Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

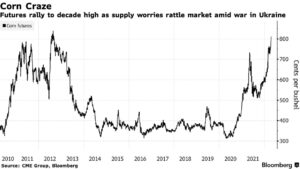

Ukraine Grain Storage at Issue- Spring Planting Seen Down by a Third, as U.S. Corn Hovers Near Record

Bloomberg writers Megan Durisin and Sybilla Gross reported yesterday that, “Chicago corn futures are hovering close to a decade high reached earlier Tuesday as the war in Ukraine curtails grain sales and weather hampers crops elsewhere.

“Ukraine’s president said Russian forces had begun a new campaign to conquer the Donbas region in the east. The crisis has obstructed shipments from the Black Sea region, a major hub of corn and wheat exports.

#plant2022 progress from @usda_nass - maps thanks to Brad Rippey at #usdaoce. Mostly slow progress but not delayed much yet #corn #soybean #sorghum Cold temperatures/#soils and wet soils east are culprits. (1/x) pic.twitter.com/OKawNbSbOj

— Dennis Todey (@dennistodey) April 19, 2022

“That’s heightened attention over the status of other exporters’ crops, which are being sown or in the midst of their growing season. Early U.S. corn plantings are trailing the average pace, and wheat conditions are waning as drought grips the Plains. Plus, parts of Brazil’s winter-corn region are adversely dry.”

Not exactly the same week, but 2022 (April 10-16) versus 2021 (April 4-10). pic.twitter.com/qKLfggvwmg

— Farm Policy (@FarmPolicy) April 19, 2022

U.S. Winter Wheat Conditions by @usda_oce

— NIDIS Drought.gov (@DroughtGov) April 19, 2022

Graph shows 3 best and 8 worst years since the mid-1990s.

Key takeaway: Winter Wheat Condition Index remains the lowest for this time of year since 1996. #drought @usda_nass @USDAClimateHubs @USDA pic.twitter.com/4FN9OfEIMQ

The Bloomberg article added that, “Ukraine is ramping up crop shipments by rail given that most of its seaports are closed. Still, cars are facing multiweek logjams at the border as the infrastructure isn’t sufficient for the increase in traffic, according to analyst UkrAgroConsult.

Moreover, a third of the country’s farmland could go unharvested or unsown this year amid the war, the United Nations estimates.

And Reuters writer Michael Shields reported yesterday that, “Ukraine has insufficient storage capacity even for its reduced 2022 grain harvest, the United Nations’ World Food Programme said on Tuesday, with the country struggling to export existing stocks during the invasion by Russia.

“Jakob Kern, the World Food Programme’s emergency coordinator in Ukraine, cited estimates that 20% of planted areas in Ukraine will not be harvested in July and that the spring planting area will be about a third smaller than usual.”

The Reuters article added that, “If Ukraine cannot export its current stocks, farmers may not be able afford harvesting costs, let alone plant the next year’s crop, he added.

“The lack of Ukrainian grain on world markets has been pushing up food prices around the world.”

In more detailed reporting on dry conditions in Brazil, Reuters writer Roberto Samora indicated yesterday that, “Dry weather forecast for the second half of April in Brazil’s central area, where some of the country’s largest grain producing states are located, might limit yields for the 2021/22 second corn crop, experts said.

“After seeing its first crop affected by the lack of rainfall, Brazil now hopes to harvest an 88.5 million-tonne second crop, which accounts for nearly 75% of its total corn output in a given year.

“But the dry weather expected to be seen at least until early May in states such as Mato Grosso, Mato Grosso do Sul, Goias, Minas Gerais, and Sao Paulo keeps worrying farmers.”

In other news regarding Brazil, Reuters writer Ana Mano reported yesterday that, “Ports in one of Brazil’s biggest farming states are handling an unusual amount of fertilizer after importers rushed to secure supplies amid fears that sanctions on Belarus and Russia would curtail trade, the Parana port authority said.

“Brazilian importers are keen to secure crop nutrient supplies even if they have nowhere to store them as Brazil relies on imports for 85% of its fertilizer needs.

“Paranagua, one of the South American country’s busiest ports, has 18 vessels awaiting to unload nearly 600,000 tonnes of fertilizer products from various origins, the Parana port authority said in a statement.”

And with respect to wheat supplies, Bloomberg writers Pratik Parija and Abdel Latif Wahba reported yesterday that, “India wants to fill the global wheat export gap left by the war in Ukraine, which means the quality of its grain will matter more than ever.

“Quality issues have prompted some buyers to be cautious of Indian wheat because of impurities in the grain,” the Bloomberg article said.