As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Federal Reserve Ag Credit Surveys- 2022 First Quarter, Farmland Values Continue to Increase at Rapid Pace

On Thursday, the Federal Reserve Banks of Chicago and Kansas City released updates regarding farm income, farmland values and agricultural credit conditions from the first quarter of 2022.

Federal Reserve Bank of Chicago

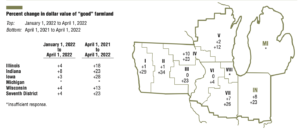

David Oppedahl, a Senior Business Economist at the Chicago Fed, explained in the AgLetter that, “The District saw a year-over-year gain of 23 percent in its farmland values in the first quarter of 2022—which just exceeded the previous quarter’s large year-over-year gain. Farmland values rose 4 percent in the first quarter of 2022 from the fourth quarter of 2021.”

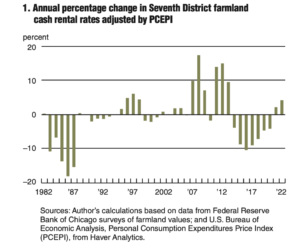

The AgLetter stated that, “Even after being adjusted for inflation with the Personal Consumption Expenditures Price Index (PCEPI), the year-over-year gain in District farmland values for the first quarter of 2022 was higher than that for any quarter since the first one of 2012 (the gain for the first quarter of 2022 also marked the eighth consecutive quarter of positive changes in real terms).”

#Farmland values in our District shot up 23% in the first quarter of 2022 from a year ago, and almost all surveyed bankers predicted prices would remain stable or increase this quarter. Read the latest #AgLetter: https://t.co/mfbESNylHJ pic.twitter.com/OiWaZ7L4kx

— ChicagoFed (@ChicagoFed) May 12, 2022

Mr. Oppedahl added that, “Cash rental rates for District farm acres increased 11 percent from 2021 to 2022. For 2022, average annual cash rents for farmland were up 10 percent in Illinois, 11 percent in Indiana, 12 percent in Iowa, and 8 percent in Wisconsin (not enough survey responses were received from bankers in Michigan to report a numerical change for that state). After being adjusted for inflation with the PCEPI, District cash rental rates moved up about 4 percent from 2021.

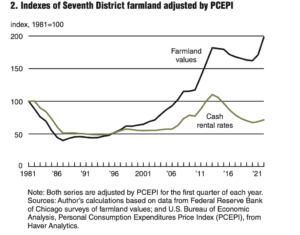

“This was just the second increase in cash rents (both in nominal and real terms) since 2013. In real terms, the index of farmland cash rental rates peaked in 2013. Even after rising again in 2022, the index of real cash rental rates was still 35 percent below its level in 2013. That said, in the first quarter of 2022, the index of real farmland values moved 9 percent above its 2013 peak. The widening gap between these two indexes over the past decade could be indicative that the demand to own farmland has outpaced the demand to rent ground. A contributing factor to this trend could be an increasing importance placed on farmland ownership’s benefits, such as relative control and wealth accumulation.”

And the Chicago Fed indicated that, “Agricultural credit conditions for the District improved once more in the first quarter of 2022.”

Federal Reserve Bank of Kansas City

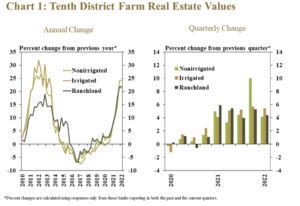

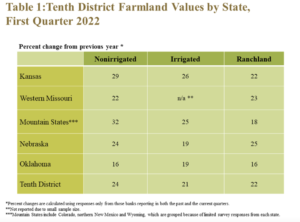

Nate Kauffman and Ty Kreitman, writing in Thursday’s Ag Credit Survey from the Kansas City Fed, noted that, “Farmland values continued to increase at a rapid pace through the end of 2021. Alongside sustained strength in farm income and credit conditions, the value of all types of farmland in the Tenth District was more than 20% higher than a year ago. The recent strength in agricultural real estate markets has been supported by strong demand, historically low interest rates and vastly improved conditions in the farm economy.

“Lenders reported a mostly favorable outlook for agriculture in the District but cited the rise in input costs as a risk to the sector. Even with uncertainty around input costs, lenders expected favorable conditions in the economy to support farm finances and lead to further gains in farmland values in 2022. The possibility of weaker agricultural income and higher interest rates in the economy remain as risks for farmland markets. Despite the risks, the agricultural sector appears to be well positioned for the year ahead, supported by strong balance sheets, high agricultural commodity prices and sharp gains in farmland values.”

Thursday’s update stated that, “Strength in farm real estate values was consistent across all states in the District. The value of all land types increased by at least 15% from a year ago in all states.”

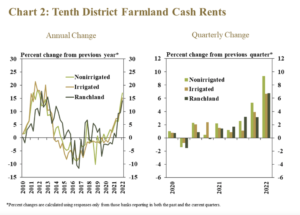

Kauffman and Kreitman noted that, “After a year of rapid growth in farm real estate values, gains in cash rents also accelerated. Cash rents for all types of land in the District were about 15% higher than a year ago, the fastest increase since 2013 (Chart 2, left panel).

“As landowners likely began to adjust rental rates along with growth in land values, leasing costs increased from the previous quarter at a notably quicker pace than previous periods (Chart 2, right panel).”