President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

Ukraine in Talks with Turkey, UN on Securing Grain Exports, as Port Damage Persists, and Ukraine Harvest Continues

Reuters writer Ronald Popeski reported yesterday that, “Ukraine is holding talks with Turkey and the United Nations to secure guarantees for grain exports from Ukrainian ports, President Volodymyr Zelenskiy said on Monday.

“‘Talks are in fact going on now with Turkey and the U.N. (and) our representatives who are responsible for the security of the grain that leaves our ports,’ Zelenskiy told a news conference alongside Swedish Prime Minister Magdalena Andersson.”

“Zelenskiy said Ukraine was working ‘directly’ with U.N. Secretary General Antonio Guterres on the issue and that the organization was ‘playing a leading role, not as a moderator,'” the Reuters article said.

Meanwhile, Reuters writer Pavel Polityuk reported late last week that, “Ukraine’s grain exports plunged 43% year-on-year to 1.41 million tonnes in June, the agriculture ministry said on Friday, highlighting the damage being inflicted on a key sector of the economy by Russia’s invasion.”

The article noted that, “The ministry said farmers in southern and eastern Ukraine had already started the 2022 harvest, threshing 293,800 tonnes of grain from around 1% of the sown area.

“It said farmers had threshed 131,500 hectares and the grain yield averaged 2.23 tonnes per hectare.”

Also last week, Wall Street Journal writers Matthew Luxmoore, Alistair MacDonald and Nancy A. Youssef reported that, “Before Ukraine can begin exporting grains via the Black Sea, mines have to be cleared, warehouses patched up and shipowners persuaded to take the risk of making the journey.

“At the port city of Odessa, few have faith that will happen soon.”

Should Ukraine and Russia agree to the U.N.-backed deal—or if the war were to end—it could still take weeks, or even months, to get traffic moving again, Ukrainian officials and industry players say.

Elsewhere, Wall Street Journal writer William Mauldin reported earlier this week that, “Days before Russia invaded its smaller neighbor, Moscow published a series of nautical alerts that effectively cordoned off sections of the Black Sea near the coast of Ukraine, a top exporter of grain and cooking oil.

“The subsequent steps Russia took—blocking or seizing the country’s ports with warships, destroying grain infrastructure and even taking farmers’ land and spiriting away Ukrainian wheat for sale abroad—are part of a geopolitical battle being fought in parallel with the Kremlin’s military war, according to Western and Ukrainian officials.

“While the invasion has united Western allies in support of Ukraine, Russia has used its increased leverage over food exports to divide the broader international community and to expand influence over developing economies in the Middle East, Africa and Asia, splitting the world in ways not seen since the Cold War. The Kremlin’s goals, Western officials say, are to use the food concerns as leverage for sanctions relief and cease-fire negotiations, to build influence and trade ties with non-Western countries and to destroy a major pillar of Ukraine’s economy.”

With respect to grain production, Dow Jones writer George Mwangi reported last week that, “Morocco’s wheat production is forecast to fall by 70% in the marketing year from June 2022 through May 2023 compared with the prior year due to drought, the U.S. Department of Agriculture said late Wednesday.

“Production is estimated at 2.25 million metric tons, down from 7.54 million tons in 2021-2022, the USDA said in its Morocco grain and feed update.”

Bloomberg writers Jerrold Colten and Antonio Vanuzzo reported today that, “Italy declared a state of emergency in five northern and central regions devastated by a recent drought, as a severe heat wave takes its toll on agriculture and threatens power supplies.”

The Bloomberg article indicated that, “The extreme conditions have led to an estimated 30% decline in seasonal harvests, including barley, grain and rice in the region, according to agricultural group Coldiretti, which estimates the overall toll from the drought to agriculture at 3 billion euros ($3.1 billion).”

And Bloomberg writer Sybilla Gross reported today that, “Major cropping regions in some parts of eastern Australia are facing the prospect of reduced wheat and canola production after yet another bout of torrential rains.”

Also, Joey Garrison and Michael Collins reported in today’s USA Today that, “On the other side of the world, Russia’s war in Ukraine has [Kansas farmer Clay Schemm] rethinking this year’s harvests, just as the Biden administration is encouraging U.S. farmers to produce more wheat in response to the disruption of the market caused by the war in Ukraine — one of the world’s top producers.

“”But Schemm said it might not be realistic for many reasons: growing seasons that are slow to respond to the unfolding crisis, federal incentives for double-cropping that aren’t viable in most of his acres and a volatile wheat market. Wheat prices have fluctuated wildly after it soared for weeks following Russia’s February invasion of Ukraine.”

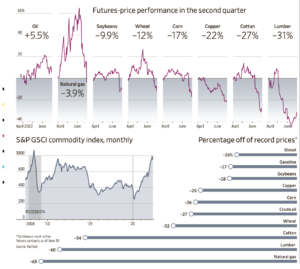

More broadly on commodity prices, Ryan Dezember reported on the front page of today’s Wall Street Journal that, “A slide in all manner of raw-materials prices—corn, wheat, copper and more—is stirring hopes that a significant source of inflationary pressure might be starting to ease.

“Natural-gas prices shot up more than 60% before falling back to close the quarter 3.9% lower. U.S. crude slipped from highs above $120 a barrel to end around $106. Wheat, corn and soybeans all wound up cheaper than they were at the end of March. Cotton unraveled, losing more than a third of its price since early May. Benchmark prices for building materials copper and lumber dropped 22% and 31%, respectively, while a basket of industrial metals that trade in London had its worst quarter since the 2008 financial crisis.”

The Journal article stated that, “Improved growing weather in the U.S., Europe and Australia is raising hopes that bumper crops can make up for the wheat, corn and vegetable oil stranded in Ukraine since Russia invaded. Grain and oilseed prices shot up after the incursion but have fallen back to or below where they were before the late-February attack.”