A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Prices of Most Fertilizers Continue Rise, as Wheat Prices Climb on Supply Concerns

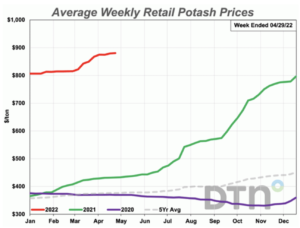

DTN writer Russ Quinn reported earlier this week that, “According to retail fertilizer prices tracked by DTN for the fourth week of April 2022, prices are somewhat mixed to end the month of April.

“Six fertilizers’ prices were higher, but none were up significantly. DTN designates a significant move as anything 5% or more.”

The DTN article stated that, “DAP had an average price of $1,049 per ton, MAP $1,082/ton (all-time high), potash $881/ton, 10-34-0 $906/ton, anhydrous $1,534/ton (all-time high) and UAN32 $730/ton (all-time high).”

“Urea had an average price of $1,004/ton, while UAN28 was at $631/ton,” the article said.

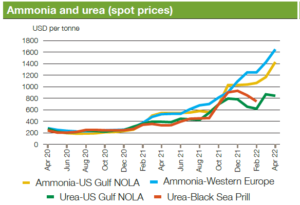

Also this week, the May update of the Market Monitor (Agricultural Market Information System (AMIS)) pointed out that, “Prices for most fertilizers continued their rise in April. Supply concerns and related price increases were particularly high for nitrogen fertilizers due to the large role of the Russian Federation in nitrogen fertilizer exports and supply shortages in western Europe.”

And Reuters writer Ana Mano reported this week that, “Crop nutrient prices rose as a result of sanctions on supplier Belarus, curbs on Chinese fertilizer exports and sanctions on Russia, a big provider to Brazil.

“Last week, farmer group Fundação MT, in association with Agrinvest, conducted a survey of about 100 grain growers from Mato Grosso state.”

“In relation to the use of fertilizers, 64% said they would reduce applications by up to 20%, while 15% said they would cut fertilizer use above that level,” the Reuters article said.

Meanwhile, Financial Times writer Derek Brower reported this week that, “The Henry Hub natural gas benchmark settled at $8.415 a million British thermal units on Wednesday, more than double the price at the start of the year and far above the $3 average of the previous 10 years.”

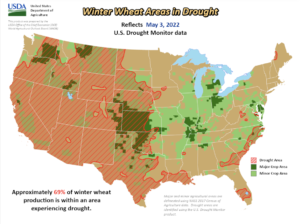

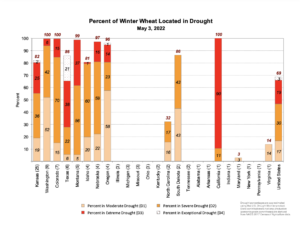

Beyond cost related variables, Bloomberg writers Kim Chipman and Megan Durisin reported yesterday that, “Hard red winter wheat gained the most in seven weeks as severe weather worldwide intensifies concern about shrinking food supplies.

“Heat has hurt wheat crops in India, spurring the country to mull export restrictions, Bloomberg reported Wednesday. The move threatens to further tighten the amount of grain available on the world market, especially since Indian shipments have been booming in the wake of Russia’s invasion of Ukraine.

“In the U.S., wheat grown in Kansas and nearby U.S. states is at risk because of harsh drought. Harvests of the grain used for bread flour are set to begin in June, meaning adequate rains will be crucial over the next few weeks if yields have any chance of improving.”

Dow Jones writer Kirk Maltais reported yesterday that, “Wheat for July delivery rose 2.8% to $11.06 1/2 a bushel on the Chicago Board of Trade Thursday, with traders continuing to consider how India’s potential absence from the wheat export market may impact availability of supply and prices.”

“Wheat futures on the CBOT rose again today, with traders continuing to eye a potential wheat export ban by India and its effect on global markets,” the article said.

Reuters writer Christopher Walljasper reported yesterday that, “Chicago wheat climbed for a second session on Thursday, underpinned by hot and dry weather across India that is likely to diminish that nation’s wheat export potential, while similar conditions erode U.S. winter wheat crops.”

Walljasper pointed out that, “U.S. wheat has also wilted under hot, dry conditions, with recent rainfall missing parts of the Southern Plains, as harvest approaches.”

Reuters writer Julie Ingwersen reported yesterday that, “Rains this week in the U.S. Plains arrived too late to help much of the winter wheat in Oklahoma, the No. 2 U.S. producer of the grain, where farmers will soon begin harvesting the smallest crop in eight years, a state wheat official said Thursday.

“‘Unfortunately I do think it is a little too late in most instances for us,’ Mike Schulte, executive director of the Oklahoma Wheat Commission, said of this week’s precipitation.

“A crop shortfall in Oklahoma adds to a dire global wheat supply picture, after Russia’s invasion of Ukraine shut down ports and knocked the No. 5 exporter off the market.”

Meanwhile, Bloomberg writer Jeanette Rodrigues reported yesterday that,

India doesn’t see a case for controls on wheat exports, the Ministry of Consumer Affairs, Food and Public Distribution said in a statement Thursday.

“Prime Minister Narendra Modi’s government is facilitating market access for export of wheat. Egypt and Turkey have approved imports of Indian wheat and European countries like Italy and Netherlands are also looking for imports from India, according to the statement.”

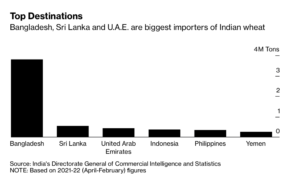

Also yesterday, Bloomberg writer Pratik Parija reported that, “Any restrictions on wheat exports by India will likely hurt neighboring countries like Bangladesh and Sri Lanka most, while some Middle Eastern and Asian markets would also be affected.”