Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Interest Rates in Focus, Ukraine Grain Exports, and Rail Strike Concerns

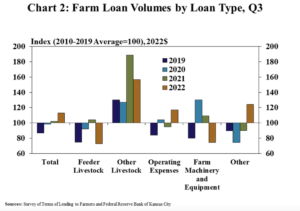

In a recent update from the Federal Reserve Bank of Kansas City, “Steady Growth in Farm Lending,” Nate Kauffman and Ty Kreitman indicated that, “Larger sized operating loans continued to boost farm lending activity. The volume of non-real estate farm loans increased by more than 10% for the third consecutive quarter. Operating loans accounted for nearly all the growth, driven by a nearly 25% increase in the average size of those loans.”

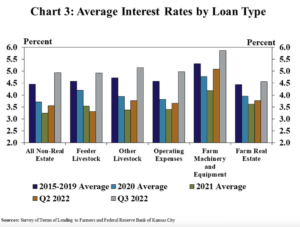

Kauffman and Kreitman pointed out that, “As lending grew further, interest rates on agricultural loans increased sharply alongside higher benchmark rates. The rates charged on all types of farm loans were an average of 180 basis points higher than the same time a year ago. The rapid rise pushed rates for all types of loans to the highest level since 2019 and slightly above the average from 2015-2019.”

The Kansas City Fed update also noted that, “As interest rates edged higher, borrowing costs grew notably from historic lows reached in 2021.

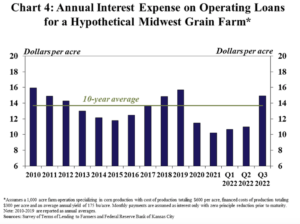

Based on current rates for an average operating note, the annual interest expense for a hypothetical mid-size grain farm in the Midwest would total about 15 dollars per acre or about 2 bushels of corn per acre at current prices.

“The notable rise in financing costs pushed interest expenses slightly above the recent historical average and could be more pronounced for operations with higher debt needs.”

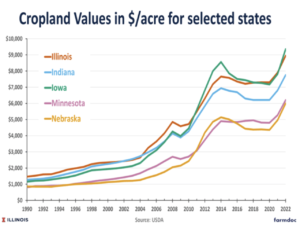

And yesterday, DTN Special Correspondent Elizabeth Williams reported that, “Despite rising interest rates and higher input costs, the farmland market across the Midwest remains strong, although not quite as robust as last fall.”

Williams indicated that, “Higher interest rates haven’t really been much of an issue in farmland sales up to now, [Steve Bruere with People’s Company based in Clive, Iowa] said. ‘And that surprised me, but there is a lot of cash out there. Incredibly strong commodity prices have outpaced the effect of increasing interest rates. But going forward, that could be a real challenge for people using leverage for land purchases.’

“[Nate Franzen, president of the ag banking division at First Dakota National Bank in Yankton, South Dakota] said that whether a farmer can lock in 5% interest or 6.5%-7% interest is not entering the decision-making process.

“‘Profitability is stable to strong. That’s been the main motivator in the land market,’ he said. ‘We continue to see new record sales all across the board this fall.'”

The DTN article added that, “However, there’s a lot to support the farmland market too. To start, the majority of land is owned debt-free. Farms are expecting strong returns. A lofty harvest price option for crop insurance will boost indemnities for those in drought areas. Farmers have the ability to lock in profitable prices for next year. That’s why most farmland experts DTN interviewed expect the pace of farmland price increases to plateau or slow to around 10% to 15% year over year in 2023.”

Elsewhere, Reuters writer Pavel Polityuk reported yesterday that, “Ukraine has exported almost 14.3 million tonnes of grain so far in the 2022/23 season, down 30.7% from the 20.6 million tonnes exported by the same stage of the previous season, agriculture ministry data showed on Monday.”

Today 7 vessels are on the way to 🇺🇦 ports for loading after JCC inspection has been done. We are ready to load it quickly and waiting for new ones. Around 100 vessels are waiting for inspection in Bosphorus. World needs our agriculture products as soon as possible.

— Oleksandr Kubrakov (@OlKubrakov) November 4, 2022

“The government has said Ukraine could harvest between 50 million and 52 million tonnes of grain this year, down from a record 86 million tonnes in 2021 because of the loss of land to Russian forces and lower yields,” the Reuters article said.

Financial Times columnist Alan Beattie pointed out last week that, “The Black Sea initiative has been helpful but not dramatic. Ukraine has doubled its grain exports but still only to levels 50 per cent lower than in 2021. In the weeks after its announcement, wheat prices dropped by only about 5 per cent, having already retraced almost all of the 50 per cent rise between February and their peak in May.”

Today 🇺🇦 BlackSea ports berthed 7 vessels under loading 131K agriculture products. Another 7 ⛴ are laying off the harbour till tomorrow, it will be loaded by 140K cereals. We are ready to do it fast. Finally relocked traffic inbound is good news for world waiting 🇺🇦products.

— Oleksandr Kubrakov (@OlKubrakov) November 7, 2022

And in a separate Reuters article from today, Polityuk reported that, “Ukraine 2022/23 winter grain sowing was 90% complete at 4.3 million hectares as of Nov. 7, the agriculture ministry said on Tuesday.”

Meanwhile, Dow Jones writer Kirk Maltais reported yesterday that, “A looming rail strike, which could come later this month without a new deal, is introducing worries of surging prices for fertilizer, the Fertilizer Institute said in a letter addressed to Congressional leaders. The group pressed Congress to settle the dispute when it reconvenes Nov. 14. ‘A rail strike would be devastating to fertilizer manufacturing and to fertilizer distribution to the farmers,’ said TFI President and CEO Corey Rosenbusch in a press statement. With supply chain issues seen in the trucking and river freight segments, a rail stoppage would be quickly felt in the economy, the group said. The latest assessment from research firm DTN shows fertilizer prices have been coming off of highs reached earlier this year but remain elevated.”