As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Amid “Extraordinary Uncertainty” and “Precarious” Geopolitical Conditions, Commodity Price Moves Are Slow to Translate Into Lower Food Costs

Earlier this week, Financial Times writers Emiko Terazono and Valentina Romei reported that, “Climate change and the war in Ukraine are set to keep food prices at far higher levels than before the Covid-19 pandemic, despite signs of moderation in global commodity markets, economists and agriculture experts have warned.

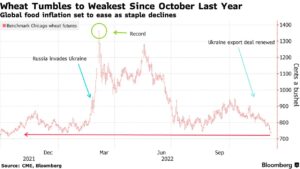

“Wholesale food prices have stabilised over recent months, raising hopes that the surge in the retail cost of staples such as rice, bread and milk seen in the past two years would diminish in 2023.

“The latest update of the food price index of internationally traded agricultural commodities, compiled by the UN Food and Agricultural Organization (FAO), published on Friday, posted its eighth consecutive monthly decline in November since peaking in March. The November index showed prices were just 0.3 per cent higher than a year earlier.”

However, the stabilisation in international markets is yet to translate into lower inflation for households around the world.

Terazono and Romei explained that, “Even before Russia’s February invasion of Ukraine, which caused prices to spike because of the importance of both countries in producing commodities such as wheat, persistent droughts in key growing regions had pushed prices higher.

“Both the Ukraine conflict, which has raised the cost of fossil fuels and energy-intensive fertiliser production, and the third year of the La Niña weather phenomenon — the cause of severe droughts in the US, Argentina and Europe — have hit farmers, curbing their ability to increase output.”

“Although costs have fallen back from the peak, prices remain high by historical standards and data from consultancy CRU show fertiliser remains unaffordable for many,” the FT article said.

Terazono and Romei added that, “Although the extension in November of the Black Sea grain deal between Russia and Ukraine, which ensures at least some of the country’s food commodities reach international customers, has lowered the risk of further price spikes, geopolitical conditions remain precarious.

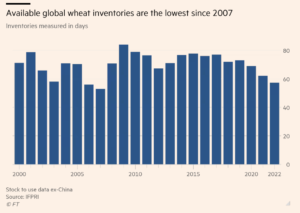

“Meanwhile, measures used by economists and traders to assess the availability of commodities, such as the stock-to-use ratio, indicate supplies of wheat at the lowest level in more than a decade.”

And Wall Street Journal writer Yusuf Khan reported in Saturday’s paper that, “Global prices for commodities such as wheat and sugar have fallen back to where they were a year ago, but consumers are still likely to feel the pinch at the checkout.

“The disconnect is because of extraordinary uncertainty about future production of key foodstuffs such as wheat, and because price pressures elsewhere—including for energy and wages—can have a major impact on grocery bills.”

Khan noted that, “Meanwhile, moves in commodity markets aren’t feeding into lower prices for households. The latest official data show U.S. food prices at home hit an all-time high in October, up 12% on the year.”

Saturday’s article indicated that, “A key reason for elevated checkout prices is that traders aren’t sure how much grain, and of what quality, will be produced next year, said Joe Glauber, senior research fellow at the International Food Policy Research Institute in Washington, D.C.”

More narrowly regarding Ukraine, Reuters writers Pavel Polityuk and David Ljunggren reported last week, “Ukraine has exported almost 18.1 million tonnes of grain so far in the 2022/23 season, down 29.6% from the 25.8 million tonnes exported by the same stage of the previous season, agriculture ministry data showed on Friday.”

Yesterday, in a separate Reuters News article, Pavel Polityuk reported that, “Ukraine’s wheat exports fell to 1.58 million tonnes in November from 1.98 million tonnes in October, the UGA Ukrainian grain traders union said on Monday.”

Pavel Polityuk reported last week at Reuters that, “Ukrainian farms had harvested 41.9 million tonnes of grain from 85% of the expected area as of Dec. 1, the agriculture ministry said on Friday.”

Meanwhile, Bloomberg writer Sybilla Gross reported yesterday that, “Australia, one of the world’s largest wheat exporters, is poised to harvest another record crop this season even as heavy rains hurt yields in the eastern states, according to the government forecaster.”

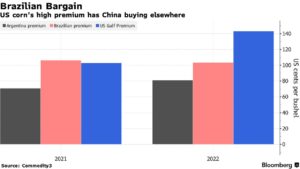

In other developments, Bloomberg writers Tarso Veloso Ribeiro and Michael Hirtzer reported yesterday that, ”

China is ramping up imports of Brazilian corn, replacing imports of the more expensive US grain.

“Four vessels loaded with Brazilian corn are currently en route to China and five more should sail to China soon, according to the shipping agency Alphamar Agencia Maritima. Additional vessels waiting to load may also head there, pushing total Brazilian corn shipments to China past 1 million tons for the year.

“Shipments to date already exceed 280,000 tons, just a month after the first cargo of Brazilian corn headed to China. Historically an importer of American and Ukrainian corn, China’s appetite for cheaper and abundant Brazilian supplies are taking a toll on US sales. Export inspections of American corn of 6.3 million tons are down 33% so far this year, pressured by a dry Mississippi River that is raising logistics costs and helping to keep supplies too expensive for importers.”

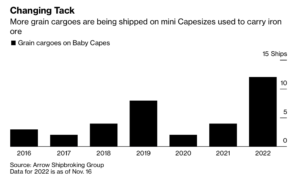

Elsewhere, Bloomberg writers Ann Koh and Jinglu Gu reported last week that, “Dirty bulk ships used to carry iron ore are being scrubbed clean so that they can transport grain to Asia, in an unusual shift of cargoes prompted by a slump in demand for the steelmaking ingredient.

“China’s downturn in the housing market has weighed on iron ore, driving freight rates for bulk carriers down 50% from a year earlier. That’s made it more attractive for some of the world’s biggest agriculture traders to book iron ore vessels for shipments of corn and soybeans.”