Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

USDA: Global Wheat Prospects Stymied by Weather and War, Prices Soar- Outlook for Lower Global Corn Production

In its monthly Grain: World Markets and Trade report yesterday, the USDA’s Foreign Agricultural Service (FAS) indicated that, “Global [wheat] production is forecast at 775 million tons, down 4 million from the previous year. The largest cut to production is in Ukraine, which is projected to have a crop one-third smaller than the prior year with reduced harvested area and lower yields due to the ongoing war with Russia.

“Australia is expected to have a smaller crop, down from last year’s record, on reduced harvested area and yields. Production in Morocco is forecast at the lowest since 2007/08 because of severe drought conditions. The crop in India is down as heatwaves have damaged yields in prominent northern growing states. European Union production is forecast modestly lower from the previous year. China, the second-largest global producer, is also expecting a slightly smaller harvest.

“The largest year-over-year growth in production is expected in Canada, where area and yield are both forecast higher on improved weather following last year’s widespread drought. Russia’s crop is forecast higher on improved yields. Turkey’s crop is forecast higher on improved weather boosting yields, offsetting a reduction in harvested area. Kazakhstan is also expecting a larger crop on higher yields.

The United States is forecast to have a larger crop on recovery in spring wheat production after a drought-plagued 2021/22.

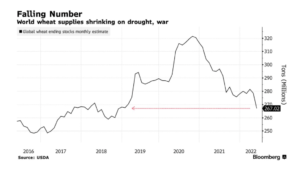

Bloomberg writers Megan Durisin, Michael Hirtzer, and Tarso Veloso Ribeiro reported yesterday that, “In all, global [wheat] stockpiles in the coming season will dwindle to a six-year low. Futures prices in the US surged by the most allowed by exchanges.”

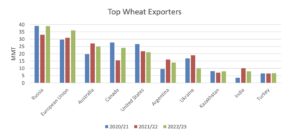

And with respect to trade, FAS stated that, “Global exports are forecast at a record 205 million tons as robust import demand and high prices are expected to lead major exporters to prioritize ample supplies for export. Russia is forecast to be the largest exporter for the third year in a row on a larger crop and strong global demand for affordable Black Sea wheat as exports from Ukraine are curtailed. Currently, Ukraine is unable to export via seaports because of the ongoing war but is seeking to use alternative routes, primarily by rail and export through neighboring European countries. The European Union is projected to be the second largest exporter, reflecting a larger crop from France, Romania, and Germany, as well as growing demand from Sub-Saharan Africa and Middle East markets.”

In a closer look at U.S. production, Reuters writer Tom Polansek reported yesterday that, “U.S. wheat futures rose on Thursday, setting contract highs as the U.S. Department of Agriculture (USDA) surprised traders with a smaller-than-expected forecast for the variety grown in the Plains and used to make bread.”

“The USDA, in a monthly crop report, projected hard red winter wheat output at 590 million bushels, below analysts’ estimates for 685 million. Hot weather has stressed the crop, with drought affecting about 69% of U.S. winter wheat areas as of May 3, according to separate government data.”

Turning to corn, FAS pointed out that, “The global corn outlook is for lower production, trade, consumption, and ending stocks. Production is projected to decline with smaller crops in Ukraine, the United States, and the European Union, more than offsetting forecast record production in Argentina and Brazil.

“Global trade will decline as exportable supplies from Ukraine are expected to be limited as a consequence of Russia’s invasion.

“Exports for Argentina and the United States remain high, and Brazil is up sharply as the other major exporters attempt to fill the gap left by Ukraine. Global consumption and ending stocks are forecast down, both modestly, but there remains uncertainty for these attributes in Ukraine.

The U.S. season-average farm price is forecast at $6.75 per bushel, the highest since the record set in 2012/13.

Reuters writer Mark Weinraub reported yesterday that, “The government also projected that U.S. corn production would fall 4.3% to 14.460 billion bushels in 2022. That was down from its February estimate of 15.24 billion and below market expectations for 14.773 billion.”

“USDA said that the cold and wet weather that delayed this year’s planting around the U.S. Midwest reduced yield prospects for the corn crop,” the article said.

Weinraub added that, “U.S. soybean production for the 2022/23 marketing year was seen at 4.640 billion bushels. The outlook compares with market expectations for 4.613 billion bushels. In the 2021/22 marketing year, U.S. soybean production totaled 4.435 billion bushels, the biggest to date.”

And Dow Jones writer Kirk Maltais reported yesterday that, “The new set of estimates from the USDA comes as farmers [in the U.S.] struggle to catch up on their much-delayed planting this spring, with drier weather seen as allowing farmers to get into the fields this week.”