As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Indonesia Bans Palm Oil Exports- Soybean Oil Surges

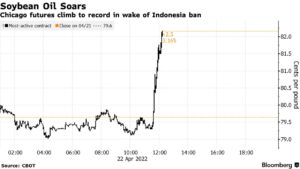

Reuters writer Nigel Hunt reported yesterday that, “Soybean oil prices soared to a record high on Friday as Indonesia’s decision to effectively ban exports of palm oil heightened concerns about already depleted global supplies of alternative vegetable oils.

“The loss of shipments from Ukraine, the world’s top supplier of sunflower oil, and drought in the world’s top soybean oil exporter Argentina had already sparked a sharp rise in global vegetable oil prices.”

“Soybean oil prices on the Chicago Board of Trade rose to a peak of 83.21 cents per lb on Friday, up 4.5% on the day and a record high, before pulling back to 81.42 — still a record for the most actively traded futures contract. Prices have now risen by almost 50% so far this year.”

Hunt explained that, “Indonesia, the world’s top producer and exporter of palm oil, blocked exports from April 28 to tackle rising domestic prices. The move looks set to fuel already surging food inflation elsewhere.”

The export ban is not for long but one has to be concerned it will be extended. This is exactly the kind of "beggar thy neighbor" export bans that ultimately makes price spikes even more extreme. https://t.co/0IiUkJUUOA

— Scott Irwin (@ScottIrwinUI) April 22, 2022

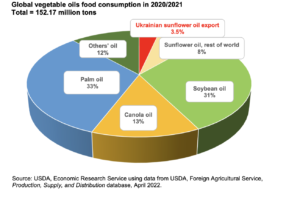

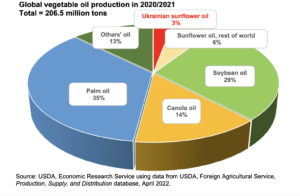

“Palm oil is the world’s most widely used vegetable oil and is used in the manufacture of many products including biscuits, margarine, laundry detergents and chocolate,” the Reuters article said.

Also yesterday, Bloomberg writers Eko Listiyorini and Anuradha Raghu reported that, “The shipment halt will start from April 28 and last until the government deems the shortage resolved, said President Joko Widodo in a Friday briefing. Most of the country’s cooking oil is made of palm oil products.

“‘I will continue to watch and evaluate the implementation of this policy so that the domestic supply of cooking oil is abundant and the price is affordable,’ said Jokowi, as the president is known.”

Meanwhile, Reuters writer Fransiska Nangoy reported yesterday that, “Global edible oil markets have been roiled this year by Russia’s invasion of Ukraine, a move Russia calls a ‘special operation’ to demilitarise its neighbour, which cut off shipments of sunflower oil from the region.

“The Black Sea accounts for 76% of world sunoil exports and commercial shipping from the region has been severely affected since Russian forces entered Ukraine in February.

“Large supplies of alternatives including soy and rapeseed oil are not readily available either, after droughts hurt the most recent crops in Argentina, Brazil and Canada.”

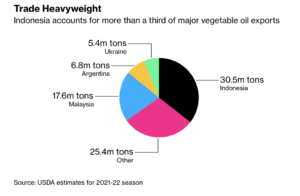

And Bloomberg writers Kim Chipman, Megan Durisin, and Michael Hirtzer reported yesterday that, “[Indonesia] accounts for more than a third of global vegetable-oil exports, with China and India, the two most populous countries, among its top buyers.”

“Indonesia’s supply of edible oil to the world is ‘impossible to replace,’ said Carlos Mera, head of agricultural commodity markets research at Rabobank. ‘It’s definitely a big blow.'”

In related news, Reuters writer Pavel Polityuk reported today that, “APK-Inform agriculture consultancy on Saturday revised down its forecast for Ukraine’s 2022 sunflower seed harvest to 9.2 million tonnes from the previous outlook of 9.6 million tonnes and compared with 16.6 million tonnes harvested in 2021.”

“The consultancy said Ukraine may produce 5.7 million tonnes of sunflower oil in the 2022/23 September-August season and export 5.4 million tonnes;” the Reuters article noted, adding that: “APK-Inform also cut its forecast for the harvest of rapeseed, which is now seen at 2.47 million tonnes against 2.52 million tonnes a month earlier.”

A separate Reuters article today reported that, “Analyst APK-Inform on Saturday raised its forecasts for Ukraine’s 2022/23 grain crop and exports due to a better than expected winter harvest.

“The consultancy said in a statement that Ukraine could harvest 41.4 million tonnes of grain in 2022, including almost 17 million tonnes of wheat and 18.5 million tonnes of corn.

“APK-Inform said 2022/23 exports could also rise to 33.2 million tonnes versus the previous outlook of 29.9 million tonnes.”