Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Federal Reserve Ag Credit Surveys- 2022 Second Quarter, Farmland Values Continued to Rise

On Thursday, the Federal Reserve Banks of Chicago, Kansas City and Minneapolis released updates regarding farm income, farmland values and agricultural credit conditions from the second quarter of 2022.

Federal Reserve Bank of Chicago

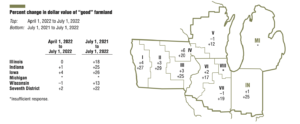

David Oppedahl, a Senior Business Economist at the Chicago Fed, explained in the AgLetter that, “At 22 percent, the year-over-year increase in the value of District farmland for the second quarter of 2022 was nearly as large as the year-over-year increase for the first quarter. Indiana and Iowa exhibited the largest year-over-year gains in agricultural land values. ‘Good’ farmland values in the District increased 2 percent in the second quarter of 2022 relative to the first quarter.”

The AgLetter stated that, “Although agricultural credit conditions in the second quarter of 2022 improved from a year ago yet again, nominal interest rates on agricultural loans surged higher. The District’s average nominal interest rates on new feeder cattle, operating, and farm real estate loans stood at 5.53 percent, 5.42 percent, and 5.17 percent, respectively, as of July 1, 2022 (levels not seen since 2019). After being adjusted for inflation with the Personal Consumption Expenditures Price Index, average agricultural interest rates were above those of the previous two quarters but remained historically low.”

Take an inside look at the state of Midwest #farming with Senior Economist and #AgLetter author David Oppedahl: https://t.co/mfbESNylHJ #agriculture pic.twitter.com/hYgyqLzPVq

— ChicagoFed (@ChicagoFed) August 11, 2022

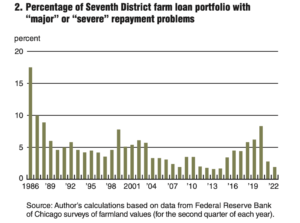

Mr. Oppedahl added that, “Last lower in 2014, the share of farm loans with ‘major’ or ‘severe’ repayment problems in the District loan portfolio (as measured in the second quarter of every year) was 1.9 percent—which represented the continuation of a remarkable turnaround from two years ago.”

And the Chicago Fed indicated that, “At least three-quarters of survey respondents in Illinois, Indiana, and Iowa were of the view that farmland was overvalued—in contrast with respondents in Michigan and Wisconsin, where at least half were of the view that farmland was appropriately valued. None of the respondents viewed agricultural ground as undervalued. Looking ahead to the third quarter of 2022, 25 percent of survey respondents anticipated farmland values to rise, 71 percent anticipated them to be stable, and 4 percent anticipated them to fall.”

Federal Reserve Bank of Kansas City

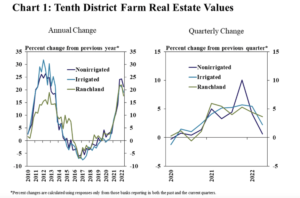

Cortney Cowley and Ty Kreitman, writing in Thursday’s Ag Credit Survey from the Kansas City Fed, noted that, “Farm real estate values continued to rise, but the pace of growth slowed in the second quarter. The value of all types of farmland in the region increased around 20% from a year ago, a slightly slower pace than prior quarters (Chart 1 below, left panel). Values increased by an average of about 2% from the previous quarter, which was the slowest increase for cropland since the end of 2020 (Chart 1, right panel). The pace of increase in ranchland values also slowed somewhat but remained slightly more stable at almost 4% quarterly growth.”

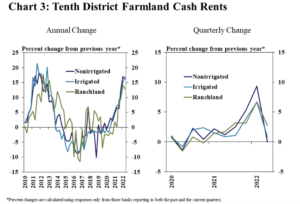

Thursday’s update stated that, “Similar to land values, the acceleration in cash rents also showed signs of slowing. Cash rents on all types of farmland in the region increased by an average of about 15% from a year ago, which was similar to the previous quarter and followed nearly a year of accelerating gains (Chart 3 below, left panel). Rents increased by an average of about 1% from the previous quarter, the slowest increase since early 2021 (Chart 3, right panel).”

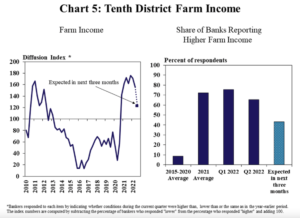

Cowley and Kreitman added that, “Farm finances across the District remained strong alongside elevated commodity prices, but the pace of increase softened. Farm income continued to improve overall, but the share of banks reporting higher incomes than a year ago dropped slightly (Chart 5 below). Expectations about the coming months were notably less optimistic, with fewer than half of all respondents anticipating higher farm incomes.

“The softer outlook for farm income has followed a notable increase in production expenses. The share of banks reporting an increase in expenses for producers was similar to a year ago, but far more respondents indicated the rise in costs was more substantial. Nearly 90% and 60% of respondents noticed a significant increase in input costs for crop and livestock producers, respectively; triple the share that reported significant increases a year ago.”

Federal Reserve Bank of Minneapolis

In an article yesterday, “Farm finances remained strong into summer, despite input cost inflation,” Joe Mahon pointed out that, “Following the trend over the past two years, land values and cash rents grew further in the second quarter. Ninth District nonirrigated cropland values increased by 20 percent on average from the second quarter of 2021. Ranchland and pastureland values also jumped, by nearly 21 percent, while irrigated cropland values increased 22 percent. The district average cash rent for nonirrigated land jumped by more than 16 percent from a year ago. Rents for irrigated land increased 22 percent, while ranchland rents increased 15 percent. Changes in land values and rents were generally consistent across district states.”

Mr. Mahon explained that, “Expectations for the remainder of the growing season were strongly optimistic. Across the district, more than 60 percent of lenders expected that farm income will increase in the third quarter of 2022, compared with 4 percent forecasting declines.”

Indiana Farmland Values- Purdue University Report

Earlier this week, an update from Purdue University, “Indiana Farmland Prices Grow at Record Pace in 2022,” stated that, “Indiana farmland prices grew at a record pace between June 2021 and June 2022, according to the recent Indiana Farmland Value and Cash Rent Survey. Statewide, the average per acre price for top quality farmland increased by 30.9% to $12,808. The average per acre price of average quality farmland similarly increased by 30.1% to $10,598. Poor quality farmland prices exhibited the largest increase of 34.0% to $8,631. Across all quality grades, farmland prices exceeded the previous highs set in 2021.”