The world's farmers face soaring fertilizer and fuel prices as the war in the Middle East escalates, leaving some scrambling for supplies as the spring planting season approaches and causing…

Kansas City Fed Examines Market Disruptions After Russian Invasion, While Ukraine Grain Production Could Rise, and Egypt Faces Wheat Strains

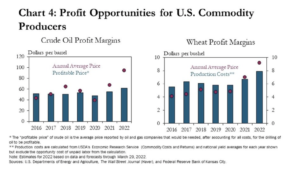

Bloomberg writer Yvonne Yue Li reported yesterday that, “Farmers are still making money despite the higher costs for fuel and fertilizer, as crop prices have risen even more.

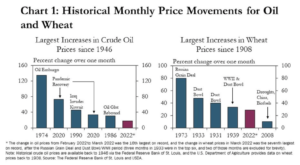

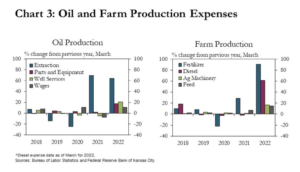

“That’s the view of Federal Reserve Bank of Kansas City researchers, who see Russia’s invasion of Ukraine have ‘long-lasting‘ effects on the commodity markets. ‘Disruptions associated with the invasion have contributed to increases in commodity prices, which could support commodity-producing regions and businesses,’ they said Monday in a report.

“Russia and Ukraine are key producers and exporters of energy and agricultural products, such as natural gas, wheat, and fertilizer. Prices of those raw materials have surged since Russia’s invasion of Ukraine and sanctions that followed disrupted production and flows of commodities.”

The report from the Kansas City Fed also pointed out that, “Although production expenses for wheat farmers have increased, prices producers receive for their wheat were higher than the costs of production, creating better opportunities for positive profit margins.”

Meanwhile, Reuters writer Pavel Polityuk reported today that, “Analyst APK-Inform on Tuesday raised its forecasts for Ukraine’s 2022/23 grain crop and exports because of a better-than-expected winter harvest.

The consultancy said in a statement that Ukraine could harvest 48.3 million tonnes of grain in 2022, including almost 17.1 million tonnes of wheat and 25.2 million tonnes of corn.

“APK-Inform said 2022/23 exports could also rise to 39.4 million tonnes versus the previous outlook of 33.2 million tonnes.”

And yesterday, Reuters writers Gus Trompiz and Forrest Crellin reported that, “The European Union’s crop monitoring service, MARS, on Monday trimmed its yield forecasts for this year’s EU wheat, barley and rapeseed harvests due to dryness and said significant rain was needed to avoid further yield losses.”

“In a monthly report, MARS lowered its forecast of the EU’s 2022 yield for soft wheat – the bloc’s biggest cereal crop – to 5.89 tonnes per hectare (t/ha) from 5.95 t/ha projected last month.

“That is now 2.5% below the 2021 level although 0.9% higher than the average of the past five years, it said.”

With respect to U.S. production, DTN Managing Editor Anthony Greder reported yesterday that, “U.S. farmers logged another productive week last week, pushing corn planting to near the three-fourths completion mark and soybean planting to the halfway point, USDA NASS said in its weekly Crop Progress report on Monday.”

The DTN article noted that, “Nationwide, winter wheat was rated 28% good to excellent, up 1 percentage point from 27% the previous week. That’s the lowest such rating since the drought of 1989, noted DTN Lead Analyst Todd Hultman.”

Spring wheat was 49% planted, lagging he five-year average of 83%.

In more specific agricultural trade developments, Bloomberg News reported yesterday that, “Russia’s blockade of Ukraine’s ports is a ‘declaration of war‘ that threatens to trigger mass migration and a global food crisis, a United Nations official said, adding to the dire warnings on the opening day of the World Economic Forum in Davos.”

Also yesterday, Bloomberg writers Anisah Shukry and Yantoultra Ngui reported that, “Malaysia will halt exports of 3.6 million chickens a month from June 1 and scrap the approved permit requirement for importing wheat until production and prices stabilize, Prime Minister Ismail Sabri Yaakob said.”

And Reuters News reported today that, “India plans to restrict sugar exports for the first time in six years to prevent a surge in domestic prices, potentially capping this season’s exports at 10 million tonnes, a government source told Reuters on Tuesday.

“India is the world’s biggest sugar producer and the second biggest exporter behind Brazil.”

Elsewhere, Chao Deng and Amira El-Fekki reported on the front page of today’s Wall Street Journal that, “Long the world’s top importer of wheat, Egypt has been hammered by Russia’s invasion of Ukraine, which has disrupted wheat supplies from both countries. The pair previously supplied more than 80% of Egypt’s imports.

“In a country where political discontent often follows spikes in food prices, the potential for bread shortages is among the most urgent security challenges the Egyptian state has faced since the 2013 coup that installed President Abdel Fattah Al Sisi in power.

“As a result, the government has cast a global net for new wheat supplies from Paraguay to India. It is also directing the country’s farmers to harvest wheat earlier than usual this year and aims to buy 57% more grain locally than the previous year, according to a Wall Street Journal calculation based on official data.”

Today’s Journal article noted that, “Bread, which Egyptians call A’ish—Arabic for life—is part of a social contract in Egypt with the government providing affordable food, gasoline and electricity. Egyptians eat more bread than most people in the world, around 330 pounds a year each on average, nearly triple the global figure.”

“Egypt has few easy answers for getting more wheat. About 98% of Egypt is desert and it has worsening problems with access to water. Authorities have resisted calls to switch to grains such as sorghum or barley that require less water because of wheat’s overwhelming popularity,” the Journal article said.