A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Planned Indonesia Palm Oil Export Ban Stokes Food Price Worries, as U.S. Crop Progress Slows

Reuters writer Bernadette Christina reported yesterday that, “Indonesia’s agriculture ministry said on Monday that crude palm oil shipments would be excluded from a planned palm oil export ban, according to a copy of an official letter sent to local government leaders.

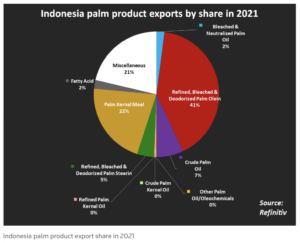

“The letter, which was verified by a ministry official, said the ban would however include refined, bleached and deodorized (RBD) palm olein.

“It was still unclear on Monday whether products such as RBD palm oil and palm stearin would be affected.”

The Reuters article pointed out that,

Though an exemption of crude palm oil from the export curbs will be positive for global markets, the majority of Indonesia’s palm exports are in the form of processed oils that remain affected by the ban.

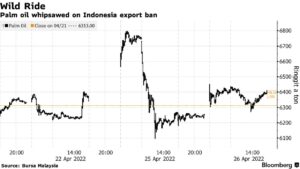

Christina added that, “Malaysian benchmark crude palm futures fell 2.09% after news that the ban only covered RBD olein, having jumped nearly 7% to their highest in six weeks.”

And Bloomberg writer Anuradha Raghu reported today that, “Palm oil rebounded as traders assessed the severity of Indonesia’s ban on cooking oil exports that sparked wild swings in the market.

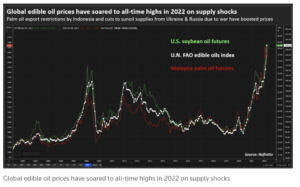

“Fears of a complete ban eased as Indonesia said it will only halt exports of RBD palm olein, a product that has been processed, while shipments of crude palm oil can continue. The move has threatened to tighten global vegetable oil supplies at a time of soaring food inflation fueled by the war in Ukraine.”

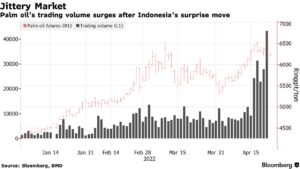

Bloomberg writers Atul Prakash, Anuradha Raghu, and Eko Listiyorini reported today that, “The lack of details about the longevity of the ban, which comes into effect April 28, kept traders on their toes while also raising concerns about Indonesia’s business image.”

Meanwhile, a separate Reuters article from today by Bernadette Christina stated that, “Indonesia is prepared to widen its ban on exports of refined palm olein if it faces domestic shortages of derivatives used in the production of cooking oil, according to details presented at a meeting between government and industry officials.”

“RBD palm olein accounts for around 40% of Indonesia’s total exports of palm oil products, according to analysts’ estimates, which means the export ban could significantly affect export earnings in Southeast Asia’s biggest economy,” the Reuters article said.

Christina noted that, “Some analysts expect the ban to be temporary due to limited domestic palm oil storage capacity.”

Likewise, Bloomberg writers Eko Listiyorini and Pratik Parija reported yesterday that, “Palm oil storage tanks in Indonesia, the world’s biggest producer of the commodity, may start brimming as producers hold stocks to comply with the government’s move to ban exports of cooking oil and its raw materials to cool domestic prices.

“In less than one month, stockpiles will climb further than five million tons and companies may start to slow down operations because they would not know where to store their output, Secretary General of the Indonesian Palm Oil Association Eddy Martono said in a phone interview on Monday.

“‘That means companies could stop buying palm’s fresh fruit bunches from farmers,’ said Martono. The ban, which is set to take effect Thursday, awaits more detailed rules from relevant ministries or it will put industry members in a difficult situation without any clarity on which products are affected exactly, he said.”

Also yesterday, Financial Times writers Hudson Lockett, Oliver Telling and Emiko Terazono reported that, “The move by Indonesia, the world’s biggest exporter of the edible oil, is the latest food export ban being implemented by countries around the world suffering from soaring food prices.”

The FT article noted that, “The tight vegetable oil market has forced retailers to start rationing cooking oil. Supermarkets in some European countries last month started limiting the amount of cooking oil customers can buy, while leading UK retailers such as Tesco and Waitrose followed suit over the past few days.”

In other developments, DTN Managing Editor Anthony Greder reported yesterday that, “Cold and snow over much of the Northern Plains, wet conditions in the Eastern Corn Belt and drought in parts of the Midwest, West and Southern Plains continued to keep planters parked and hampered the development of winter wheat last week, USDA NASS reported in its weekly Crop Progress report on Monday.

“Planting progress [for corn]: 7% nationwide as of Sunday, April 24, up just 3 percentage points from the previous week. Current progress is 9 percentage points behind last year’s 16% and 8 percentage points behind the five-year average of 15%.”

And for soybeans, “Planting progress: 3% nationwide as of Sunday, up just 2 percentage points from the previous week. That was 4 percentage points behind last year’s 7% and 2 percentage points behind the five-year average of 5%.”

The DTN article added that, “Nationwide, winter wheat was rated 27% good to excellent, falling 3 percentage points from 30% the previous week. The current rating is well below last year’s good-to-excellent rating of 49%.

“‘The winter wheat crop’s current good-to-excellent rating is the lowest on record for this time of the year,’ said DTN Senior Analyst Dana Mantini.”

Dow Jones writer Kirk Maltais reported yesterday that, “Corn for July delivery rose 1.1% to $7.98 a bushel on the Chicago Board of Trade Monday, with traders viewing weather over the weekend as keeping corn planting limited.”