Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Black Sea Exports in Focus, While Global Potash Market Evolves

Reuters writer Michelle Nichols reported yesterday that, “A senior U.N. official had ‘constructive discussions‘ in Moscow with Russian First Deputy Prime Minister Andrei Belousov on facilitating Russian grain and fertilizer exports to global markets, U.N. spokesman Stephane Dujarric said on Tuesday.

“The U.N. official, Rebecca Grynspan, is now in Washington for talks on the same issue ‘with the key aim of addressing growing global food insecurity,’ Dujarric said.”

The Reuters article stated that, “U.S. Ambassador to the United Nations Linda Thomas-Greenfield said the United States is prepared to give ‘comfort letters’ to shipping and insurance companies to help facilitate exports of Russian grain and fertilizer.

“She noted that Russian grain and fertilizer were not directly sanctioned by the United States but that ‘companies are a little nervous and we’re prepared to give them comfort letters if that will help to encourage them.’

“U.N. Secretary-General Antonio Guterres, who visited Moscow and Kyiv last month, is trying to broker what he calls a ‘package deal‘ to resume both Ukrainian food exports and Russian food and fertilizer exports.”

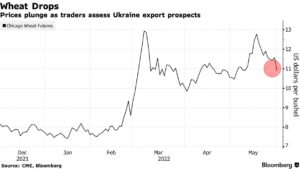

Dow Jones writer Kirk Maltais reported yesterday that, “Wheat futures on the CBOT weighed heavily on the agricultural complex following reports that Russia is still open to allowing Ukrainian grain shipments out of Black Sea ports in exchange for an easing or lifting of sanctions.”

And Bloomberg writers Kim Chipman and Michael Hirtzer reported yesterday that, “Russia discussed Black Sea exports with Turkey on Monday and said it is willing to help ensure Ukrainian exports, though the Kremlin provided no details and some analysts expressed doubts.”

The Bloomberg article noted that, “In the US, a June weather forecast looked favorable for much of the Farm Belt, and a report showed wheat planting progress ahead of expectations.”

Also yesterday, Reuters writer Christopher Walljasper reported yesterday that, “The U.S. Department of Agriculture in its weekly crop conditions and planting progress report graded 29% of the winter wheat crop in good-to-excellent condition by May 29, and pegged spring wheat planting at 73% complete, versus the 5-year average of 92%.

“Corn planting reached 86% planted, just one percentage point behind the 5-year average and ahead of analyst expecations, while soybean acres were 66% seeded, one point below analyst expectations.”

Elsewhere, Financial Times writers Neil Hume, Emiko Terazono, and Michael Pooler reported yesterday that, “For the best part of a decade the potash market struggled with overcapacity and low prices. But as sanctions throttle supplies of the fertiliser from Russia and Belarus, which account for almost 40 per cent of global supply, buyers are scrambling for cargoes and warnings are growing of a global food crisis.

“In Brazil, an agricultural powerhouse, prices have surged 185 per cent over the past year hitting records above $1,100 a tonne, according to commodities consultancy CRU. In Europe they are up 240 per cent to €875 a tonne.”

The FT writers explained that, “Crucial to the production of food staples such as corn, soy, rice and wheat, a sudden plunge in supply threatens to devastate global crop yields.

“Producers are now looking to capitalise on the surge in potash prices and geopolitical tensions that have upended traditional trade flows and highlighted the importance of security of supply.”

Hume, Terazono, and Pooler pointed out that, “But while the potash market has a history of boom and bust dating back to the 1960s, analysts and industry executive believe that even if prices cool, they will remain above the long-term average.

“At a recent conference Germany’s K+S said a new floor price of $500 a tonne was possible — half the current spot price but double the average price of the previous decade.”

In other production related news, DTN writer Russ Quinn reported yesterday that, “Diesel fuel prices are considerably higher for farmers this spring as they plant corn and soybean crops and get ready to harvest forage crops across the Corn Belt. As a result, these higher fuel prices are causing large increases in farmers’ fuel budgets.

For the week ending May 23, the U.S. average #diesel fuel price decreased 4.2 cents from the previous week to $5.571 per gallon, 231.8 cents above the same week last year, https://t.co/I3RnFsKchw pic.twitter.com/vOnXwOil1U

— Farm Policy (@FarmPolicy) May 26, 2022

“Diesel fuel prices hit a new high in May 2022 as the Ukraine war makes a tight fuel stocks situation worse.”

Average U.S. price per gallon for gasoline ticks higher in the week ended May 23, to $4.59, while the average price for diesel dips slightly, to $5.57 per gallon https://t.co/WkDYEUE1xe pic.twitter.com/bynvczIrWn

— St. Louis Fed (@stlouisfed) May 24, 2022

The DTN article added that, “A price of $3/gallon and a fuel usage of 3 gallons/acre would cost a farmer $9/acre in diesel costs. Double the fuel price to $6/gallon and the fuel cost increases to $18/acre, a $9/acre increase.”