As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

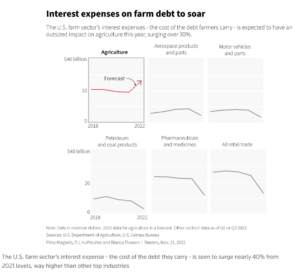

Rising Cost of Credit Impacting Farmers

Earlier this week, Reuters writers P.j. Huffstutter and Bianca Flowers reported that, “Montana farmer Sarah Degn had big plans to invest the healthy profits she gleaned for her soybeans and wheat this year into upgrading her planter or buying a new storage bin.

“But those plans have gone by the wayside. Everything Degn needs to farm is more expensive – and for the first time in her five-year career, so is the interest rate on the short-term debt she and nearly every other U.S. farmer relies upon to grow their crops and raise their livestock.

“‘We might have made more money this year, but we spent just as much as we made,’ said Degn, a fourth-generation farmer in Sidney, Montana. The interest rate on her operating note doubled this year and will be higher in 2023. ‘We can’t get ahead.'”

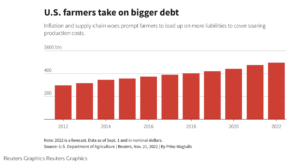

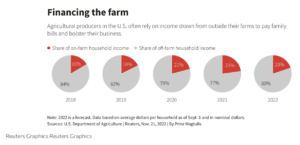

Huffstutter and Flowers explained that, “Most U.S. farmers depend on short-term, variable-rate loans they take out after fall harvest and before spring planting to pay for everything from seeds and fertilizer to livestock and machinery.

“Farmers repay these loans after harvest with cash from their crops before repeating the process. Often, farmers seek to secure loans by year-end or early January to take advantage of suppliers’ early-pay discounts and to ensure they won’t be caught short as global supplies of fertilizers and chemicals remain tight.

“Now, producers are wrestling with how to pay for that debt as interest rates rise headed into the next planting season, according to interviews with two dozen farmers and bankers, as well as data from the U.S. Department of Agriculture and the Kansas City Federal Reserve.”

“This rising cost of credit is straining some producers’ liquidity and prompting them to look at reducing fertilizer or chemical use, or plant fewer seeds next spring. That, in turn, could reduce crop yields, and place upward pressure on the cost of producing that food,” the Reuters article said.

The Reuters article added that, “The short-term federal funds rate is now in a range of 3.75% to 4%, from a range of 0% to 0.25% in early March, just before Fed policymakers began raising rates. Inflation is still high, however, and demand is strong, and Fed policymakers have signaled they will continue raising rates until they see broader evidence of their effect.

“In agriculture, the pinch is already here: The average interest rate of all farm operating loans is 4.93%, according to the latest Kansas City Fed data.”

Huffstutter and Flowers also noted that, “The financial hit is being felt on equipment dealers’ lots, where farmers are forgoing buying equipment on credit, according to interviews with four dealers.

“Dealers said they are seeing banks tightening underwriting standards, which can be a hurdle for newer and smaller farm operators seeking capital to purchase equipment.”

Meanwhile, Financial Times writers Colby Smith and Harriet Clarfelt reported on Wednesday that, “A ‘substantial majority‘ of Federal Reserve officials support slowing down the pace of interest rate rises soon, even as some warned that monetary policy would need to be tightened more than expected next year, according to an account of their most recent meeting.

“Minutes from the November meeting, at which the Fed raised its benchmark rate by 0.75 percentage points for the fourth time in a row, suggested officials are committed to ploughing ahead with their campaign to stamp out elevated inflation.

“However, the account also signalled that officials are prepared to start raising rates in smaller increments while they assess the economic effect of the most aggressive tightening campaign in decades.”