Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Doubts Persist on Black Sea Grain Export Breakthrough, As Food Inflation Fears Ease- But 10% of World Population Faces Hunger

Bloomberg writer Volodymyr Verbyany reported yesterday that, “Ukraine’s top diplomat cast doubt on a near-term breakthrough in talks to unblock crop exports from the war-ravaged nation’s Black Sea ports, as fears of a global hunger crisis intensify.

“Foreign Minister Dmytro Kuleba said a number of logistical details need to be worked out in talks brokered by Turkey and United Nations between Ukraine and Russia, though breaking the deadlock will be difficult. The comments contrast with those of Turkish President Recep Tayyip Erdogan, who on Tuesday echoed media reports that a deal could be reached in a week to 10 days.”

The Bloomberg article noted that, “Kuleba expressed skepticism that Moscow is willing to reach an agreement, since its blockade provides leverage over Ukraine. The government in Kyiv has accused Russian troops of pilfering metal and grain shipments to hit the economy as well as global food safety.”

Meanwhile, Reuters writer Pavel Polityuk reported yesterday that, “Ukraine expects a grain harvest of at least 50 million tonnes this year, which is ‘not bad given all the difficulties,’ the country’s first deputy agriculture minister said on Wednesday.

“Ukraine, a major global grain grower and exporter, harvested a record 86 million tonnes of grain in 2021.”

And a separate Reuters article yesterday by Pavel Polityuk indicated that, “Ukraine’s grain traders union UGA revised up on Wednesday its forecast for the country’s grain and oilseed harvest to 69.4 million tonnes from the previous 66.5 million, but still far below the 2021 level of 106 million tonnes.”

Elsewhere, Chao Deng and Tom Fairless reported in Wednesday’s Wall Street Journal that, “Governments around the world are rushing to cushion the blow of food and energy inflation, launching new subsidies and boosting social-spending programs to stave off unrest and hunger amid the rising cost of daily living.”

“The moves come as oil prices have more than doubled in the past two years, pushing up costs across the supply chain, including for basic food items like bread,” the Journal article said.

With respect to domestic food prices, Nathan Solis reported on the front page of Wednesday’s Los Angeles Times that, “Rising food and fuel costs have forced some street vendors to ration their supplies or raise their prices on what some take for granted as convenient and affordable food. But for many entrepreneurs their livelihood is at stake amid soaring inflation.

“From April 2021 to April 2022, prices jumped by 14% for meat, poultry, fish and eggs across the United States, one of the largest increases since 1979, according to the U.S. Bureau of Labor Statistics.”

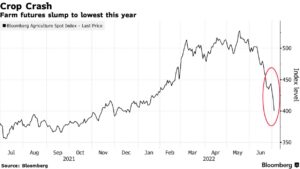

Nonetheless, Bloomberg writers Sing Yee Ong and James Poole reported this week that, “Worries over surging global food costs are easing as prices of everything from cooking oils to wheat and corn tumble to the lowest levels in months on increasing physical supplies and as investors reduce their bullish bets on futures markets.

“Palm oil, the world’s most consumed edible oil, has plunged more than 40% from a record close in April to the weakest level in a year, while wheat has slumped over 35% from an all-time closing high in March, and corn has dropped about 30% from its peak this year.”

And Financial Times writers Emiko Terazono, Neil Hume, Laurence Fletcher and David Sheppard reported yesterday that, “Commodities prices are tumbling from historic highs, as investors reverse bullish bets on everything from corn to copper and oil in the latest sign of recession fears gripping financial markets.”

Dow Jones writer Kirk Maltais reported yesterday that, “After finding record highs this year on supply-chain disruptions stemming from the Russia-Ukraine conflict, continuous corn and soybean futures trading on the CBOT are now down slightly year-to-date.”

Also yesterday, DTN writer Russ Quinn reported that, “Average retail fertilizer prices continued to be mostly lower the fourth week of June 2022, according to sellers surveyed by DTN. This trend has been in place for five weeks now.”

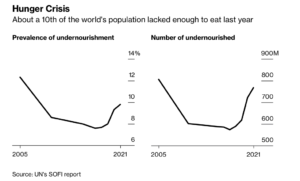

Elsewhere, Dow Jones writer Yusuf Khan reported yesterday that, “The number of people facing hunger reached 828 million in 2021, with the Covid-19 pandemic raising the costs of food globally and putting millions more at risk of food insecurity, according to a new report from the United Nations.

“The new figure is a rise of 46 million people since 2020 and 150 million since the start of the pandemic according to the 2022 edition of the State of Food Security and Nutrition in the World report.”

In news highlighting agricultural production, Reuters writer Gus Trompiz reported today that, “The European Union is heading towards a smaller wheat crop this year as drought and extreme heat shrink yields in some regions, offsetting more favourable prospects elsewhere after timely rain, a Reuters poll showed.”

“With harvesting under way, the EU is expected to produce 125.7 million tonnes of common wheat – or soft wheat – in 2022, down 3.4% from last year’s crop, according to an average of 13 forecasts in the poll.”

Eric Sylvers reported in Wednesday’s Wall Street Journal that, “Italy’s worst drought in decades threatens to ruin many crops and is forcing a reckoning of how the country manages its water resources, as rising average temperatures increase the frequency of extreme weather events across Europe.”

Bloomberg writers Irina Vilcu and Andra Timu reported yesterday that, “Romania is urging people to cut back on water use as a severe drought strains supplies that are needed for electricity generation and agriculture in one of the European Union’s largest grain producers.”

Also yesterday, Dow Jones writer George Mwangi reported that, “Algeria’s wheat production is forecast to rise by 25% in the marketing year beginning July through June 2023 compared with the prior year, the U.S Agriculture Department said.”

And earlier this week, Bloomberg writer Jen Skerritt reported that, “A soggy start to spring in parts of Canada may be good news for wheat supplies.

“Wheat acres will rise 8.7% to 25.4 million acres, the highest level in a decade, Statistics Canada said Tuesday in a report. Analysts in a Bloomberg survey expected 24.7 million. High prices and heavy rainfall in parts of the eastern Prairies may have spurred farmers to shift acres to cereal crops.”