A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

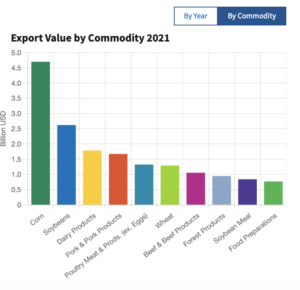

Brazil Exports Corn to China, Amounts Could Increase, as Mexico Signals Softening of Planned Import Ban of U.S. GMO Corn

Bloomberg writer Tarso Veloso Ribeiro reported yesterday that, “The first vessel carrying Brazilian corn to China is set to sail Wednesday after a deal earlier this year between the two nations.

“The Star Iris is moored in Santos port, loaded with about 68,000 metric tons of grain for Chinese trader Cofco Corp., according to the shipping agency Alphamar.

“China made the decision to start buying Brazilian grains back in May in part to reduce dependence on the US and replace supplies from Ukraine cut off by the Russian invasion. In October, China approved over 130 facilities for export. The US accounted for about 70% of Chinese purchases in the 2020-2021 season.”

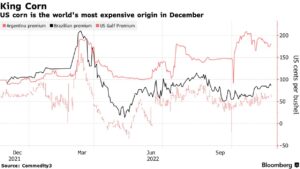

Ribeiro explained that, “The market was expecting imports to start in December, since the US just finished harvesting a crop. But because US corn is the most expensive in the world, not only are the first exports happening ahead of the expected pace, but the total imports might be higher as well.”

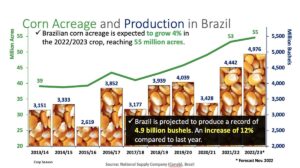

Also yesterday, Reuters writers Roberto Samora and Ana Mano reported that, “Brazilian corn exports could jump exponentially next year if farmers harvest a full crop and Chinese demand is strong, Brazil’s National Association of Grain Exporters said on Tuesday.

Brazil is poised to export 40 million tonnes to 50 million tonnes of corn next year, boosted by a new trade protocol with China and a potential bumper crop, said Sergio Mendes, director general of the group, known as Anec, in an interview.

“Brazil could export as much as 5 million tonnes of corn to China alone in 2023, making it a key supplier to the country alongside the United States. China’s import demand is 18 million tonnes for the 2022/2023 cycle, according to the U.S. Department of Agriculture.”

In other corn export related news, Bloomberg writers Eric Martin, Mike Dorning, and Maya Averbuch reported yesterday that, “Mexican President Andres Manuel Lopez Obrador signaled he’s softening his stance on a planned ban of a type of US corn amid pressure from the US government.

“AMLO, as he’s also known, said Tuesday that he’s considering allowing imports of genetically-modified yellow corn for livestock feed. That’s a change in tone from previous government statements to phase out GMO corn by early 2024.”

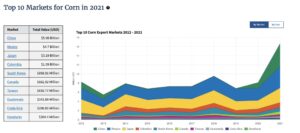

The Bloomberg article added that, “If Mexico follows through with AMLO’s latest comments on the corn dispute, it would provide relief for US farmers, as Mexico is their second-largest export market. The issue has mobilized President Joe Biden’s administration, as well as policymakers in key corn-growing states, including Senators Chuck Grassley and Joni Ernst from Iowa.

“The US Department of Agriculture ‘will continue to engage in conversations with Mexican officials about the critical importance of the bilateral trade relationship,’ a spokesperson said. USTR didn’t immediately respond to requests for comment on Lopez Obrador’s remarks.”

In other production news, Financial Times writer David Feliba reported yesterday that, “Last year, Argentina’s produce accounted for 8 per cent of global wheat exports, 18.5 per cent of corn exports and 40 per cent of exports of soyabean oil and meals.

“It produced 22.15mn tonnes of wheat in the 2021-22 season, of which 16.25mn were exported, almost as much as Ukraine’s 18.8mn.

“But the widespread effect of the drought this season has led to sharp cuts in estimates. The US Department of Agriculture now expects production of 15.5mn tonnes, while local exchanges forecast as little as 11.8mn.”

Elsewhere, Bloomberg writer Sybilla Gross reported yesterday that, “Flooding in eastern Australia is hurting the quality of the wheat harvest in one of the world’s biggest exporters, worsening a global shortage of the high-grade variety used to make bread and ramen noodles.”

In other news, DTN Ag Policy Editor Chris Clayton reported yesterday that, “The White House on Monday made it clear that a railroad shutdown ‘is unacceptable’ to President Joe Biden as agricultural groups and other business lobbies continue to clamor for Congress to step in.

“Asked about the four major union votes against a deal negotiated by Labor Secretary Marty Walsh in September, White House spokeswoman Karine Jean-Pierre reiterated the president’s stance.

“‘As the president has said from the beginning, a shutdown is unacceptable because of the harm it would inflict on jobs, families, farms, businesses, and communities across the country,’ Jean-Pierre said Monday.”

Also yesterday, Reuters writer Stephanie Kelly reported that, “A group of oil, renewable fuel and farm trade organizations have joined together for the first time to voice support for U.S. legislation that would expand nationwide of E15, a higher ethanol-gasoline blend, according to a letter from the group.

“Organizations including the American Petroleum Institute (API), Renewable Fuels Association and the National Farmers Union wrote to congressional leaders to urge them to adopt legislation that would effectively lift restrictions on E15 sales.

“API’s support is a win for the biofuel and farm groups because the oil industry has at times resisted efforts to expand the market for ethanol.”

Meanwhile, Ian James reported on the front page of today’s Los Angeles Times that, “California has just gone through the state’s driest three-year period on record, and this year the drought has pushed the fallowing of farmland to a new high.

“In a new report on the drought’s economic effects, researchers estimated that California’s irrigated farm- land shrank by 752,000 acres, or nearly 10%, in 2022 compared with 2019 — the year prior to the drought. That was up from an estimated 563,000 acres of fallowed farmland last year.

“Nearly all the farmland that was left unplanted and dry falls within the Central Valley, and a large portion of it in the valley’s northern half. The state’s main rice- growing regions in Sutter, Colusa and Glenn counties were hit particularly hard, the report said, with about 267,000 acres fallowed this year.”