A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Meeting on Ukraine Grain Corridor Likely, “Heat Apocalypse” Batters Europe, and U.S. Panel Revokes Russian Fertilizer Duties

Reuters writers Tuvan Gumrukcu, Yesim Dikmen, Orhan Coskun and Michelle Nichols reported yesterday that, “Officials from Russia, Ukraine, Turkey and the United Nations will most likely meet this week to discuss resuming Ukraine’s Black Sea grain exports, Ankara said on Monday, while a Turkish official said lingering ‘small problems‘ should be overcome.”

The Reuters article noted that,

A senior Turkish official said there was a high probability the quartet would sign a deal this week.

“‘However there are a couple of small problems. Negotiations continue to overcome these,’ the official said, adding that any positive steps were affected by an attack or other major developments occurring in the war.

“‘But there is a general expectation that it will be signed this week. I am quite optimistic. It won’t take long before a final agreement is reached,’ the person added.”

A separate Reuters article yesterday reported that, “Russian President Vladimir Putin and his Turkish counterpart Tayyip Erdogan will discuss the export of Ukrainian grain at their meeting in Tehran on Tuesday, a Kremlin aide has told reporters.”

“‘The issue of Ukrainian grain shipment will be discussed with Erdogan … We are ready to continue work on this track,’ Yuriy Ushakov, foreign policy adviser to Putin, said on Monday.”

Meanwhile, Financial Times writer Ben Hall reported yesterday that, “Ukraine’s farmers will plant up to two-thirds less wheat later this year if the country’s main export route is still blocked, prolonging the global food crisis, its agriculture minister predicted.

“Mykola Solskyi said farmers faced a financial crisis if the Russian blockade of the Black Sea was not lifted. Many would lack the cash to pay for seed, fertiliser, herbicide and fuel for winter wheat and would grow rapeseed instead, which is not used in cereal or bread production but commands a higher price and has a lower yield, meaning there would be less to transport.”

The FT article added that, “Although only 75 per cent of Ukraine’s arable land was sown this year, the government expects the total arable harvest to be 10 per cent larger than forecast a few months ago, at 60mn rather than 55mn tonnes, thanks to good growing conditions.”

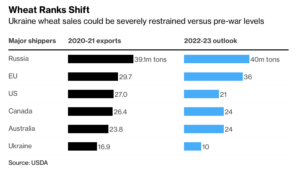

Elsewhere, Bloomberg writer Aine Quinn reported yesterday that, “Russia started the season exporting wheat at almost twice the speed of last year, just as Ukraine struggles to ship its produce due to the war and other major producers are hit by drought.

“Russia has shipped 1.2 million tons of wheat in the first two weeks of this agricultural year, Interfax reported, citing comments from Russian Grain Union analyst Elena Turina. The number of countries buying its wheat has halved to 12 from a year earlier, but ‘shipments to countries that are our traditional buyers have sharply increased,’ she said.”

Also yesterday, Reuters writer Ana Mano reported that, “Brazilian corn exports via southern ports in Parana state have continued to exceed expectations, with shipments rising 221% in the first half of the year amid Ukraine’s absence from the market.”

In a broader look at grain markets, Jesse Newman and Patrick Thomas reported in today’s Wall Street Journal that, “Growing fears of a global recession and easing concerns over world food shortages are reversing a sharp rally in grain markets, but pressure on food supplies could linger for years, executives and agricultural economists say.

“Prices for agricultural commodities such as corn and wheat have tumbled in recent weeks following a monthslong surge touched off by Russia’s invasion of Ukraine in late February. War between the two agricultural giants drove futures prices for wheat at the Chicago Board of Trade up by $4 a bushel in March, but prices since then have fallen back below prewar levels, dropping more than $5 a bushel, or 40%.

“In the weeks after fighting broke out in Ukraine, government officials and agricultural companies raced to remake a more than century-old grain-trading system, with countries around the world working to boost grain production at home or source crops from new locations abroad in case vast supplies of corn, wheat and sunflower oil ceased to flow from Eastern Europe.”

With respect to weather variables and global growing conditions, Rick Noack and William Booth reported on the front page of today’s Washington Post that, “An unforgiving heat wave in Western Europe laid bare Monday how extreme temperatures will increasingly challenge everyday life, as dozens of heat records were shattered, key sectors were hobbled, and emergency services confronted spreading wildfires and rising death tolls.

“In France, officials warned of a ‘heat apocalypse‘ as the temperature soared up to 109 degrees (43 Celsius). France’s meteorological service placed a stretch of its Atlantic coast under the highest-possible alert level. More than 15,000 people were evacuated amid wildfires in France.”

And Bloomberg writer Megan Durisin reported yesterday that, “Corn yields are waning, milk output is shrinking and chickens are sipping electrolytes as unprecedented heat bakes some of Europe’s key farming regions.

“France, an agriculture heavyweight, is at risk of record-breaking temperatures and fires, while the UK has issued its most severe heat warning and half of Italian farms are parched. That’s compounding problems for food producers, who weathered frosts, hail and drought in the first half of the year.”

In other developments impacting agricultural production, Reuters writer David Lawder reported yesterday that, “The U.S. International Trade Commission revoked hefty anti-dumping and anti-subsidy duties on urea ammonium nitrate fertilizers from Russia and Trinidad and Tobago on Monday, concluding that those imports did not hurt American producers.

“The panel’s vote may help ease shortages and price increases for fertilizers brought on by Russia’s invasion of Ukraine, both major fertilizer exporters. It also marks a rare trade reprieve for Moscow amid tightening Western sanctions and other economic pressure over the nearly five month-old Ukraine conflict.”

Bloomberg writer Jen Skerritt reported yesterday that, “The US has put a simmering trade spat over fertilizer imports on ice.

“The US International Trade Commission ruled Monday it will not impose tariffs on Russian and Trinidadian imports of urea ammonium nitrate, which is used in liquid fertilizers. The decision came as a surprise as the Commerce Department said earlier this year that tariffs are needed as Russian and Trinidadian imports are sold at less than fair value in the US.”