As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

“Backups and Bottlenecks” on Mississippi, as World Food Prices Fell in September

New York Times writer Jacey Fortin reported yesterday that, “Low water levels in the Mississippi River have snarled barge traffic along one of the nation’s busiest waterways this week and have threatened the drinking water supply in Plaquemines Parish, La., just southeast of New Orleans.

“The river is always relatively low in the early autumn, but this year the situation is especially pronounced after a very dry summer.

Unless more rain falls soon in the Midwest, which is drained by the Mississippi, the southern reaches of the river could soon fall to some of their lowest levels in a decade.

The Times article noted that, “For the agriculture industry, ‘the timing of this couldn’t be more inopportune,’ said Mike Steenhoek, the executive director of the Soy Transportation Coalition.

“Lower water levels mean that fewer barges can travel the river at any one time, and those that do must carry lighter loads than they otherwise would. That has led to backups and bottlenecks in shipping soybeans and other commodities on the river this week, with long lines of trucks waiting at loading facilities. The delays hurt farmers and drive up retail food prices.”

The dryness is part of a larger, regional pattern that has caused low flow concerns along MS and OH Rivers.

— Illinois State Climatologist (@ILClimatologist) October 6, 2022

7-day forecast totals are mostly less than 0.50" for the area, not enough to improve conditions. #ilwx 2/3 pic.twitter.com/9MjulTCytG

Bloomberg writers Elizabeth Elkin, Will Wade, and Michael Hirtzer reported yesterday that, “The Mississippi River is a vital US waterway that ferries key commodities between the heart of America and the Gulf Coast — and drought is putting waterborne trade in jeopardy.

“Drought depleted river levels so much that in some spots vessels are getting stuck. One shipping company said low water levels are causing severe impacts to navigation not seen since 1988. It’s a key concern for transporting goods from a river basin that produces 92% of the nation’s agricultural exports, especially during harvest season.”

The Bloomberg writers explained that, “The Mississippi River is currently closed near Stack Island, Mississippi, causing a backup of 117 vessels and 2,048 barges in the area as of midday Thursday, while a shutdown near Memphis, Tennessee has caused a smaller logjam, according to the Coast Guard. The US Army Corps of Engineers is dredging near Stack Island and the Coast Guard intends to reopen the waterway with restrictions at some point Friday.”

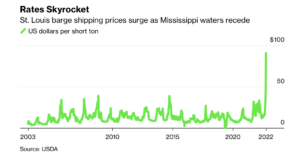

The Bloomberg article added that, “Major barge lines on the river are turning away spot business as they struggle to meet demand for grains, metals and other raw materials already contracted well in advance. Shipping prices are soaring.”

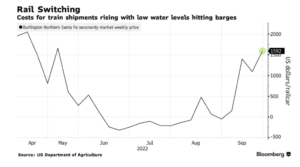

Also yesterday, Bloomberg writers Joe Deaux and Diego Lasarte reported that, “Shippers are scrambling for other ways to move goods after near-historic low water levels on the Mississippi River have forced barge companies to stop taking orders for immediate delivery of everything from metals to agricultural products to fertilizers.

“Now, companies are paying a premium to move steel, aluminum and other goods by rail and truck, despite cost that are up to five times more than what they’d normally pay by barge.”

And in its weekly Grain Transportation Report yesterday, the USDA’s Agricultural Marketing Service (AMS) stated that, “Barge transportation is an essential mode for grain, especially this time of year as the corn and soybean harvests ramp up in the Corn Belt States. In recent weeks, barge carriers and shippers have dealt with increasingly severe low water levels—reducing shipping capacity and resulting in record rates. Beginning in July, the average level of the Mississippi River at New Orleans was well below the 5-year average and continued to drop. With lower water levels, vessel operators and shippers have had to use lighter loads per barge because of draft restrictions and fewer barges per tow. American Commercial Barge Line said tonnages per southbound barge have been reduced by 20-27 percent. Moreover, the number of barges per tow have been reduced by 17-38 percent. The industry has also experienced groundings and intermittent outages.

As of October 4, the cost per ton to ship from St. Louis to the Gulf was $90.45/ton, up 218 percent from last year and up 379 percent from the 3-year average.

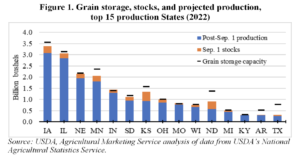

The AMS update also pointed out that, “Relatively low starting stocks, increased storage capacity, and declines in forecasted production, all contribute to relatively abundant storage this season compared to prior years. Figure 1 [below] shows which States could have shortfalls in storage and, hence, more pressure on their transportation systems this harvest.”

Reuters writer Naveen Thukral reported today that, “Typically, overseas demand for U.S. agricultural products surges during harvest but low water on southern sections of the Mississippi River halted most shipping traffic, sending prices for barges soaring.”

In other market developments, Dow Jones writer Jeffrey T. Lewis reported yesterday that, “Brazilian crop agency Conab forecast record harvests of soybeans and corn for the 2022-2023 growing season as farmers increase the area planted with both crops.

“Brazilian farmers will produce 152.4 million metric tons of soybeans this season, the agency said Thursday in its first report on the new season. Brazil produced 125.5 million tons of soybeans in 2021-2022, a decline from the previous season, after a drought in the country’s southern states hit the crop. The 2021-2022 harvest was still the second-biggest in the country’s history.”

“Brazilian farmers will produce a total of 126.9 million metric tons of corn this season, Conab said Thursday. In 2021-2022 the country produced 112.8 million tons,” the Dow Jones article said.

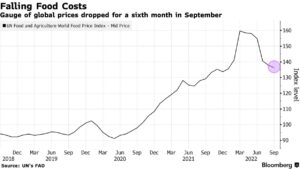

Elsewhere, Bloomberg writer Megan Durisin reported today that,

Global food prices fell for a sixth month, potentially offering relief to consumers battered by across-the-board inflation.

“Agricultural demand is easing on mounting worries about an economic downturn that risks curbing dairy sales and biofuel use. Plus, crop exports from Ukraine have picked up, buffering world grain supplies that had been threatened by Russia’s invasion.

“A United Nations gauge of food prices declined 1.1% in September to the lowest since January. Costs for vegetable oils, sugar, meat and dairy products retreated, keeping the index in the longest slump since 2015, the UN’s Food and Agriculture Organization said Friday.”

Also today, Dow Jones writer Yusuf Khan reported that, “The FAO also lowered its cereal-production forecast for the coming 2022 to 2,768 million metric tons–1.7% below 2021’s figure, with utilization rates also falling on lower animal feed usage. World grain trade is also expected to fall 2.4% between July 2022 and June 2023 because of the Ukraine war and U.S. dollar strength.”