As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

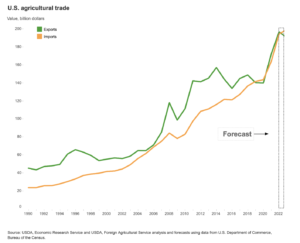

USDA Lowers FY 2023 Forecast for U.S. Agricultural Exports

On Tuesday, the USDA released its Outlook for U.S. Agricultural Trade, a quarterly report from the Department’s Foreign Agricultural Service (FAS) and Economic Research Service (ERS). Today’s update includes highlights from the report, which was coordinated by Bart Kenner, Hui Jiang, Dylan Russell and James Kaufman.

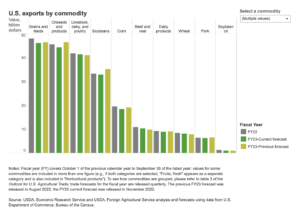

The Outlook stated that, “U.S. agricultural exports in fiscal year (FY) 2023 are projected at $190.0 billion, down $3.5 billion from the August forecast. This decrease is primarily driven by reductions in soybeans, cotton, and corn exports that are partially offset by gains in beef, poultry, and wheat. Soybean exports are forecast down $2.4 billion to $32.8 billion due to smaller production and increased competition from South America.”

The Outlook also noted that, “Grain and feed exports are projected to decrease by $300 million to $46.2 billion, with declines in corn, sorghum, and rice exports partially offset by higher exports of wheat and feeds and fodders.

The forecast for corn is down $600 million to $18.5 billion on lower volumes.

FAS-ERS pointed out that, “With remaining uncertainty on the continuation of the Black Sea Grain Initiative despite its recent extension and reduced exportable supplies in the United States, U.S. corn prices are expected to remain high relative to other exporters. Low water levels in the Mississippi River have disrupted grain deliveries to the Gulf, further hampering shipments and supporting prices. Sorghum exports are forecast at $1.6 billion, down $400 million from the August forecast on lower volumes due to sharply reduced production. Early season outstanding sales of both corn and sorghum are far below last year. Feeds and fodders exports are forecast at $10.6 billion, up $100 million from the August forecast. Wheat exports are forecast at $8.1 billion, up $300 million from the previous forecast on higher unit values more than offsetting smaller export volumes. U.S. wheat export prices continue at multi-year highs making exports uncompetitive relative to other major exporters.”

With respect to regional exports, FAS-ERS indicated that, “The export forecast for China is down $2.0 billion from August to $34.0 billion, primarily due to reduced soybean export prospects on resurgent competition from South America. In addition, lower cotton unit values, sharply reduced U.S. sorghum production, and weak pork demand further constrain the trade outlook. Despite the downward revision, China is projected to remain the largest market for U.S. agricultural exports.”

“The export forecast for Canada is down $200 million to $28.3 billion, largely driven by reduced corn prospects. The export forecast to Mexico is down $500 million to $28.0 billion, due to lower soybean, corn, and pork trade expectations,” The Outlook said.

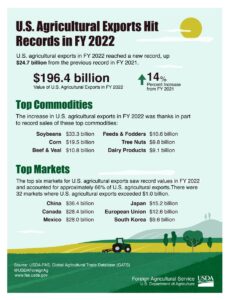

Recall that U.S. agricultural exports in Fiscal Year 2022 set a new record of $196.4 billion, up $24.7 billion, or 14%, from the previous record in Fiscal Year 2021.

And in 2021, U.S. agricultural exports totaled $177 billion, the current annual calendar year record.