. China is the most substantial example of lost U.S. market share this year, with total commitments of HRW [Hard Red Winter], HRS [Hard Red Spring], and White wheat all down substantially this year, while only commitments of SRW [Soft Red Winter] are stronger.”

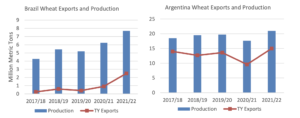

Wheat Production, Argentina and Brazil

With respect to global wheat production, in its monthly Grain: World Markets and Trade report last week, USDA’s Foreign Agricultural Service (FAS) stated that, “Record wheat crops in both Argentina and Brazil have provided ample exportable supplies as major importers scramble to find alternative sources of wheat amid the disruption to Ukraine exports.”

FAS noted that, “Brazil, a traditional net importer of wheat, has taken advantage of strong global import demand, tightening global supplies, and elevated international prices to expand its exports. 2021/22 exports, which are adjusted up 800,000 tons this month to 2.5 million, have nearly tripled since last year’s total and are just under its 2010/11 record. Brazil, which typically ramps up exports in December and tapers off in April, has exported 2.1 million tons so far this year. Monthly exports in December, January, and February all reached record levels. Compared to previous years, Brazil has expanded its exports significantly to Saudi Arabia, Indonesia, Morocco, Pakistan, and Turkey.”

FAS added that, “Argentina, meanwhile, is normally a top global wheat exporter. 2021/22 exports are adjusted up 500,000 tons this month to 15.0 million, up 56 percent since last year and surpassing its 2017/18 record by 1.0 million tons. Argentina usually boosts exports in November following harvest, peaks in January, and drops off in April. Exports total 11.5 million tons so far this year and February exports hit a record. Vessel loading data indicates that exports in March remained over 2.0 million tons. Apart from frequent buyer Brazil, major destinations include Indonesia, Algeria, Morocco, Chile, Kenya, and Nigeria.”