A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Lower Water Levels on Mississippi Tributaries a Concern, as U.S. Wheat Exports at 50 Year Low

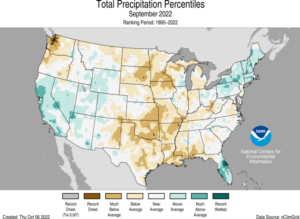

Bloomberg’s Brian K Sullivan, Joe Deaux, and Michael Hirtzer reported earlier this week that, “The Mississippi River isn’t out of the woods as falling water levels along its major tributaries threaten to deepen a crisis on the US’s main artery for moving vital products.

“While one bottleneck may have been eliminated on the Mississippi near Stack Island, additional pressure points are emerging along its more than 2,000 miles as the river falls into low stage, according to the National Weather Service. In Memphis, it has dropped nearly 2 feet since Saturday and is forecast to fall another 2 feet by Oct. 25, which would tie it for the third lowest on record. And now the Ohio River — which provides about 60% of the Lower Mississippi River’s water — is seeing closures at multiple locations due to groundings and dredging work.

ICYMI: The Mississippi is in trouble and it is going to get worse. https://t.co/xG4hlqItSh

— Brian K. Sullivan (@WeatherSullivan) October 11, 2022

“The Ohio is a significant vein of heavy industry shipping across the US Rust Belt. In total, some 184 million tons of cargo are shipped along it each year. It’s the aluminum industry’s equivalent to Silicon Valley. The river, which runs nearly 1,000 miles from western Pennsylvania to southern Illinois, is a key artery for coal mined in the region.”

Is this a trend developing where more droughts are developing and intensifying in the autumn? Looks like 2022 and 2020 fit that profile when looking at soil moisture trends. @DroughtCenter

— BrianFuchs (@BrianFuchs_NE) October 12, 2022

@usda_oce

@USDAClimateHubs pic.twitter.com/WsQ0u0e92w

The Bloomberg article added that, “Climate conditions have meteorologists warning that lower water levels will persist, crippling trade for weeks to come. Across the US, 98 river gauges have fallen below the low water threshold, and most of those are on the Mississippi or its tributaries, according to the weather service.”

And yesterday, Bloomberg writers Jen Skerritt and Kim Chipman reported that, “The world desperately needs more grains to help temper rampant food inflation, yet there are signs that the US, a key producer, will ship the smallest amount of wheat in 50 years.

“American wheat is too expensive and sales have been slow, the US Department of Agriculture said in its monthly supply-and-demand report. Adverse weather across parts of the US breadbasket have limited harvests, and low water levels along the Mississippi River are making it slower and more expensive to get crops to export terminals. Corn, soybean and rice export outlooks were also weaker.”

Forecast for U.S. wheat exports is lowered 50 million bushels to 775 million on reduced supplies, slow pace of export sales, and continued uncompetitive U.S. export prices. This would be the lowest U.S. wheat exports since 1971/72. #OATT #WASDE pic.twitter.com/8tPaGwdSvf

— USDA Office of the Chief Economist (@usda_oce) October 12, 2022

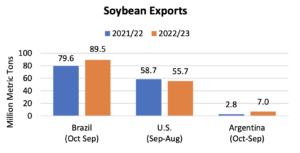

In its monthly Oilseeds: World Markets and Trade report yesterday, the USDA’s Foreign Agricultural Service noted that, “Higher Argentine soybean exports in the final months of 2022 are also expected to impact the global 2022/23 soybean outlook. This month, 2022/23 Brazil (Oct-Sep) soybean exports are raised just 500,000 tons due to competition from Argentina, despite a 3-million-ton production increase. Additionally, 2022/23 U.S. exports are lowered more than 1 million tons this month on increased competition from Argentina and Brazil and smaller U.S. supplies on lower production more than offsetting higher carryin.”

Meanwhile, Bloomberg writers Tarso Veloso Ribeiro and Jonathan Gilbert reported yesterday that, “Argentina is considering tightening the screws on wheat exports as a drought withers plants that are harvested at year-end and food inflation spirals, according to people with knowledge of the matter.

“The government has convened a meeting with exporters because of concerns among domestic millers that there won’t be enough wheat available locally, said the people, who asked not to be identified discussing confidential emails.

“A brutal season of drought and frosts appears to be forcing the government’s hand as it juggles efforts to shield local consumers from surging prices with the need to replenish hard currency reserves. Further restrictions on Argentine wheat would add to global tightness with US exports at the lowest in 50 years and the war in Ukraine continuing to hamper shipments.”