Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

U.S. to Contribute $68 Million to World Food Program to Buy Ukrainian Wheat

William Mauldin and Jared Malsin reported in today’s Wall Street Journal that, “The U.S. Agency for International Development is spending more than $68 million to purchase and ship Ukrainian grain in the largest such export deal since Russia’s invasion this year and the start of a July agreement to allow for renewed shipments from Ukraine’s Black Sea ports.

“USAID is providing the funds to the World Food Program, a United Nations agency that historically gets the biggest part of its grain from Ukraine, to purchase, ship and store up to 150,000 metric tons of wheat, the agency said.

“‘While this additional wheat will be used to help feed people in countries facing severe hunger and malnutrition, much more is needed to help the world recover from the global devastation caused by Putin’s brutal war,’ USAID administrator Samantha Power said in a statement.”

The United States will contribute $68 million to the World Food Program to buy Ukrainian wheat to address the world’s pressing food crisis. We’re committed to supporting global food security for the most vulnerable and call on all countries to follow suit.

— Secretary Antony Blinken (@SecBlinken) August 17, 2022

Today’s article explained that, “The U.S. so far has provided $4.8 billion to the World Food Program this year, the most of any year. Some of those donations come from the emergency humanitarian funding that Congress gave USAID in May in response to the conflict in Ukraine and the global repercussions.

“The July grain export deal, brokered by the United Nations and Turkey, has been gathering momentum in recent days as the pace of ships moving in and out of Ukrainian ports has accelerated.

“Five more ships left Ukraine under the agreement on Tuesday in the largest single convoy to depart since the deal was signed in July. Another four ships were set to be inspected in Istanbul on their way to Ukraine, according to the Turkish defense ministry.”

Mauldin and Malsin pointed out that,

So far, 21 ships have been authorized to leave three Ukrainian ports in and around Odessa under the agreement, according to the United Nations. The ships carried a total of 563,317 metric tons of corn, wheat, sunflower meal, soy beans, sunflower oil and other products.

Meanwhile, Bloomberg writer Megan Durisin reported today that, “Top wheat exporter Russia is struggling to ship its record harvest.

“Analysts have progressively hiked estimates throughout the summer as yields were buoyed by good weather, with the crop expected to notch an all-time high. That should fuel a similar surge in shipments, which seasonally peak at this time of year, but sales so far are running well behind the norm.

Durisin noted that, “Russian wheat exports in July and August are estimated at 5.8 million tons, a ‘painfully slow’ rate and 28% behind last year, according to research firm SovEcon. The Russian Grain Union also said sales are trailing the prior season, when the country reaped a much smaller crop, Interfax reported. The number of export destinations and traders shipping wheat has halved, it said.

“Russia’s invasion of Ukraine hasn’t triggered sanctions on food and agriculture trade. Still, it’s spurred logistical and financial constraints, with some banks and shipping companies opting to shun the region.”

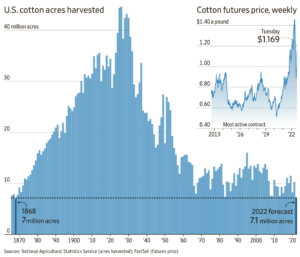

And on the front page of today’s Wall Street Journal, Ryan Dezember reported that, “Southwestern cotton growers are abandoning millions of parched acres that they planted in spring, prompting forecasts for the weakest U.S. harvest in more than a decade and sending prices sharply higher.

“U.S. agricultural forecasters expect drought-struck farmers to walk away from more than 40% of the 12.5 million acres they sowed with cotton and harvest the smallest area since Reconstruction. Back then, in 1868, yields per acre were less than a fifth of what they are today, but the market for cotton was vastly smaller too.

“December cotton futures, the most-traded contract, rose Tuesday for the sixth straight trading session to close at $1.169 a pound. Last week, futures gained about 13%, the sharpest weekly climb since March 2011, when prices were on their way to a record of $2.141 a pound.”

The Journal article stated that, “The U.S. Department of Agriculture on Friday slashed its forecast for the domestic cotton crop to 12.6 million bales, which are about 480 pounds apiece. That would be down 28% from last year, and the smallest crop since the meager 2009 harvest that helped set the stage for record prices. The USDA also predicted some of the lowest end-of season inventories in decades.”