A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Food Protectionism Adds to “Chaos in Global Food Markets,” While Ukraine Could Plant a Majority of Spring Crops

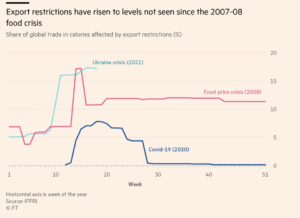

Financial Times writers Oliver Telling, Benjamin Parkin and Emiko Terazono reported yesterday that, “Rising protectionism is exacerbating chaos in global food markets brought on by the war in Ukraine, with governments clamping down on exports of staples including grains, cooking oil and pulses.

“Soaring food prices and, in some cases, the threat of social unrest have led to an increase in exporters banning overseas sales or putting in place other restrictions such as taxes or quotas.

These protectionist steps have only driven up the food import bill further for countries dependent on international markets for important food commodities, hitting some of the poorest in the world.

The FT writers explained that, “Indonesia last month became the latest country to announce an export ban, stopping overseas sales of palm oil. The commodity is the most traded vegetable oil in the world, used in everything from cakes to cosmetics.”

“The move by the leading palm oil exporter has meant that, together with Ukrainian and Russian sunflower oil, more than 40 per cent of supplies on the international vegetable oil market have become difficult to access.”

Telling, Parkin and Terazono added that, “Prices quoted on wheat markets around the world have risen over the past few days following reports that New Delhi was also considering restricting exports to protect domestic stocks from further shortfalls.

“But India’s food secretary Sudhanshu Pandey disputed that restrictions were an option, saying the country had enough to meet its domestic needs. ‘Wheat exports are on,’ he told reporters on Wednesday, adding that the arrival of Argentina’s own wheat crop from June should ease pressure on Indian and global supplies.”

Supply disruptions are mounting throughout global wheat markets. Presented by @CMEGroup pic.twitter.com/40dijyBvhP

— Bloomberg Quicktake (@Quicktake) May 9, 2022

Reuters writer Naveen Thukral reported today that, “The U.S. Department of Agriculture (USDA) on Monday rated 29% of the U.S. winter wheat crop in good to excellent condition, up 2 percentage points from the previous week and a bigger improvement than most analysts had expected, but still among the lowest ratings on record for this point in the year.”

And with respect to U.S. planting progress, DTN Managing Editor Anthony Greder reported yesterday that, “[Corn] planting progress [reached] 22% nationwide as of Sunday, May 8, up just 8 percentage points from 14% the previous week. Current progress is now 42 percentage points behind last year’s pace of 64% and 28 percentage points behind the five-year average of 50%.”

“[Soybean] planting progress [climbed to] 12% nationwide as of Sunday, up 4 percentage points from the previous week. That is 27 percentage points behind last year’s 39% and 12 percentage points behind the five-year average of 24%,” the DTN article said.

New data from @usda_nass shows that across the U.S. 18% of the combined acres for #corn #soybeans and spring #wheat has been planted as of May 8 #Plant22 @SenateAgGOP pic.twitter.com/sFGCMNIoL6

— John Newton (@New10_AgEcon) May 9, 2022

More broadly on global grain prospects in 2022, DTN writer Todd Neeley reported last week that, “Despite the ongoing military conflict in Ukraine, the country’s farmers are expected to complete a majority of spring planting, the head of a major U.S. seed company said during an earnings call Thursday.

“Dave Anderson, Corteva Agriscience executive vice president and chief financial officer, said the company is performing well in Europe, the Middle East and Africa, despite the war in Ukraine, which has created logistical constraints.

“‘Speaking of Ukraine, demand was strong in military-free areas for both crop protection and seeds,’ Anderson said.

“‘Farmers continue to plant crops, and for local estimates, many expect more than 70% of Ukraine spring crops will be planted.'”

And yesterday, Reuters writer Pavel Polityuk reported that, “Ukraine has sown about 7 million hectares of spring crops this year, or 25-30% less than a year earlier, Agriculture Minister Mykola Solskyi said on Monday.”

Also yesterday, Bloomberg writer Tatiana Freitas reported that, “Brazilian fertilizer company Galvani is ramping up production as the nation begins to grow desperate for hard-to-acquire crop nutrients.

“The closely held company will double phosphate output at its plant in Luis Eduardo Magalhaes in Bahia state to 1.2 million tons in two years, Chief Executive Officer Marcos Stelzer said in an interview. While the expansion was planned before the latest fertilizer crisis began, the increased output will still be a welcome addition for local farmers struggling to afford the inputs they need in a runaway global marketplace.”