A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Retail Fertilizer Prices Higher, as Chinese Soybean Demand Weakens

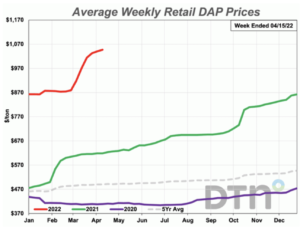

DTN writer Russ Quinn reported yesterday that, “Retail fertilizer prices tracked by DTN for the second week of April 2022 show all eight major fertilizers had higher prices than the previous month. This has been the trend in recent weeks.

“Leading the way higher was DAP. The phosphorus fertilizer was 8% more expensive compared to last month and had an average price of $1,047/ton, which is an all-time high price in the DTN data set.”

Quinn explained that, “Two fertilizer prices were also significantly higher compared to last month. DTN designates a significant move as 5% or more.

“MAP and urea were both 7% higher than in late March. MAP had average price of $1,071/ton while urea is at $1,017/ton (all-time high).

“The remaining five fertilizers were slightly higher looking back to last month. Potash had an average price of $875/ton, 10-34-0 $906/ton, anhydrous $1,534/ton (all-time high), UAN28 $630/ton (all-time high) and UAN32 $730/ton (all-time high).”

Also yesterday, the Federal Reserve released its April Beige Book report, which included several references to higher farm input costs.

The Atlanta, Chicago, St. Louis, Minneapolis, Kansas City, Dallas, and San Fransisco Districts all alluded to concerns over rising costs.

Nonetheless, crop prices have also risen recently, muting some of the impact of higher costs on farm profitability.

The Minneapolis Fed noted that: “Strong crop prices appeared to outweigh increases in input costs, bolstering incomes, according to contacts.”

And the Kansas City Fed pointed out that, “While crop prices supported farm revenues, concerns about the cost and availability of agricultural inputs intensified.”

The Dallas Fed stated, “While higher crop prices can help alleviate some of the financial pressure, it remains to be seen if prices will still be high at harvest time when producers have a crop to sell.”

In other news, Reuters writers Hallie Gu and Gavin Maguire reported yesterday that, “Chinese soybean crushers have slowed bean purchases for deliveries through August as poor margins curbed appetite, traders and analysts said.

“Reduced demand in the world’s top soybean buyer could cut China’s appetite for bean imports, already forecast to drop in 2021/22 by nearly 10% from a year ago due to poor livestock production margins and elevated bean prices.”

The article pointed out that, “The United States Department of Agriculture further lowered its estimate for China’s 2021/22 soybean imports to 91 million tonnes in April, down 9% from a year earlier.”

In its monthly Oil Crops Outlook report last week, the USDA’s Economic Research Service (ERS) pointed out that, “Reports from China’s’ National Grain and Oil Information Centre indicate that soybean crush rates continue to drop, posting 3 consecutive weeks of decline. Year to date, soybean crush volumes are down over 4.5 million metric tons from last year. Poor crush margins, driven by high soybean prices, along with weaker demand from China’s swine and poultry sectors are the main contributing factors. For these reasons, the 2021/22 soybean crush estimate in China is reduced by 3 million metric tons to 89 million. This lowers the soybean meal and oil production estimates by nearly 2.38 million metric tons to 70.48 million and 536,000 metric tons to 15.95 million, respectively. Moreover, the weakening soybean demand has resulted in a lower 2021/22 soybean import estimate for China, down from 94 million metric tons last month to 91 million.”

However, ERS added that, “USDA raised the 2021/22 soybean export forecast by 25 million bushels this month to 2.12 billion bushels. As a result, season-ending stocks for 2021/22 are expected to be drawn down to 260 million bushels.

“The 2021/22 season average soybean price forecast is unchanged at $13.25 per bushel.”

And Reuters writers Hallie Gu and Dominique Patton reported yesterday that, “China’s soybean output is set to increase by 25.8% in 2022, an agriculture ministry official said on Wednesday, amid major efforts to boost oilseed production.

“The land planted with soybeans will expand by 16.7% this year, said Tang Ke, director general of the market department, under the Ministry of Agriculture and Rural Affairs, citing the 2022 agricultural outlook report.”

The article indicated that, “China plans to produce about 23 million tonnes of soybeans by the end of 2025, part of a pledge to secure food security.”

Meanwhile, Reuters writer Naveen Thukral reported today that, “China’s soybean imports from the United States plunged in March from a year earlier, customs data showed on Wednesday, as poor margins curbed buying.

“China, the world’s top importer of soybeans, brought in 3.37 million tonnes last month from the U.S., down from 7.18 million a year earlier, data from the General Administration of Customs showed.

“For corn the market continue to monitor weather forecasts for the U.S. Midwest, where planting is off to a slow start.”

The Daily U.S. Agricultural Weather Highlights report from the USDA’s Office of the Chief Economist noted on Wednesday that, “Midwestern conditions are largely not conducive to planting activities and other spring fieldwork, due to cool soils, wet fields, or a combination of both.”