The frustration in the room at Commodity Classic has been palpable following a year in 2025 where strong production was again unable to overcome swelling costs and expenses. Farmers here…

Federal Reserve Ag Credit Surveys- 2022 Third Quarter

Yesterday, the Federal Reserve Banks of Chicago, Kansas City and Minneapolis released updates regarding farm income, farmland values and agricultural credit conditions from the third quarter of 2022. The Federal Reserve Bank of Dallas also released its Agricultural Survey for the third quarter last month.

Federal Reserve Bank of Chicago

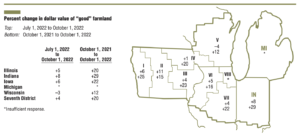

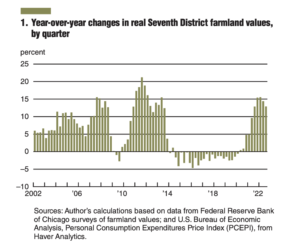

David Oppedahl, a Policy Advisor at the Chicago Fed, explained in the AgLetter that, “With farm incomes still robust, the District had a year-over- year gain of 20 percent in its agricultural land values in the third quarter of 2022. This was the fourth year-over-year increase in a row of at least 20 percent for District farmland values. Indiana led the way with a year-over-year surge in farmland values of 29 percent; the other District states also saw double-digit year-over-year growth in farmland values.”

The AgLetter stated that, “After being adjusted for inflation with the Personal Consumption Expenditures Price Index (PCEPI), District farmland values were still up 13 percent in the third quarter of 2022 relative to a year ago; this was the fifth consecutive quarter with at least as large a year-over-year increase in real farmland values.”

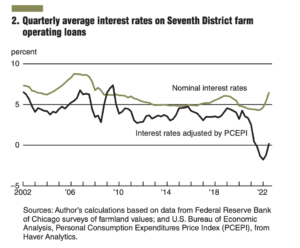

Mr. Oppedahl added that, “On balance, the District’s agricultural credit conditions were better in the third quarter of 2022 than a year earlier, despite average interest rates on agricultural loans rising sharply.”

Did Midwest agriculture continue to be resilient in the third quarter of 2022? Take an inside look at the state of #farming in the Seventh District with Policy Advisor and AgLetter author David Oppedahl: https://t.co/2Cx7y13jzG pic.twitter.com/XpSIMqb0UT

— ChicagoFed (@ChicagoFed) November 10, 2022

And the Chicago Fed indicated that, “In real terms (after being adjusted for inflation with the PCEPI), the average interest rate on farm operating loans was slightly above zero in the third quarter of 2022, after being in negative territory for the four previous quarters; the average real interest rate on feeder cattle loans followed a similar trajectory over this period. Yet, the average real interest rate on farm real estate loans remained negative for the fifth quarter in a row.”

Yesterday’s report also stated that, “In regard to the current situation facing Midwest agriculture, one Indiana banker noted: ‘Inputs are much above norms, and if commodity prices begin to fall, it will not be pretty. We still have good equity on most farms, but that can dissipate quickly.'”

Federal Reserve Bank of Kansas City

Nate Kauffman and Ty Kreitman, writing in yesterday’s Ag Credit Survey from the Kansas City Fed, noted that, “Interest rates on farm loans increased sharply in the third quarter and the acceleration in farm real estate values continued to ease.

Farm income and credit conditions remained solid, but the pace of improvement softened.

“The financial impact of drought also intensified, particularly in the southern and western portions of the District. Despite recent headwinds, farm finances remained strong and continued to support sound agricultural loan performance.”

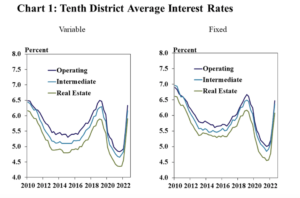

Yesterday’s update stated that, “The average rate charged on farm loans rose rapidly alongside higher benchmark rates. Variable and fixed rates on all types of loans were about 75 and 65 basis points higher than last quarter, respectively.”

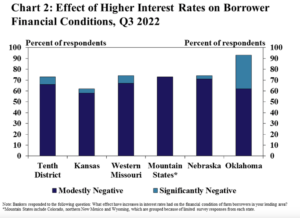

The Ag Credit Survey indicated that, “Higher interest rates have had a direct impact on farm borrowers according to lenders. About two thirds of respondents in the District indicated that higher interest rates had a negative effect on financial conditions for borrowers.”

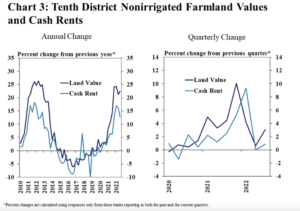

With respect to land values, the Kansas City Fed pointed out that, “As interest rates increased, growth in farm real estate values showed more signs of softening. The value of nonirrigated farmland increased about 23% and 3% from the previous year and quarter, respectively.”

The Survey added that, “Similar to farm income, key measures of credit conditions remained strong, but improvements were more limited in the third quarter. Farm loan repayment rates continued to increase, but the pace of improvement slowed.”

Federal Reserve Bank of Minneapolis

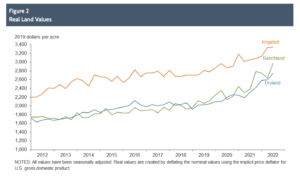

In an article yesterday, “Farm incomes held up through harvest season,” Joe Mahon pointed out that, “Land values and cash rents jumped again in the third quarter after growing strongly in the previous survey. Ninth District nonirrigated cropland values increased by 20 percent on average from the third quarter of 2021. Values for irrigated land increased by 15 percent, while ranchland and pastureland values increased almost 20 percent. Land rents followed suit, as the district average cash rent for nonirrigated land increased by 11 percent from a year ago. Rents for irrigated land grew by 13 percent while ranchland rents jumped 4 percent.”

Federal Reserve Bank of Dallas

Early last month, in its Agricultural Survey, the Dallas Fed noted that, “Bankers responding to the third-quarter survey reported overall weaker conditions across most regions of the Eleventh District. Extreme dry conditions are putting a strain on agricultural production, particularly for cotton and pasture.”

The Survey added that, “Ranchland and dryland values rose this quarter, while irrigated cropland values were steady.

“According to bankers who responded in both this quarter and third quarter 2021, cropland, dryland and ranchland values increased at least 10 percent year over year in Texas, with some segments seeing much higher increases.”