As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Crimea Food Exports Soar, Indicating That Stolen Ukrainian Grain Likely Moving on to Export Markets

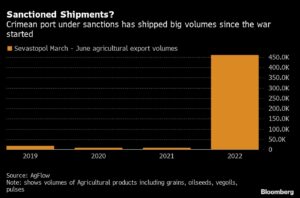

Late last week, Bloomberg writer Aine Quinn reported that, “The Russian-occupied peninsula of Crimea is shipping more than 50 times the volume of food it usually does at this time of year, likely indicating that seized Ukrainian grain is being taken abroad, according to analysts and the Kyiv School of Economics.

“The port of Sevastopol shipped about 462,200 tons of agricultural goods such as grains, oilseeds, vegetable oils, pulses and proteins since the beginning of March, according to Geneva-based researcher AgFlow, which compiles and cross-references data based on inspection reports, bills of lading, port lineups and AIS from private sources. Last year, the port shipped about 8,000 tons.”

The Bloomberg article pointed out that, “The Kyiv School of Economics estimates that, as of June, more than 1 million tons of grain and oil crops valued at about $600 million have been taken by Russia or damaged during the war.

“‘The first signals were in March,’ KSE researcher Roman Neyter said. ‘We assume based on the pace that grain is being smuggled from all occupied regions.’

“Most of it, though, is coming from the Kherson and Zaporizhzhia regions in southeast Ukraine, he said. Russia has been occupying about 60% of those regions, which are at the heart of the nation’s agriculture industry.”

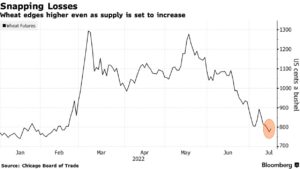

And Bloomberg writer Michael Hirtzer reported last week that, “Chicago wheat futures extended losses back to the lowest since before Russia invaded Ukraine in February, capping its worst week in a decade with surging shipments of agricultural goods in Crimea underscoring how grain is still entering world markets despite the war.”

“Futures slumped as much as 3.7%, briefly wiping out all of the gains from 2022, before trimming losses and settling 1.8% lower at $7.81 a bushel. That’s well off the record of almost $13 notched up in the weeks after the invasion and marks the biggest one-week drop since March 2011,” the Bloomberg article said.

Dow Jones writer Paulo Trevisani reported on Friday that, “Wheat is the big loser in Friday’s grain complex, falling for the fifth consecutive session. Markets are shaken by fears of a recession that could sap demand, but wheat has the added concern of a potential influx of Ukrainian supply as an agreement with Russia to reopen export routes seems to advance.”

Also on Friday, Reuters writer Mark Weinraub reported that, “Chicago Board of Trade wheat futures tumbled to a five-month low on Friday, with hopes for a pick-up in exports from war-torn Ukraine threatening the recent gains made in demand for U.S. supplies, traders said.”

Nonetheless, Bloomberg’s Jasmine Ng reported today that, “Wheat snapped a run of declines with investors assessing a broader rise in commodities against the outlook for increasing supply.”

Meanwhile, Reuters writer Pavel Polityuk reported last week that, “Ukraine is hurrying to clinch a deal with Russia, Turkey and the United Nations next week to export grain via its Black Sea ports, a senior Ukrainian official source said on Friday.”

And a separate Reuters article last week by Pavel Polityuk indicated that, “Ukrainian farmers have threshed 3.6 million tonnes of grain of the 2022 grain harvest from about 10% of the sowing area, Ukrainian agriculture ministry said on Friday.”

In other news, Dow Jones writer George Mwangi reported last week that, “Egypt’s wheat imports fell 18% on year in the first half of 2022, the U.S. Agriculture Department said late Wednesday.

“Wheat imports for the first half of the year amounted to 3.86 million metric tons, down from 4.72 million tons for the same period last year, the USDA said.”

However, Dow Jones writer Yusuf Khan reported today that, “Egypt’s state buyer for wheat launched an international tender late on Sunday for an unspecified volume of the grain.

“In its tender, the General Authority For Supply Commodities excluded wheat from the European Union and the Black Sea–the country’s usual import destinations–and instead specified imports from the U.S, Canada, Argentina, Brazil and Australia, according to traders.”

Elsewhere, Associated Press writers Helena Alves and Joseph Wilson reported last week that, “More than 3,000 firefighters battled Thursday alongside ordinary Portuguese citizens desperate to save their homes from several wildfires that raged across the European country, fanned by extreme temperatures and drought conditions linked to climate change.”

And Claire Thornton reported in today’s USA Today that,

An ongoing heat wave is fueling wildfires, causing heat-related deaths and breaking records in Western Europe.

“British authorities are issuing dire warnings, as temperatures may reach 104 degrees Fahrenheit in southern Britain, a region usually known for moderate summer heat, with July highs in the 70s. It’s the first time such a forecast has been made in the area.”